The media is becoming fixated on the repair/rebuilding of just about every public piece of infrastructure in the known universe. And that’s a good thing.

Not to mention replacing pipes of all varieties (oil, water, gas etc.) and the attendant support structures. Infrastructure bellwethers such as SNC Lavalin (TSX: SNC) is trading near it’s 52-week high at C$56, up from C$40 on Jan 1, 2016. Others and US peers have experienced comparable growth.

Not so for some juniors.

A Pure Infrastructure Play and More: Only C$0.30 a Share…

Calgary Tunneling (CT) is a leading infrastructure design, developer and construction company that appears to have been mispriced by markets. Under the Enterprise Group umbrella, it has been stained by the ‘low oil price’ watusi that wrongly impacts a lot of quality juniors, to a greater or lesser degree.

Even though you have to buy the parent Enterprise Group to get exposure to CT, the other three subsidiaries noted below are all impressive in their own right. CT contributes about 1/3 of annual revenues to parent Enterprise Group.

“Investors make a costly mistake tying CT’s fortunes to vagaries of the oil and price fluctuations. Only 15% of our revenues are derived from the oil and gas sector. As a matter of fact, we are looking for a 40% revenue increase next year and that does not fully incorporate our ambitious expansion plans. We plan to grow the Company from a successful regional Western Canadian company to a major national player. Initially that growth will focus on the BC lower mainland markets and those of Southern Ontario,” states Steve Kelly, CT Operations Manager.

Kelly goes on to mention that those two opportunities alone are massive, as they have found customers welcoming of their approach, professionalism and competitive costing. He had noticed ‘supplier fatigue’ in the region and an alternative approach appears to be a great revenue opportunity. In Southern Ontario, there really is no competition at least in CT’s method of work, expertise, experience and costing.

Safety and environmental concerns are key to CT and Enterprise. So much so that CT’s WCB premiums and related groups are actually at a significant discount to its peers.

Trenches Are So 90’s

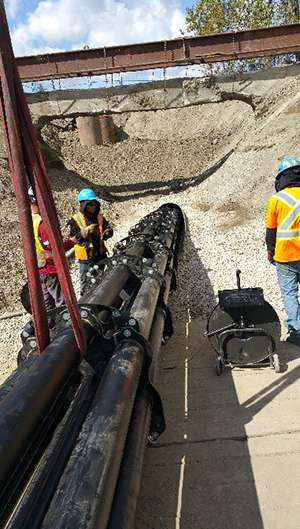

The increasing use of trenchless technologies throughout the world is a direct result of the high economic, social, and environmental costs of traditional trenching installations. Increasingly throughout the world, existing and new methods of trenchless technology are replacing those disruptions, often at a fraction of the economic and social costs, and with minimal impact on the environment.

CT’s business mix is 85% water, sewage and rail work and 15% oil and gas. As stated, wrongly stained. Society always needs municipal and provincial/state infrastructure.

Canadian Fed Government Budget 2017 confirms that the it will be making additional infrastructure investments of C$81-billion over the next 11 years, starting in 2017-18, in support of public transit, green infrastructure, social infrastructure, transportation supporting international trade, projects that support Canada’s rural and northern communities, and now smart cities.

Money, Money, Money

That money is starting to hit Canadian municipal coffers and the sector is seeing a significant rise in not only business planned, but also optimism for the future; always a good thing. CT, as parent Enterprise through its other subsidiaries, Artic Therm, Hart Oilfield and Westar Rentals have their collective ears to the ground and are seeing both business and incoming enquiries rising nicely; not a tsunami as yet, but growing weekly.

The days of digging trenches, laying pipe and chewing up the environment are gone. Enterprise, through CT, delivers the very best in state of the art, cost effective services; numbering roughly a dozen solutions as well as customizable. The parent Company, Enterprise, has a breakup of about C$0.85 cents and is trading at C$0.30.

That said, Enterprise’s daily volumes are increasing, so it appears savvy investors are looking deeper. They will quickly realize the myriad of competitive advantages.

It would take way more ink to dig into all of CT’s drilling technologies. From utility installation to fluid movement to flood abatement, Horizontal Auguring is used to minimize traffic disruption, ground disturbance, and environmental impact.

This policy is extremely important in areas of high population density, existing utility installations, and sensitive environmental areas.

Steve Kelly states; “trenchless tunneling is an environmentally superior method of burying infrastructure. By reducing, or eliminating surface disturbance, CT dramatically lowers the environmental footprint of our projects. Our continuing efforts to meet or exceed environmental guidelines and best practices in our theater of operations will continue to show our sincere commitment to social and environmental responsibility.”

As part of a highly experienced management team, Steve Kelly has over 35 years of in-country and international experience in safety. Since 1980 Stephen has focused on the implementation policies, practices & procedures. Stephen familiarity with all aspects of the industry makes him an invaluable asset to the Company when it comes to compliance, site safety, and proper job completion, project planning & Safety program design.

Legal Disclaimer/Disclosure: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Baystreet.ca assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Baystreet.ca has been compensated ten thousand dollars for its efforts in distributing the TSX:E profile on its web site and distributing it to its database of subscribers. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.