Silver prices may be on the cusp of an historic squeeze. In fact, according to Dolly Varden Silver Corporation (TSXV: DV) (OTCQX: DOLLF) CEO Shawn Khunkhun, "The 850 million ounces we mine annually will be entirely consumed by growing industrial demand," Khunkhun stated. He pointed out that recent years have already seen significant silver deficits, and with investment demand expected to surge during the upcoming bull market, the squeeze could lead to record-breaking silver prices by 2026,” as quoted by The Jerusalem Post. Not only would that be bullish for to Dolly Varden Silver Corporation, but also for silver companies such as Hecla Mining (NYSE: HL), First Majestic Silver Corp. (NYSE: AG) (TSX: AG), Pan American Silver (NYSE: PAAS) (TSX: PAAS), and Avino Silver & Gold Mines (NYSE: ASM).

In addition, First Majestic Silver CEO Keith Neumeyer says silver could climb to $100, even $130 per ounce. All thanks to silver’s deficit, its strong industrial demand, and just how undervalued it is as compared to gold. “Neumeyer has previously stated that he expects a triple-digit silver price in part because he believed the market cycle could be compared to the year 2000, when investors were sailing high on the dot-com bubble and the mining sector was down. He thinks it’s only a matter of time before the market corrects, like it did in 2001 and 2002, and commodities see a big rebound in pricing,” as noted by InvestingNews.com.

Dolly Varden Silver (TSXV: DV) (OTCQX: DOLLF) Just Announced New Drilling Numbers

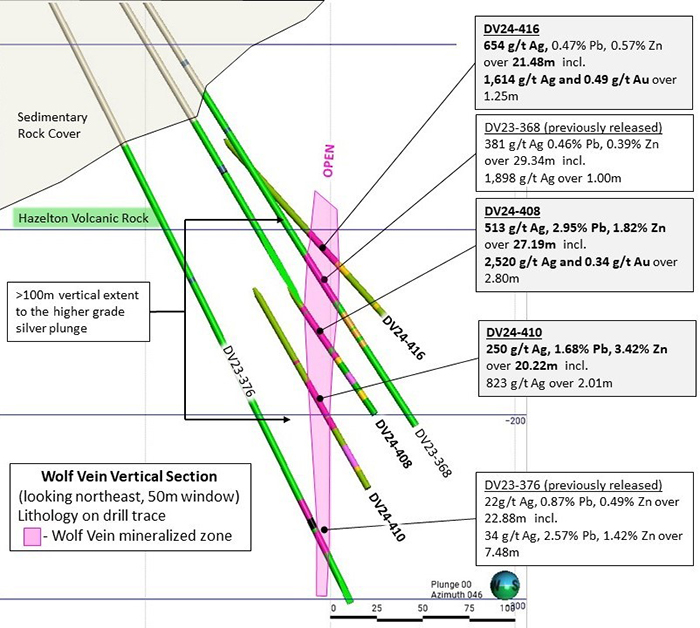

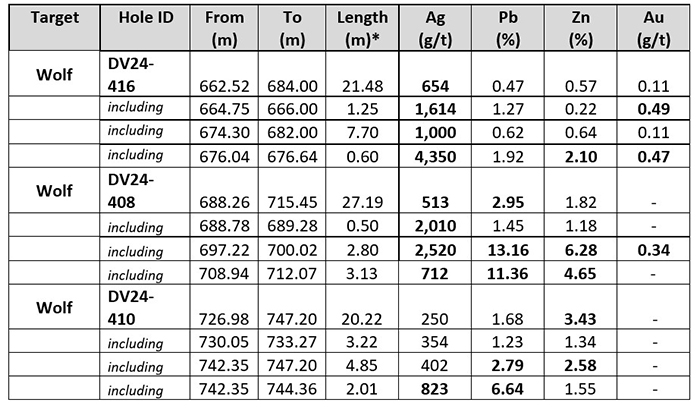

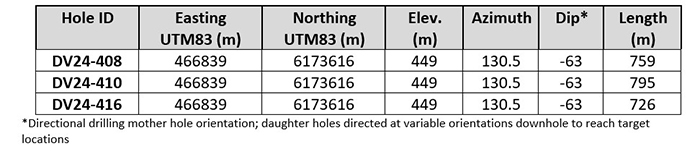

Dolly Varden Silver Corporation announced results from the Wolf Vein high-grade silver plunge expansion directional drilling. Drill hole DV24-416, averaged 654 g/t Ag, 0.47% Pb and 0.57% Zn over 21.48 meters and drill hole DV24-408, averaged 513g/t Ag, 2.95% Pb and 1.82% Zn over 27.19 meters. Both holes are located on the same vertical section and are separated by 44m vertically. The intersections demonstrate consistent thicknesses and indicate an increased vertical extent to the mineralized zone as it plunges to the southwest. The 2024 exploration drill program on the Kitsault Valley Project has been expanded to 32,000 m from the initial planned 25,000 m based on the successful drilling and supported by the recently completed financing. Currently, 3 drills continue expansion drilling at the Homestake Silver Deposit.

Wolf Vein Extension Drilling

Highlights include:

- DV24-416: 654g/t Ag, 0.47% Pb and 0.57% Zn over 21.48 meters, including 1,000 g/t Ag, 0.11 g/t Au, 0.62% Pb and 0.64% Zn over 7.70 meters.

- DV24-408: 513 g/t Ag, 2.95% Pb and 1.82% Zn over 27.19 meters, including 2,520 g/t Ag, 0.34 g/t Au, 0.18% Pb and 0.88% Zn over 2.80 meters.

* intervals shown are core length. Estimated true widths vary depending on intersection angles and range from 55% to 70% of core lengths, further modelling of the new intersections is needed before true widths can be estimated.

“The Wolf Vein continues to deliver exceptional silver grades, often with significant base metal values and strong native silver mineralization over potentially bulk-mineable widths. The extended drill program will prioritize lateral and vertical step-outs from these new Wolf results and follow up at other exploration targets including the silver zone at Moose. Resource expansion and exploration drilling efforts at the Homestake Silver Deposit continues within the projection of wider higher-grade gold and silver plunge zone defined in 2023,” said Shawn Khunkhun, CEO of Dolly Varden Silver.

This release includes results for three directional drill holes drilled from the same pad and intersecting the Wolf Vein on the same section, approximately 80 meters to the northeast of previously released (August 18, 2024) that documents step-out holes DV24-404, 409, 412 and 414. Directional drilling technology from this second drill pad was used to precisely target areas for vertical extension. Drill holes DV24-416 and DV24-408 intersected wide and high-grade silver mineralization in Wolf Vein breccias and coliform grey silica and carbonate approximately 14 meters above and 30 meters below, respectively from previously reported (September 11, 2023) drill hole DV23-368 that graded 381 g/t Ag, 0.46% Pb and 0.39% Zn over 29.34 meters including 583 g/t Ag, 0.13 g/t Au, 0.66% Pb and 0.45%Pb over 16.97 meter with 1,898 g/t Ag over 1.00 meter (Figure 1).

Figure 1. Section of Wolf Vein showing extended vertical expression of the Wolf vein silver mineralization and consistent wide zones of silica and carbonate vein and vein breccia with native silver, and silver sulphonate mineralization.

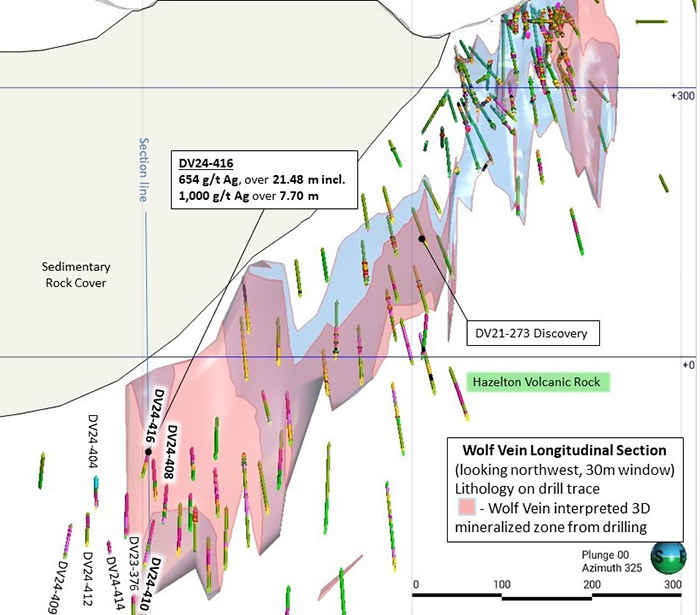

Drill hole DV24-416 confirms that high grade silver mineralization extends further up dip than expected, increasing the potential for a broader mineralized zone. There is also an increase in gold associated with higher grade silver as seen in a 0.60 meter interval from 676.04 to 676.64 meters grading 4,350 g/t Ag and 0.47 g/t Au. The mineralized vein remains open towards the sediment cap above it (Figure 3). Step out drilling along the upper portion of the plunge has been prioritized for late season.

Drill hole DV24-408 intersected the wider central portion of the higher-grade silver plunge and shows that in the southwestern drilling on the Wolf Vein, as the exploration approaches the projection of the intersection of the mid-valley north-northwest structures there is an increase in gold values associated with the higher grades of silver and the vein and vein breccias occur within a wide consistent structure.

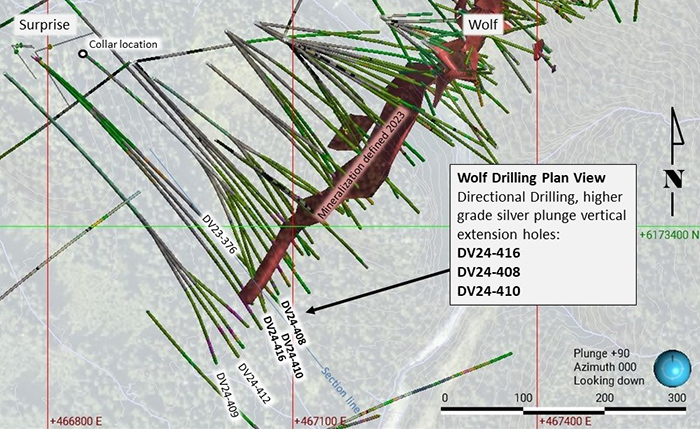

Figure 2. Plan of Wolf Vein mineralized zone (in red) with all drilling to date. Lithology shown on drill trace- grey: sedimentary rock, green: volcanic rock, pink/red: mineralization. DV24-408, 410 and 416 are drilled from a collar location 80 meters northeast of the previously released step out holes.

Drill hole DV24-410 intersected the lower projection of the high-grade plunge, approximately 43 meters vertically below DV24-408. The vertical expression of the Wolf vein shows increased base metals at depth and on section, increased silver values into the high-grade plunge. This hole intersected 20.22 meters length of vein breccias that had a mix of low grade and high-grade silver, lead and zinc mineralization averaging 198 g/t Ag, 1.68% Pb and 3.42% Zn overall, with a higher-grade interval attributed to more sulphide-rich breccias, grading 823g/t Ag, 6.64% Pb and 1.55% Zn over 2.80 meters (table 1).

Figure 3. Longitudinal Section of Wolf Vein with mineralization envelope in red. Plunge of high-grade silver mineralization expanded vertically over 100m height. Drill traces in this release with bold font.

Wolf Vein

The Wolf Vein is hosted in Jurassic-age Hazelton Formation volcanic rocks and is interpreted as a structurally controlled, multi phased, epithermal vein and vein breccias that occur along a southwest plunging zone of wider, higher grade silver mineralization. Native silver, pyargerite, argentite and argentiferous galena are hosted in multiple phases of silica and iron carbonate veins and breccias. The extention of the mineralization discovered underneath the sedimentary rock cap and the outcropping Wolf deposit has a plunge extent of over 950 meters at -45 to the southwest.

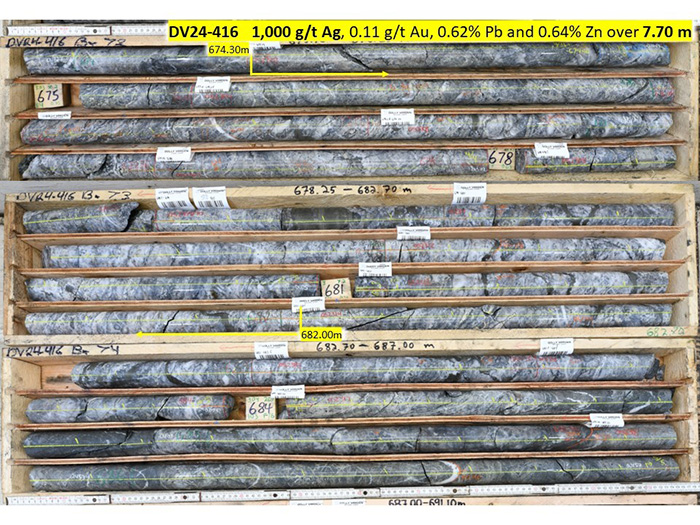

Figure 4. Whole core of Wolf Vein and Vein Breccia in DV24-416 showing interval 674.30m to 682.00m (7.70 meters) with grades highlighted within broader vein intersect.

Figure 5. Cut core sample face of Wolf Vein silver mineralization in DV24-408 @ 698.10m consisting of coarse native silver in epithermal grey silica vein breccia fragments, local coliform texture open space fill. From an individual sample length of 0.78 meters grading 3,760 g/t Ag, 0.18 g/t Au, 10.60% Pb, 4.72%Zn. Field of view is 5cm across.

Table 1: Completed Drill Hole Assays from Wolf Vein (hole order in vertical sequence from top)

*All intervals shown are core length. Estimated true widths vary depending on intersection angles and range from 55% to 70% of core lengths, further modelling of the new interpretation is needed before true widths can be calculated.

Table 2: Drill hole data for Wolf Vein holes reported in this release

*Directional drilling mother hole orientation; daughter holes directed at variable orientations downhole to reach target locations

Other related developments from around the markets include:

Hecla Mining announced second quarter 2024 financial and operating results. "Hecla saw significant improvement in gross profit and free cash flow during the quarter - with our gross profit increasing more than 1.5 times over the prior quarter, and free cash flow generation of $28.3 million, which allowed us to reduce our net debt by $25.1 million," said Cassie Boggs, interim President and CEO. "This financial performance was driven by strong results and free cash flow generated at Greens Creek and Lucky Friday, while Keno Hill's ramp-up progressed well with throughput in excess of 400 tpd. With this strong performance and favorable price environment, we will continue our focus on reducing debt while continuing to invest in our operations and exploration programs."

First Majestic Silver Corp. and Gatos Silver, Inc. entered into a definitive merger agreement pursuant to which First Majestic will acquire all of the issued and outstanding common shares of Gatos. Gatos is a silver dominant producer with a 70% interest in the Los Gatos Joint Venture, which owns the producing Cerro Los Gatos underground silver mine in Chihuahua, Mexico. Under the terms of the Definitive Agreement, Gatos shareholders will receive 2.550 common shares of First Majestic for each common share of Gatos held. The consideration implies a total offer value of US$13.49 per common share of Gatos based on the closing price of First Majestic’s common shares on the New York Stock Exchange on September 4, 2024, and represents a 16% premium based on each company’s closing prices and 20-day volume weighted average prices on the NYSE ending September 4, 2024

Pan American Silver reported unaudited results for the quarter ended June 30, 2024. “Operations generated record cash flow before working capital changes of $203.3 million in Q2 2024, with solid performance on costs, which were below our expected ranges for both the silver and gold segments in the quarter. This resulted in free cash flow of $102.1 million in Q2 2024,” said Michael Steinmann, President and Chief Executive Officer. “We completed the new ventilation infrastructure at La Colorada on schedule in early July, and we are now seeing significant improvements in the underground working conditions. We expect silver production to increase in the second half of the year, which will bring annual silver production to within our guidance range based on first half 2024 results. We are also on track to meet our annual production outlook for gold, zinc, lead and copper.”

Avino Silver & Gold Mines, a long-standing silver producer in Mexico, announced its consolidated financial results for the second quarter of 2024, with record revenues and further cash generation. “In the second quarter, we delivered record revenues as a result of higher metal prices combined with consistent production from our Avino Mine,” said Nathan Harte, CFO. “We saw improvements in all key financial metrics compared to Q2 2023, with cash flow generation and operating margins strengthening our cash and working capital positions. This strength will allow us to move forward with our plans at La Preciosa as efficiently as possible, and we look forward to delivering additional value to shareholders along the way.”

Legal Disclaimer / Except for the historical information presented herein, matters discussed in this article contains forward-looking statements that are subject to certain risks and uncertainties that could cause actual results to differ materially from any future results, performance or achievements expressed or implied by such statements. Winning Media is not registered with any financial or securities regulatory authority and does not provide nor claims to provide investment advice or recommendations to readers of this release. For making specific investment decisions, readers should seek their own advice. Winning Media is only compensated for its services in the form of cash-based compensation. Pursuant to an agreement Winning Media has been paid three thousand five hundred dollars for advertising and marketing services for Dolly Varden Silver Corporation by Dolly Varden Silver Corporation. We own ZERO shares of Dolly Varden Silver Corporation. Please click here for disclaimer.

Contact:

Ty Hoffer

Winning Media

281.804.7972

[email protected]