Gold prices breaking over $1,800 per ounce in June was a significant milestone that signaled the precious yellow metal was ready to make a run at a new all-time high. That’s exactly what happened early in August when gold surged to $2,089 per ounce, driven by the classic catalysts, namely being a safe haven asset during times of uncertainty and rising against protracted periods of low interest rates.

With no end in sight to either, gold prices continue to simmer over $1,900 an ounce, as investors look for exposure to the metal, either in physical form, exchange traded funds, majors or upcoming juniors. Even Warren Buffett’s Berkshire Hathaway (NYSE: BRK.B), famously against buying gold stocks, joined the gold rush this year with a $565 million investment in Barrick Gold Corp. (NYSE: GOLD)(TSX: ABX).

The Abitibi Legacy Goes On

The Abitibi Greenstone Belt straddling the Canadian provinces of Ontario and Quebec is one of the most famous gold-bearing regions in the world. Val-d’Or, Kirkland Lake, Red Lake, Rouyn-Noranda, Malartic and Timmins are just a few of the world-class gold camps that call the Abitibi home. As it happens, the Canadian Malartic Mine – a JV between Yamana Gold (NYSE: AUY)(TSX: YRI) and Agnico Eagle (NYSE: AEM)(TSX: AEM) – is the largest open pit gold mine in Canada.

The belt has produced about 180 million ounces of gold since the first discoveries in the early 1900’s, with dozens of miners working to extract tens of millions of ounces already known to still be hosted in the Abitibi’s rocks.

For instance, Kirkland Lake Gold (NYSE: KL)(TSX: KL) in January completed its C$4.89 billion (US$3.68 billion) acquisition of Detour Lake Gold, taking ownership of the Detour Lake Mine in the northern Abitibi that has a mine life of approximately 22 years with an average gold production of 659,000 ounces per year.

Amongst the most well-known structural faults in the Abitibi, the Cadillac-Larder break is a premier target, as part of the Kirkland Lake-Larder Lake gold belt that has produced several mines, including the Kerr Addison Mine that produced 10.5 million ounces of gold. This is the area of focus for Gatling Exploration (TSX-V: GTR) (OTCQB: GATGF), a company proving that prior explorers at its Larder project overlooked something.

Gatling: A Picture is Worth a Thousand Words (and two pics are worth more)

Gatling’s 3,370-hectare Larder project is located 7 kilometers west of the aforementioned Kerr Addison Mine. Larder was the subject of an historical mineral resource estimate completed in 2011 viewing it as three, separate high-grade gold deposits, dubbed Bear, Cheminis and Fernland. Per the report, 960,800 ounces of gold were estimated in the Indicated and Inferred categories. To the point of the estimate, more than 200,000 meters of historical drilling are part of the database, in addition to property-wide ground sampling and survey results.

Most recently, Goldfields (NYSE American: GV) drilled 31,000 meters (59 holes) in 2012-2013, data which has not been included in the resource report, not to mention the highly relevant drilling completed during 2019-2020 by Gatling.

The hidden value here is the analysis of the data by Gatling to hypothesize that the three deposits aren’t separate at all as previously thought, but rather part of a single mineralized system spanning a minimum of 4.5 kilometers.

In 2019, Gatling proved with drilling that the Bear and Cheminis deposits were indeed connected, making 2.5 kilometers of continuous strike.

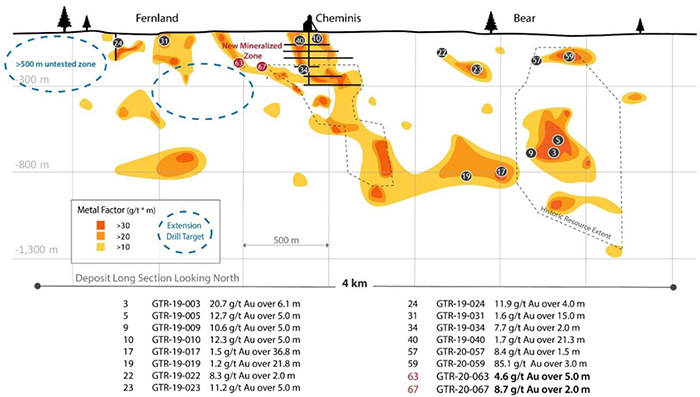

And now, according to news released on Monday, Gatling has proven that the Fernland and Cheminis are connected, stretching the mineralization out to the targeted 4.5 kilometers while remaining open along strike and depth. The image below shows the latest metal factor across the 4.5 kilometers, as well as the signifcant intercepts. These drill results include grades as high as 85.1 grams per tonne gold (g/t Au) over 3.0 meters at a shallow depth and the latest near-surface cuts that show a new mineralized zone via intersects of 4.6 g/t Au over 5.0 meters and 8.7 g/t over 2.0 meters.

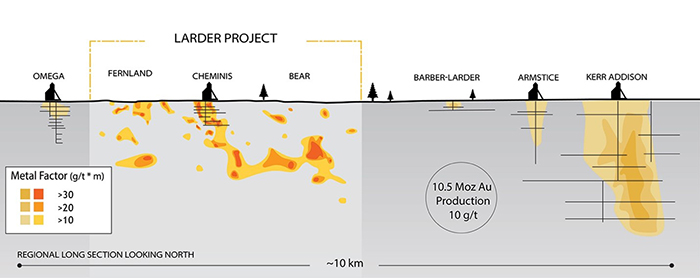

While impressive, some context to the potential of Larder is evident when a wider view of the region is added, as in the image below.

The Kerr Addison Mine to the east produced 10.5 million ounces of gold at an average 10 g/t gold. Of course, mineralization at nearby properties is by no means a guarantee of similar results at Gatling’s property, but it can certainly underscore some optimism to keep drilling to better define and expand the resource while bringing the data to current National Instrument standards.

According to Nathan Tribble, VP Exploration for Gatling, “Now that we have proven the continuity of mineralization over 4.5 kilometers, we have our sights on the expansion of near surface mineralization potential at Fernland. Fernland is the least explored of the three deposits and we intend to test continuity of mineralization down plunge and along strike in upcoming drilling phases.”

The Company has mobilized drill rigs already and plans to keep drilling west to evaluate the untested ground heading towards the Omega deposit that could extend the strike to a full 5 kilometers.

Legal Disclaimer/Disclosure: While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our article is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company, in communications, writing and/or editing. Nothing in this publication should be considered as personalized financial advice. We are not licensed under any securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this article is not provided to any individual with a view toward their individual circumstances. Baystreet.ca has been paid a fee of thirty thousand dollars for Gatling Exploration Inc. advertising from the company. There may be 3rd parties who may have shares of Gatling Exploration Inc. and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this article as the basis for any investment decision. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing Baystreet.ca, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.