Morgan Stanley recently raised their rating on Tesla (NASDAQ:TSLA) for the first time in 3 years. Two weeks later and the stock has already smashed through their $540 price point, and it’s still rising.

But the real news here isn't about Tesla, or even about EVs... it's much, much bigger than that.

What it means is this: It’s not about EVs anymore …

It’s about tech, software, services, and limitless verticals.

It’s about an entire EV ecosystem.

"Tesla is on the verge of a profound model shift from selling cars to generating high margin, recurring software, and services revenue … To only value Tesla on car sales alone ignores the multiple businesses embedded within the company,” Morgan Stanley’s Adam Jonas wrote in a note to investors.

Just like $7-billion asset manager Blackrock got the sustainable investing megatrend before anyone else, crowning it the new king of Wall Street …

Morgan Stanley gets the profoundly profitable future of the EV ‘ecosystem’.

And there’s one EV tie-in stock out there right now that has a similar multiple businesses platform … aiming for the upside of Tesla before Elon Musk defied the skeptics and proved everyone wrong, 1,000 times over.

The company is Facedrive (TSXV:FD,OTC:FDVRF) and it’s already got tie-ins to household names like utility giant Exelon, and more …

it’s on an upward trajectory because it ticks every single box for most investors right now:

- It’s got multiple verticals

- It’s entirely tech-driven

- It has a tie-in to a series of multi-billion-dollar industries

- It boasts an entire ecosystem of “sustainable” services to attract the billions in “ESG” money that’s desperately looking for someplace to park itself

Future Profit Is About Platforms, Not Products

Apple (NASDAQ:APPL) isn’t just about the iPhone. It’s about services. That’s already becoming crystal clear in its profit picture. And where all future growth comes from.

Tesla, as Morgan Stanley has bet the bank, isn’t just about EVs. It’s about batteries, energy storage, solar, and more.

And while you can catch your first-ever carbon-offset ride with Facedrive (TSX:FD.V; OTCMKTS:FDVRF) … this isn’t a ride-hailing company.

It’s a tech ecosystem with 6 tech-driven, ESG-focused verticals that all have fantastic growth potential.

It’s carbon-offset ride-hailing, food delivery, and pharma deliveries …

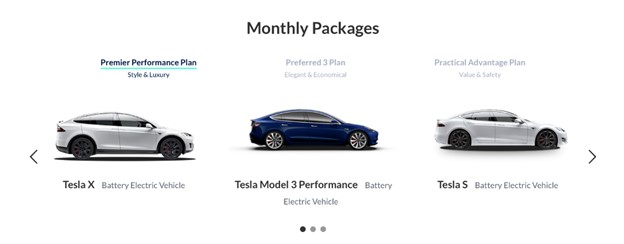

It’s accessible EV car subscriptions that plan to revolutionize the private transportation industry and change the way we feel about car ownership.

It’s stand-alone COVID-19 contact tracing technology and wearables, which have already earned it a pilot deal with Air Canada.

It’s tech-driven social distancing solutions that allow for connectivity at a critical time, which is why Facedrive’s newly launched HiQ app has already hit over 2 million downloads.

It’s even tech-driven stay-at-home Tally Technology that gets fans re-engaged in Major League Sports … and could help Major League Sports, including the NFL, NBA and NHL find new paths to revenue.

It’s a tech-driven, sustainable way of life.

Tons of Momentum to Grab Onto

This company has been nailing acquisition after acquisition as it builds out its six tech-driven divisions … all of them playing to the tune of the massive sustainable investing megatrend that giants like Blackrock are looking for.

The news flow, as you can imagine with a company with this many different tech divisions, is incredibly fast and impactful.

Just in the past two months …

On November 19th, Facedrive announced a collaboration with Microsoft Azure for TraceScan contact-tracing.

On November 3rd, launched its Facedrive Foods Mobile App, integrating its recently acquired FoodHwy and Foodora (acquired from giant Delivery Hero) assets, and it’s now opening the floodgates for contactless food delivery via an app available on iOS and Android.

On October 20th, Facedrive’s HiQ App hit 2 million downloads and made a move towards further expansion by partnering with Tally Technology to combine free-to-play sports predictions with the social distancing platform. The first stop for the combo--backed by Superbowl-winning quarterback Russell Wilson--will be the widely viewed Indian Premier League Cricket tournament with an Asian market of nearly 40 million viewers.

On October 15th, Facedrive was approved to trade on the Frankfurt Stock Exchange to support its expansion plans into the United States and Europe. That move followed Facedrive’s launch of trading on October 8th on the OTCQX.

On October 7th, Air Canada signed a deal with Facedrive Inc. (TSXV:FD,OTC:FDVRF) to launch a pilot project for its employees using proprietary TraceSCAN technology.

Air Canada isn’t the only major player taking the TraceSCAN plunge...

The Government of Ontario lent its support to TraceSCAN back in July because it’s the only feasible technology that will get masses of government employees back to work without spreading COVID-19. And now, talks with other airlines are in motion because the industry is facing more than $84 billion in losses … so, the news flow is expected to be fast and momentous.

And in one of its biggest moves yet, on September 8th, Facedrive acquired Washington, D.C.-based Steer from energy giant Exelon (NASDAQ:EXC)--a deal that also came along with a $2-million strategic investment by energy giant Exelon’s wholly-owned subsidiary, Exelorate Enterprises, LLC.

The three plan to challenge the transportation industry with a seamless EV car subscription service that could be the harbinger of a major disruption.

Steer intends to revolutionize transportation by letting people get into EVs without breaking the bank, and by upending the conventional notion of car ownership.

This acquisition isn’t just a potential boom for Facedrive … it’s positioned to boost EV ownership in general and stands to be a high-growth vertical.

This is a Platform with limitless potential … and exactly everything that today’s Big Money is looking for: It’s driven by state-of-the-art technology, pushing multiple platforms for maximum impact and fast-paced growth … and it’s already got tie-ins to some of the biggest household names on the continent.

With its feet now firmly planted in the United States and a major expansion push heading for Europe, this Canadian “Silicon Valley” company is already showing some major potential upside, and the next big news is expected to be coming soon.

Canadian companies are also looking to capitalize on the ESG trend:

NFI Group (TSX:NFI)

NFI Group is another one of Canada’s electric vehicle pioneers producing transit busses and motorcycles. The company had a tough go at it towards the beginning of the year, but has since cut its debt and begun to address its cash flow struggles in a meaningful way. Though it remains down from January highs, NFI still offers investors a promising opportunity to capitalize on the electric vehicle boom.

In the previous months, NFI has seen an uptick in insider stock purchases which is often a sign that the board and management strongly believe in the future of the company. In addition to its increasingly positive financial reports, it is also one of the few in the business that actually pay dividends out to its investors.

GreenPower Motor (TSXV:GPV)

GreenPower Motor is a promising young electric bus manufacturer. Currently, its focus is primarily on the North American market, but it has plenty of room to grow as the industry takes off. Founded over a decade ago, GreenPower has been on the frontlines of the electric movement, manufacturing affordable battery-electric busses and trucks. From school busses to long-distance public transit, GreenPower’s impact on the sector can’t be ignored.

Year-to-date, GreenPower Motor has seen its share price soar from $2.03 to $24.45. That means investors have seen 1104% gains this year alone. And with this red-hot sector only going up, GreenPower will likely continue to impress.

Shopify Inc (TSX:SHOP)

Shopify is a rapidly-expanding tech giant in the e-commerce sector. It’s already got over 1 million businesses using its platform, including Budweiser, Tesla and Red Bull. Shopify has revolutionized the e-commerce world, allowing anyone, even if they do not know how to code, build and deploy an e-commerce website. And it’s not without its ethical grounding, either. Shopify is pushing towards sustainability in a major way. It has started its own sustainability fund, which it adds $5 million to each year to help tackle the looming climate crisis.

Shaw Communications Inc (TSX:SJR.B)

Shaw is one of Canada’s leading telecom infrastructure and cloud service providers. Its dominance in Canada’s telecom sector means that if any internet-based services want to operate, they’ll likely be utilizing the company’s infrastructure. After all, without telecoms, these TaaS companies would not be able to operate. And that’s not necessarily a bad thing when you consider Shaw’s sustainability goals. In fact, it is one of the biggest customers of Bullfrog Power which sources its electricity from a blend of wind energy and hydropower. It is also building its own portfolio of clean energy investments.

BCE Inc. (TSX:BCE)

BCE is another household name in Canadian telecom. Throughout its push into the position of one of Canada’s top telco groups, it has bought and sold a number of different firms. BCE is currently at the forefront of the Internet of Things movement in Canada. That means it will play a vital role in building new sustainability projects and making Canada’s cities smarter and more efficient. Likewise, it will play a key role in the adoption of transportation technologies and self-driving vehicles.

By. Glen Carrick

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements /

Forward looking statements in this publication include that Facedrive will be able to expand to the US and Europe; that transport in an EV will become much more popular and that Facedrive will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially. Risks that could change or prevent these statements from coming to fruition include that riders are not as attracted to EV rides as expected; that competitors may offer better or cheaper alternatives to the Facedrive businesses; Facedrive’s ability to obtain and retain necessary licensing in each geographical area in which it operates; and whether markets justify additional expansion. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) owns a considerable number of shares of FaceDrive (TSX:FD.V) for investment, however the views reflected herein do not represent Facedrive nor has Facedrive authored or sponsored this article. This share position in FD.V is a major conflict with our ability to be unbiased, more specifically:

SHARE OWNERSHIP. The owner of Oilprice.com owns a substantial number of shares of this featured company and therefore has a substantial incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company and the writer are not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.