The Bitcoin boom is well and truly underway, and investors are constantly looking for new ways to gain an advantage in this space. The best way to do this, it seems, is by cutting the energy costs of mining this precious commodity.

The Bitcoin mining industry consumes 22.5 TWh of energy annually, which amounts to 13,239,916 barrels of oil equivalent. With 12.5 bitcoins being mined every 10 minutes, that means the average energy cost of one bitcoin would equate to 20 barrels of oil equivalent.

Mining Bitcoin has the potential to be a wildly lucrative business, with a single Bitcoin now valued at more than 100 barrels of oil. That kind of price makes it one of the most valuable commodities on the planet and, just like oil, this commodity is increasingly valuable to mine if the energy costs can be kept down.

Bitcoin transactions are secured by computer miners, who are competing for rewards in the form of coins from the network. The more computation power they use, the better their chances. The drill rig is a computer, and hydraulic fracturing is done with the tip of your fingers. It’s a phenomenally energy-intensive process.

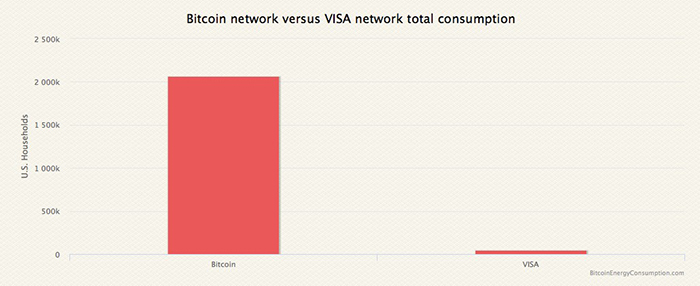

To put this in perspective, the total energy consumption of the world’s Bitcoin mining activities is more than 40 times greater than that required to power the entire Visa network.

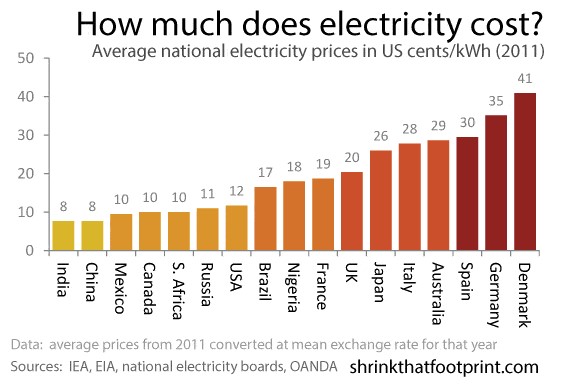

Cheap electricity is exactly what made China the Bitcoin mining king. The yearly cost of the energy necessary to mine Bitcoin determines its economics. But to get in on that you risk reputation because you’re either siphoning off surplus energy from somewhere else, or you’re partnering with the government. No matter how you look at it, it’s a very gray area. No one wants dirty coal fueling such a sophisticated endeavor, for example.

That’s why HIVE Blockchain Technologies Ltd.—a gold-miner-turned-Bitcoin-miner—has set up in Iceland.

As one of the first public companies that lets you participate in the build-up and infrastructure of crypto mining, HIVE is taking advantage of Bitcoin’s favorite element: Ice.

It’s freezing in Iceland, so the relative energy cost of mining there is lower. Mining hardware requires enormous power and creates tons of heat, and natural temperature is key: Iceland saves on cooling costs, making it one of the most potentially profitable places to mine Bitcoin.

Iceland: New Ground (Below) Zero for Bitcoin?

Bitcoin is all about digital infrastructure. In this burgeoning industry that offers a chance at significant profits, just about any computer can be used, but companies dedicated to ether mining are the latest thing, and this is where things can really get lucrative.

This is industrial-scale bitcoin mining, and some of these companies are worth tens of millions of dollars, according to Bloomberg.

And for all of them, the Great Bitcoin Game is to keep energy costs down to make ether mining more cost-effective.

Right now, about 85 percent of the world’s Bitcoin trading volume comes from China. Countries with heavily subsidized energy are obvious ether mining haunts, but now the colder countries have something to offer that has nothing to do with the government, and doesn’t involve any legal gray areas that will come under scrutiny.

It’s 100 percent Mother Nature, and as long as she keeps Icelandic temperatures … Icelandic, then natural cooling should be a boon for Bitcoin. The cold countries are now the home of what is being dubbed ‘geothermal gold’.

Giant ether mining start-up, BitFury Group, is there. BitFury, out of the Netherlands, generated over $90 million in revenue this year, and predicts it will be generating $585 million in revenue by 2021. While its flagship data center is in the Republic of Georgia, it’s also now tapping into the cool temperatures of Iceland.

Emmanuel Abiodun, founder of Cloud Hashing, a company which owns a computing facility in Iceland, chose Iceland because of its cheap and plentiful geothermal and hydroelectric energy, and the “free Arctic air” that is piped in to cool the machines.

Iceland is also ground zero for Hong-Kong-based Genesis Mining Ltd, which is building the largest ether mining facility in the world in Iceland. Alphabet (NYSE:GOOG) and Facebook are there, too, taking advantage of the cold.

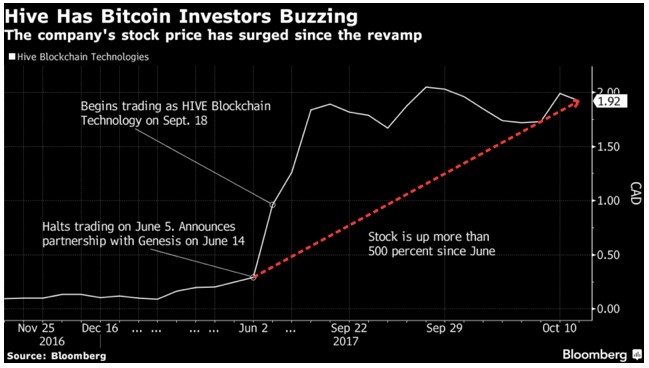

And HIVE has recently acquired a new data center from Genesis for $9 million and a 30 percent equity stake in HIVE, according to Bloomberg, which says HIVE shares have “Bitcoin investors buzzing”.

Right next door to this landmark Bitcoin facility in Reykajanes, Iceland, HIVE has just acquired a second data center from Genesis.

Billionaire Money Pouring into Big Bitcoin

An internet advisor for Russian President Vladimir Putin is eyeing entrance into this great game, planning to raise $100 million in cryptocurrency to help Russia challenge China’s hegemony in Bitcoin mining.

“Russia has the potential to reach up to 30 percent share in global cryptocurrency mining in the future,” Putin’s internet ombudsman, Dmitry Marinichev, was quoted as saying, adding that $10 million from the proceeds of the Russian Miner Coin ICO may be spent developing processors.

Japanese billionaire Masatoshi Kumagai, co-founder of giant GMO Internet Inc., announced plans last month to invest over $90 million in a new Bitcoin mining business that will operate as a fund, partially, by soliciting capital from investors and repaying them in cryptocurrency.

In North America, all the buzz is about HIVE and Genesis, and two legendary billionaire backers known for their early-in investment intuition.

HIVE’s backers include mining mavericks Frank Giustra and Frank Holmes. Giustra built up Goldcorp (NYSE:GG) in 2000 and today it trades at a market cap of nearly $11 billion, and is one of the largest gold-mining companies in the world. He was also behind Silver Wheaton, which is now Wheaton Precious Metals Corp. (NYSE:WPM), the biggest silver and gold streaming company in the world. Giustra’s 20-oscar-winning entertainment behemoth, Lion’s Gate, also took in $2.4 billion in revenue in 2015. And these are just a few of his multi-billion-dollar hits.

Holmes is the CEO of San Antonio-based U.S. Global Investors, which has $2.6 billion in assets under management and is one of the definitive top precious metals funds in.

Both have backed HIVE, and Holmes is now its chairman.

Both still love gold because gold will always be gold, but they’re not old-fashioned. Bitcoin is huge, and they won’t be left out of the wave.

Blockchain technology is like the Internet before everyone realized its explosive potential as a revolutionary information distribution channel. Email, like AOL, was that catalyst. Now, Bitcoin and Ethereum are doing for blockchain what email did for the Internet.

“There's a huge scramble to be able to apply this so that you'll be able to trade stocks 24/7” Holmes said in a recent interview.

But if you want to successfully mine cryptocurrency, you need cheap energy, ideally around 2 cents a kilowatt hour.

Mathematics Rules the Day

Speaking at the Money20/20 event in Las Vegas on 22 October, Apple Computers co-founder Steve Wozniak definitively sided with the Bitcoin camp, calling the U.S. dollar “phony” because more can always be printed. Bitcoin, he told CNBC, is “stable” because it can’t be diluted, and its future supply is fixed at 21 million bitcoins. “Maybe there’s a finite amount of gold in the world, but Bitcoin is even more mathematical and regulated and nobody can change mathematics,” Wozniak said.

With Bitcoin hitting $6,000 per coin on 21 October, and breaking new records as its adoption surges, this is no longer just a game for individual miners with fast computers. It’s now about industrial-scale mining and billionaire backing.

Even though cryptocurrency inhabits an unearthly geography in virtual time and space, where it is mined is just as important as it is for oil, gas, gold, or any other resource we mine.

The crypto sphere is everywhere, but mining its bounty means tapping into the cheapest sources of energy to keep costs down. The race now is to find the best venue with cheap energy and few reputational risks. Right now, that’s Iceland, the Genesis of the new wave of Bitcoin.

Other tech companies to watch closely:

Celestica Inc. (TSX:CLS) (NYSE:CLS) is a manufacturer of electrical devices used in IT, telecommunications, healthcare, defense and aerospace industries. The company has seen strong growth YoY which we expect to continue as the sales expectations are almost 3% better than last year’s.

While many investors thought the stock was overvalued after a stellar run in 2016, the recent correction and volatility in the stock has attracted new buyers and the stock has recovered since.

While telecommunications stocks have been volatile recently, defense, IT and aerospace industries have outperformed and while many see limited upside, these industries continue to surprise both investors and analysts.

Shopify Inc (TSX:SHOP) (NYSE:SHOP) is a Canadian e-commerce company with more than 500,000 companies rely on Shopify’s real-time e-commerce, including Tesla, Budweiser and Red Bull, among many others. Shopify manages their e-commerce machines, and its stock is now up to over $106 right now, with a market cap of over $10 billion. CNET called the application “clean, simple, and easy-to-use" in a review of the Shopify platform.

The company’s online presence and sheer reach make it an ideal buy for investors. Shopify makes purchasing goods and services easy for anyone – and in a time where convenience is king, Shopify surely has staying power.

Power Financial Corp (TSX:PWF): Montreal-based Power Financial Corp has been in the finance industry since 1984. The company operates in three segments: Lifeco, IGM and Pargesa Holding SA (Pargesa). And, with its holdings in a diversified portfolio spanning the United States and Europe, Power Financial is a leader in its field.

Focusing its investments in the emerging FinTech industry, Power Financial stands to benefit by riding this wave into the future. The company’s forward-thinking attitude and liberal approach to technology is sure to leave investors satisfied.

We like PWF because it owns 60 percent of Wealthsimple, a leading robo-advisor for investing in ETF portfolios.

Mogo Finance Technology Inc. (TSX:MOGO): This is a new spin on unsecured credit, which is a burgeoning sub-segment of FinTech. Providing loan management, the ability to track spending, stress-free mortgages, and even credit score tracking, Mogo is at the forefront of an online movement to assist users with their financial needs.

Mogo’s software analyzes borrowers instantly and greatly reduces the traditionally cumbersome underwriting process for loans. It’s online only, so there’s very low overhead and a ton of cash to spend on marketing. Labeled as “the Uber of finance” by CNBC, Mogo is definitely turning heads.

Blackberry Ltd (TSX:BB) This well-known cell-phone pioneer is engaged in the sale of smartphones and enterprise software and services. The Company's products and services include Enterprise Solutions and Services, Devices, BlackBerry Technology Solutions and Messaging.

Blackberry used to be a worldwide leader in phones, but Apple, Google and other Android manufacturers have rapidly acquired market share. Blackberry has since focused on software and is now developing systems for autonomous vehicles. Tech giants such as Apple and Google won’t be able to repeat Blackbery’s success in this sector that easily.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This news release contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include that HIVE Blockchain Technologies Inc. (“HIVE”) will be able to take advantage of lower natural temperatures in Iceland in its Bitcoin mining operations, that natural cooling in Iceland will be a boon for Bitcoin, that other players in the cryptocurrency mining space, including Bitfury, Cloud Hashing, Russia and the Russian Miner Coin and Masatoshi Kumagai, will continue to invest in such space and derive positive returns from their investments in such space, that HIVE is planning on acquiring a second data center from Genesis in Iceland and that HIVE and certain of its large investors will not be left out of the Bitcoin wave. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. Risks that could change or prevent these statements from coming to fruition include that HIVE will not be able to take advantage of lower natural temperatures in Iceland in its Bitcoin mining operations, that natural cooling in Iceland will not be a boon for Bitcoin, that other players in the cryptocurrency mining space may not continue to invest in such space or derive positive returns from their investments in such space, that HIVE will not be able to complete the acquisition of a second data center from Genesis in Iceland and that HIVE, Frank Giustra and Frank Holmes and certain of its large investors will be left out of the Bitcoin wave. The forward-looking statements contained in this news release reflect the current expectations, assumptions and/or beliefs of the writer based on information currently available to the writer. In connection with the forward-looking statements contained in this news release, the writer has made assumptions about HIVE’s ability to take advantage of lower natural temperatures in Iceland in its Bitcoin mining operations and the expected success of HIVE’s acquisition of a second data center from Genesis in Iceland. The writer has also assumed that no significant events will occur outside of the HIVE’s normal course of business. Although the writer believes that the assumptions inherent in the forward-looking statements are reasonable, the forward-looking statements are not a guarantee of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. The forward-looking information contained herein is given as of the date hereof and the writer assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

PURPOSE OF DISCLOSURE. This communication is not a recommendation to buy or sell securities. This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. We have not investigated the background of HIVE – TSXV: HIVE and OTC: PRELF. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. These non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor awareness efforts. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company, in communications, writing and/or editing.

DISCLOSURE. Oilprice.com, Advanced Media Solutions Ltd., and their owners, managers, employees, and assigns (collectively, “we” or the “Company”) does not make any guarantee or warranty about what is advertised above. This article and the information herein are provided without warranty or liability.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market, but will not trade on material information that has not been disclosed to the public. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc., discussed in this message and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher.