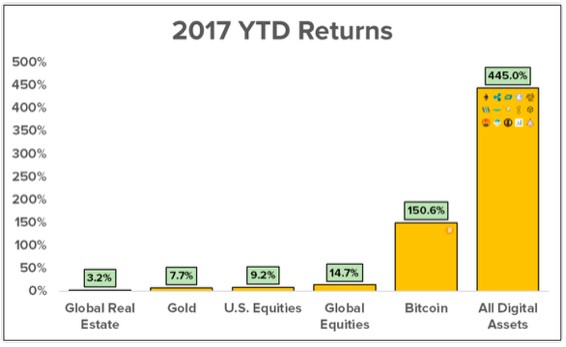

As investors bide their time, waiting for the first Bitcoin or Ethereum ETF to launch, a much bigger opportunity for profits is quietly slipping away.

As we all know, cryptocurrencies are booming. Bitcoin turned a tiny, $100-investment into a whopping $75 million in 7 years, and just this week it hit a record high of over $17,000 per bitcoin. Ethereum has also been on a steady upward trend over the last two years, turning a $100 investment into $94,000.

Now, as the first ever bitcoin futures begin to trade, cryptocurrencies are as valuable as they have ever been, and the forward-thinking investors who bought big into Bitcoin are reaping huge rewards.

While the bitcoin investment boat may have already set sail, it is likely far from the last huge opportunity in the space. The cryptocurrency and blockchain market is expanding at a significant rate, and there is one unique and simple investment opportunity that could give investors access to the entire space.

While Wall Street drags its heels, one Canadian company is breaking away from the mainstream and preparing a unique investment opportunity, one which American investors can get in on too.

Global Blockchain Technologies Corp. (TSX: BLOC.V; OTC: BLKCF) is Canada’s first blockchain-focused investment company. Yes, Bitcoin is at an all-time high, but it’s possibly still far from its peak and only makes up a fraction of the blockchain market. Global Blockchain allows investment in blockchain now, before the next wave of money rolls into this booming market.

Make no mistake, blockchain is one of the most disruptive financial technologies the market has ever seen. It shows great potential to be the universal and uncontested depository of all transactions between all parties, whether we’re talking money or paperwork. Blockchain is the hub where everything can come together with seamless trust, transparency, efficiency and, more importantly than ever, protection from hackers.

Blockchain is poised to transform every major industry, whether it be global shipping, prescription drugs, healthcare, automotive, aviation, manufacturing, banking, finance--and even government. You name it. That’s why Global Blockchain’s plan to take the next evolutionary step, with simplified exposure to both established blue-chip crypto holdings and small-cap high-growth blockchain and crypto-currency potential plays, could lead to major profit in an era of prosperity.

As investors scramble, searching for profits amid the market disruption caused by cryptocurrencies, Global Blockchain plans to offer a unique solution. This comes in the form of a basket of holdings that:

- Definitively answers massive demand from investors

- Will be one of the first way to find and gain exposure to a wide breadth of cryptocurrencies and blockchain companies

- Is packaged in a publicly listed security accessible in the U.S., Canada and Europe, with Asia and Australia to follow

- Plans to give investors access to ICOs that they would never be able to secure on their own

- Is led by major crypto-pioneers who are ready to make the crypto-world a lot less cryptic

Here are 5 reasons to keep a close eye on Global Blockchain (TSX: BLOC.V; OTC: BLKCF), an investment company hoping to become the first-ever vertically integrated originator and manager of startup Blockchains and investor in top-tier digital currencies:

#1 Blockchain is Set to Disrupt Everything

Blockchain is automation and collaboration on steroids, with market growth predictions headed into trillion-dollar territory. The technology isthe backbone of the exploding crypto-currency market, worth a pretty $150 billion today, and up an astounding 800 percent over the first eight months of this year.

There’s likely no industry that’s isolated from being disrupted by blockchain technology.

- Banking: Seven major global banks have partnered with fintech companies to develop new blockchain technologies, because blockchain and cryptocurrencies simplify so many things in the banking world, from fees for sending payments through middlemen, privacy threats, and security risks to cumbersome lending in the $134-trillion global banking industry.

- Global Logistics: Blockchain technology is already being used to track global trade and shipments in this $8-trillion-plus industry.

- Real Estate: This $7.4-trillion industry is also a major beneficiary of blockchain tech. Look no further than the real estate mecca of Dubai, which is putting its entire land registry on a blockchain.

- Healthcare: The global healthcare IT market, valued at $134 billion last year, is publicly seeking IT solutions from Blockchain.

- Crowdfunding: Even this $96-billion market is embracing Blockchain.

And the list goes on …

“Blockchain solutions in finance are virtually endless...any centralized marketplace that is dominated by a few middle men is likely to be taken over by blockchain technology,” says BLOC Chairman Steve Nerayoff. The opportunities are mind-boggling.

#2 Exposure to the a Wide Cross-Section of the Blockchain Ecosystem

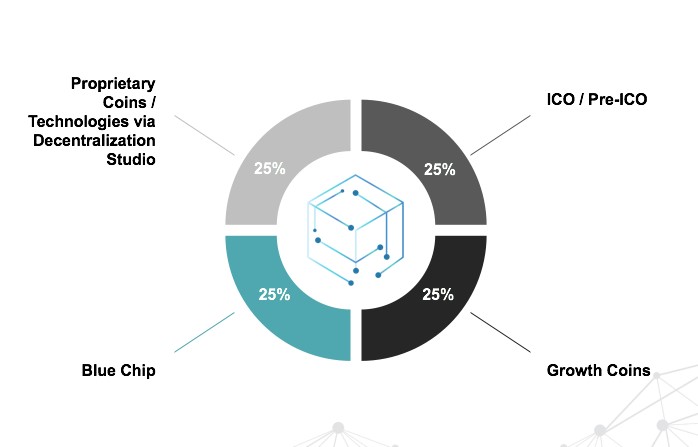

Global Blockchain (TSX: BLOC.V; OTC: BLKCF) meets existing investor demand with plans to invest in a basket of holdings within the Blockchain space. This innovative strategy would make Global Blockchain the first global investment company with exposure to a wide cross-section of the Blockchain ecosystem—all backed by start-up equity and token diversification.

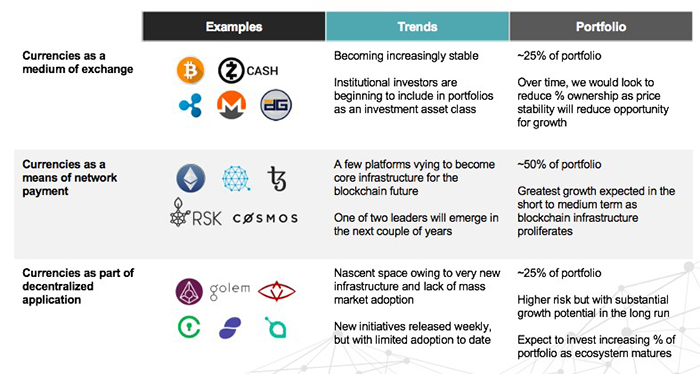

This proposed plan is expected to lead to diversified exposure and lower risk for investors by balancing large cap companies with hand-picked high-growth potential small-caps. Global Blockchain also plans to diversify portfolios by balancing crypto-currencies by category.

You can buy it right now from an online broker, and even add it to your IRA or 401K.

Here are Global Blockchain’s planned investments:

But it’s not just about a basket of currencies to speculate on. It’s about the potential of building an investment portfolio based on the token economy—one of the first of its kind.

Here is Global Blockchain’s projected Asset Allocation:

#3 Crypto-Pioneers Leading the Innovation

The team behind Global Blockchain (TSX: BLOC.V; OTC: BLKCF) qualifies investments for you and buys them as an investment for its portfolio, for reduced uncertainty and minimized risk.

Remember the Ethereum ICO? It’s risen over 94,000 percent. Global Blockchain’s Chairman and CEO, Steve Nerayoff, was not only a senior advisor to Ethereum leading up to its ICO, but was the architect of the Ethereum crowsdale, the way the project was funded. He also was a senior advisor to the Lisk Cryptocurrency project, which now has a $526-million market cap. Nerayoff is an early leader of the blockchain industry, and one of its most important pioneers.

But Global Blockchain’s doesn’t stop with Nerayoff.

- Rik Willard: Cryptocurrency and ICO veteran, co-founder of the Silicon Valley Blockchain Society, and an advisor to Luxembourg and other countries’ Blockchain initiatives.

- Shidan Gouran: Cryptocurrency and ICO expert with a long track record.

- Kyle Kemper: Executive director of the Blockchain Association of Canada.

- Jeff Pulver: Has consulted and invested in 350 startups.

- Michael Terpin: Co-founder of BitAngels, the world’s first angel network for digital currency startups, managing partner of bCommerce Labs, the first Blockchain incubator fund in the world. Founded Marketwire, one of the largest company newswires, which was acquired in 2006 by NASDAQ for $200 million.

And it’s not just their blockchain successes and expertise investors will be harnessing: It’s their exclusive access to assets investors would have difficulty investing in otherwise.

#4 Promising Futures

If/when the U.S. Securities and Exchange Commission (SEC) approves crypto ETFs, digital currencies will likely push even higher. Some projections show that as much as $300 million could pour into a bitcoin ETF in its first week, Bloomberg reports.

Cryptocurrencies are also set to be benefit as futures are launching by CBOE, CME, and NASDAQ. Futures trading is likely to further boost the market, with even more interest and investments flowing.

We’re looking at a total current market cap of tokens at $20 billion, and more than $2 billion has already flowed into ICO (initial coin offering) token sales. This is where Global Blockchain (TSX: BLOC.V; OTC: BLKCF) comes into play, with their expertise to make solid decisions on which ICOs have what it takes to be winners, and how to play the futures. And they intend to balance large-cap holdings with small-cap and emerging cryptocurrencies so investors can benefit from the stability of one, and the growth potential of the other at the same time.

But it’s also planning to become an incubator for new crypto technologies, which means that investors are not just investing in assets—they’re investing in innovation.

#5 More Upside with Global Blockchain Coin Creation

Global Blockchain (TSX: BLOC.V; OTC: BLKCF) also plans to create additional value with its own incubator for new tokens, taking advantage of a major gap in the token world. Most new ICOs have one-dimensional teams—they’re developing but not following through in the market. This is where Global Blockchain sees an opportunity. They won’t just help new blockchain companies build; they’ll help brand and distribute.

This could be the next phase of maturity in an industry that is lacking development and is being guided by a team with real-world experience, backed by top blockchain programmers in the world. With Global Blockchain providing investors access to a basket of holdings within the blockchain space, managed by a team of industry early adopters and pioneers, investors have a chance to access a market of huge proportions, because Blockchain could affect every industry.

New waves of money have been entering this market, and the next wave could be Wall Street hedge funds. After that, possibly ETFs. And then everyone else. Getting ahead of the wave could be possible possible with Global Blockchain’s investment and incubator strategy.

Honorable Mentions:

The Descartes Systems Group Inc. (TSX: DSG) (commonly referred to as Descartes) is a Canadian multinational technology company specializing in logistics software, supply chain management software, and cloud-based services for logistics businesses. The company is making waves in the tech industry with its futuristic products and visionary leadership.

As a key stock in Canada’s tech boom, Descartes Systems is a smart choice for investors. The company has a huge market cap of $2.6-billion and the stock has grown by nearly 20% YTD.

Kuuhubb Inc. (TSXV: KUU) is a company active in the development and acquisition of lifestyle and mobile video game applications. Its strategy is to create sustainable shareholder value through undervalued, but proven applications with robust long-term growth potential.

The company is headquartered in Helsinki, Finland and operates in both U.S. and Asian markets. The company has seen its stock increase after a few recent acquisitions and currently trades at $1.60.

Mogo Finance Technology Inc. (TSX:MOGO): This is a new spin on unsecured credit, which is a burgeoning sub-segment of FinTech. Providing loan management, the ability to track spending, stress-free mortgages, and even credit score tracking, Mogo is at the forefront of an online movement to assist users with their financial needs.

Mogo’s software analyzes borrowers instantly and greatly reduces the traditionally cumbersome underwriting process for loans. It’s online only, so there’s very low overhead and a ton of cash to spend on marketing. Labeled as “the Uber of finance” by CNBC, Mogo is definitely turning heads.

With increasing membership growth and revenue lines continuing to improve, and a platform which many banks have failed to offer, Mogo could well become an acquisition target in the near future.

EXFO Inc (TSX:EXFO): EXFO isn’t new to the Canadian tech sector. The company was founded in 1985 in Quebec City, and its original products were portable testing products for optical networks. Since then, the company has acquired and build 3G, LTE, protocol, copper/xDSL, IMS, and VoIP test and service assurance products.

Recent developments from EXFO are promising for long term growth potential. The new baseband unit emulation technology which is sure to be adopted on a large scale, as the tech offers operators a reduction of costs and a faster revenue stream.

EXFO Inc is a model in the telecommunications industry. With a market cap of $273-million, EXFO is strong, but still growing.

Power Financial Corp (TSX:PWF): Montreal-based Power Financial Corp has been in the finance industry since 1984. The company operates in three segments: Lifeco, IGM and Pargesa Holding SA (Pargesa). And, with its holdings in a diversified portfolio spanning the United States and Europe, Power Financial is a leader in its field.

Focusing its investments in the emerging FinTech industry, Power Financial stands to benefit by riding this wave into the future. The company’s forward-thinking attitude and liberal approach to technology is sure to leave investors satisfied.

We like PWF because it owns 60 percent of Wealthsimple, a leading robo-advisor for investing in ETF portfolios.

Forward-Looking Information

Forward-looking information includes, but is not limited to: the rate of cryptocurrency and blockchain technology adoption and the resultant effect on the growth of the global cryptocurrency and tokens market capitalization; Global Blockchain Technologies Corp.’s (“BLOC”) anticipated ability to reduce risk for investors and give investors exposure to a broad cross-section of the blockchain ecosystem; BLOC’s projected asset allocations, business strategy and investment criteria, including the anticipated contributions of BLOC’s incubator program; the expected strengths and contributions of BLOC’s management and advisors; that Wall Street and ETFs could step into the Blockchain market; and the risk reduction strategies of BLOC. Readers should be aware that BLOC has no assets except cash from a recently completed financing and its business plan is purely conceptual in nature: there is no assurance that it will be implemented as set out herein, or at all. Forward-looking information is based on certain factors and assumptions about BLOC believed to be reasonable at the time such statements are made, including but not limited to statements and expectations regarding: the adoption and growth of the global cryptocurrency and tokens market capitalization; BLOC’s ability to reduce risk for investors and give investors exposure to a broad cross- section of the blockchain ecosystem; BLOC’s ability to acquire a basket of cryptocurrency assets and pre-ICO and ICO financings on favorable terms or at all, successfully create or incubate its own tokens and ICO's and execute on future investment and M&A opportunities in the cryptocurrency space; BLOC’s ability to capitalize on the skills and expertise of its management and advisors; and such other assumptions and factors as set out herein. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of BLOC to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks related to changes in cryptocurrency prices; the estimation of personnel and operating costs; that BLOC will receive required regulatory approvals; the availability of necessary financing; permitting of businesses that BLOC intends to invest in; general global markets and economic conditions; risks associated with uninsurable risks; risks associated with currency fluctuations; risks associated with competition faced in securing experienced personnel with appropriate industry experience and expertise; risks associated with changes in the financial auditing and corporate governance standards applicable to cryptocurrencies and ICO's; risks related to potential conflicts of interest; the reliance on key personnel; financing, capitalization and liquidity risks including the risk that the financings necessary to fund continued development of BLOC's business plan may not be available on satisfactory terms, or at all; the risk of potential dilution through the issuance of additional common shares of BLOC; the risk of litigation; the risk that BLOC’s management and advisors may not contribute as much as expected to the company’s success; and the risk that cyber crime may severely damage the value of any or all of BLOC’s investments. There may be many other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. We undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by law. Investors are cautioned against attributing undue certainty to forward-looking statements.

DISCLAIMERS

PURPOSE OF DISCLOSURE. This communication is not a recommendation to buy or sell securities. This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. If we own any shares we will list the information relevant to the stock and number of shares here. We have not investigated the background of BLOC. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. These non- compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor awareness efforts. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur. Our emails may contain forward looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company(s), in communications, writing and/or editing.

DISCLOSURE. Safehaven.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) does not make any guarantee or warranty about what is advertised above. The Company is not affiliated with, any specific security. While the Company will not engage in front-running or trading against its own recommendations, The Company and its managers and employees reserve the right to hold possession in certain securities featured in its communications. Such positions will be disclosed AND will not purchase or sell the security for at least two (2) market days after publication.

The opinions expressed in this article are exclusively those of the author and have in no way been approved or endorsed by BLOC. This article and the information herein are provided without warranty or liability.

SHARE OWNERSHIP. The owner of Shareprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Safehaven.com will not notify the market when it decides to buy more or sell shares of this issuer in the market, but will not trade on material information that has not been disclosed to the public. The owner of Oilpatch.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing the Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR- OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

All trades, patterns, charts, systems, etc., discussed in this message and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher. No system or methodology has ever been developed that can guarantee profits or ensure freedom from losses. No representation or implication is being made that using the methodology or system will generate profits or ensure freedom from losses. The testimonials and examples used herein are exceptional results, which do not apply to the average member, and are not intended to represent or guarantee that anyone will achieve the same or similar results.

The information contained herein may change without notice.