The marijuana market is poised to see the biggest investor bull rush of the 21st century, and gaining exposure to this burgeoning industry is one of the most important investment questions of our time.

In the U.S. alone, the marijuana market is set to reach $25 billion by 2020 despite recreational use being legal in only two states. The Canadian market is forecast to hit $8 billion, and is set to see federal legalization implemented within a matter of months.

Unsurprisingly, the legalization of this enormous market has already brought investors incredible returns – with the twelve largest companies seeing an average gain of 332 percent over the course of a year. And as the recreational use of marijuana in Canada gains country-wide approval in the coming months, these stocks are set for another big spike.

The biggest question facing investors in 2018 is how to isolate those companies with the most exposure to these gains, and how to gain access to both Canadian and U.S. markets.

With all of that in mind, here are 5 cannabis stocks that you should keep an eye on in 2018:

#1 Canopy Growth Corp. (TSX:WEED)

With a market cap of $3.79 billion, Canopy Growth Corp. is a giant in this space and has seen significant gains in the past year – with its stock price more than doubling since September.

As the federal legalization of recreational cannabis in Canada approaches, this is undoubtedly one of the companies to watch. With new facilities recently licensed at its Smiths Falls flagship project, this giant is constantly expanding its growing capabilities. As a result of this growth, Canopy Growth Corp. became the first Cannabis company to be added to the S&P/TSX Composite Index.

With its reputation as ‘the biggest weed producer in the world’, investors may look to Canopy Growth as one of the safer names in the space. While there will likely be companies seeing higher returns, there is undoubtedly value in having one of the Big Weed stocks in your portfolio next year.

Just as in any industry, when a bull run is underway, investors are sure to see returns from the industries biggest players. As long as demand continues to surge as it has been, Canopy Growth will be there to dominate supply.

Investors can expect to see the growth trend here continue into the New Year and gain a further boost when Canada’s next big piece of cannabis legislation is signed.

#2 Cannabis Wheaton (TSX-V:CBW; OTC: CBWTF)

For investors interested in gaining exposure to the entire North American market, Cannabis Wheaton is a company unlike any other.

This innovative company is doing what Silver Wheaton has done for the mining industry and what Netflix has done for movies – Cannabis Wheaton is streaming pot.

As demand soars and companies attempt to get in on the biggest bull run of the century, Cannabis Wheaton is providing a route to the top of the industry for new and existing growers. It is a royalty-based business that is entirely new to a market that is set to explode in 2018.

This business model removes the risks associated with betting on a single producer, instead giving you access to a much larger portion of the industry. And the team putting those deals together is made up of some of the biggest names in the space.

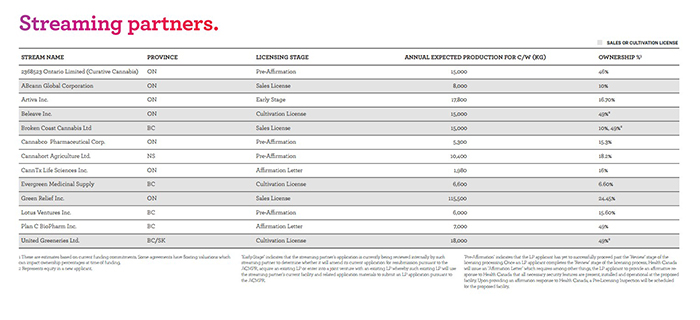

This one-of-a-kind company has already lined up 15 partners, with 17 facilities—for 1.4 million effective square feet of growing acreage. In return, they get minority equity interests and a portion of the pot produced.

As recreational use is legalized across Canada in 2018, Cannabis Wheaton will be a significant catalyst in a space that is already struggling to keep up with soaring demand.

And on top of all of that, Cannabis Wheaton already has 39 clinic relationships, and it is growing fast, with access to over 30,000 registered medical marijuana patients.

This one-of-a-kind company is providing a win-win situation for investors, with lower risk and diversified exposure to the hottest market in 2018.

This one-of-a-kind company is providing a win-win situation for investors, with lower risk and diversified exposure to the hottest market in 2018.

Traditional licensed cannabis producers are likely to benefit during the boom, but Cannabis Wheaton’s innovative business strategy is giving investors an edge in this space.

The recent $15-million purchase of common shares of ABcann Global Corporation in August was a taste of things to come. Upon completion of a further $15 millon investment and capital to contruct an expansion, the deal will add another 50,000 square feet of pot production to ABcann’s portfolio.Cannabis Wheaton will get 50 percent of the production from ABcann’s 50,000 square feet of new cultivation for almost 100 years.

This is a business and model to watch very closely.

#3 Sanofi (NYSE:SNY)

The medical marijuana industry is booming, and the one sector that you can be sure will cash in on this craze is big pharma. But for investors this will all be a question of timing. Currently, the giants of the pharma space are biding their time, waiting for the ambitious small caps to get through the cash intensive development and trial stages before swooping in to buy them up.

2018 is going to be the year that big pharma makes its move, as recreational marijuana sends the medical space into overdrive and the late stage developments become ripe for a buyout. These giants won’t be competing with medical marijuana companies, they will own them. So investors can afford to avoid the risk of backing medical marijuana companies and instead just wait on big pharma to reap all of the rewards.

Given the momentum behind the market in Canada and the major legislative breakthroughs cannabis has achieved this year, you can be sure that big pharma is likely to make its move soon.

Sanofi is a French-based giant, with a current market cap of over $109 billion and has seen a dip in its stock price of late. This provides investors with a nice entry point if the company makes a move on the medical marijuana market in the New Year.

This giant is already working with cannabinoids, marketing Rimonabant – a drug designed to control appetite. You can be sure that it is already scouring the market for a late stage medical marijuana company.

#4 Pfizer (NYSE:PFE)

Pfizer is another big pharma pick and boasts some sizzling dividends for investors as well as a very solid growth picture over the past five years. Its two segments, innovative health and essential health, generated $52.8 billion in revenue last year, with net income of $7.2 billion.

While its legacy products may be experiencing declining sales, its new products are very promising, driving its impressive growth in 2017. It is in this new product segment that we will be seeing cannabis breakthroughs and with a market cap of over $215 billion, Pfizer has the influence to bring in winning deals.

Adding to the upside for investors, Pfizer is currently developing two new cancer drugs and an autoimmune disease drug that could be game changing for the sector, and this giants stock price.

Arguably the companies most attractive aspect is its financial flexibility, which puts it ahead of its peers. While the company’s debt-to-equity ratio wasn’t great for Q1, that was largely because of a series of acquisitions (Anacor Pharmaceuticals, Hospira, Medivation). Its revenues have been increasing on a year on year basis, making it a strong bet to win any battles for cannabis breakthroughs.

This is a promising pharma play at the worst of times, but with the potential upside of the looming cannabis boom it is looking even better for investors.

#5 Scotts Miracle-Gro (NYSE:SMG)

Scotts Miracle-Gro is a ‘pick and shovel’ company for the marijuana industry and is yet another way investors can look to play the boom. As the race for supply heats up, this industry leader will be at the center of it all, providing investors with a fantastic opportunity.

SMG is currently trading at $102.56 having experienced impressive growth for the last five years. With a market cap of nearly $6 billion, it is a name to be reckoned with in one of the hottest markets in the world right now.

Its success so far has come largely from outside the marijuana sector, becoming a household name in everything from pest deterrent to weed killer. But now this giant in hungrily eyeing the marijuana market and is manufacturing a growing collection of products for us in hydroponic growing – a huge section of the pot market.

Hydroponics is the process of growing plants without soil, and SMG has a wholly owned subsidiary, Hawthorne Gardening Company, that is focused on hydroponics as 10 percent of its total sales currently – a figure that will grow at a rapid rate. Year-over-year, this segment has organically grown 20 percent, but Scotts is also actively acquiring companies in the space to boost that figure further still.

What SMG offers, then, is a way to gain unique exposure to the marijuana industry, without going all out for direct pot stocks.

Honorable Mentions:

Aurora Cannabis Inc (TSX:ACB) which is a producer and distributer of medical marijuana across Canada. The company, formally Prescient Mining Corp, is a Vancouver-based business founded a little over one decade ago. Aurora’s main objective is to bring medicine to the people reliably and economically, which sets it aside from many of its major competitors. In the marijuana industry, patients will often have to jump through hoops to procure their medication, but with Aurora’s caring and knowledgeable staff, patients no longer have to worry.

One of the most appealing things for patients ordering medications from Aurora is the company’s delivery method. This marijuana major sells marijuana by phone and over the internet and then it is delivered straight to the patient’s door.

Emerald Health Therapeutics Inc (TSXV:EMH) is another producer and distributer of medical marijuana. Based in British Columbia, Emerald Health is fully licensed by Access to Cannabis for Medical Purposes Regulations (ACMPR) and provides high quality medicine of different varieties. The company’s approach to research is what really sets the company apart from the competition. With the incredible emphasis placed on isolating the most important qualities in each strain and creating new products for patients, it is no wonder their medicine is so popular.

Hydropothecary Corp (TSXV:THCX) is a another heavy hitter in Canada’s cannabis scene. With former BC Health Minister Dr. Terry Lake as the VP of Corporate Social Responsibility, and the well-versed Ed Chaplin, who has raised millions for his previous ventures, as the Chief Financial Officer, the company is sure to have a bright future ahead.

With 4 primary products, including Canada’s only peppermint flavored medical cannabis oil sublingual mist, Hydropothecary has chosen quality over quantity. Offering patients the ability to administer their medication in a smoke-free format provides users with an option that is not available just anywhere.

OrganiGram Holdings. (TSXV:OGI): Organigram Inc. is a licensed medical marijuana producer in Canada, while it managed to maintain its production license this year, the company saw its stock price fall somewhat Year-To-Date, but we see strong upside for this stock as the changing Canadian cannabis legislation could give a massive boost to the market.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

FORWARD-LOOKING STATEMENT. Statements in this communication which are not purely historical are forward-looking statements and include statements regarding beliefs, plans, intent, predictions or other statements of future tense. Forward looking statements in this article include that new cannabis legalizing legislation will create an $8-billion-dollar industry; that there will likely be a supply shortage; that this industry will be $25 billion annually in the US; that Cannabis Wheaton’s business model reduces risk for investors; the ability to generate revenue or take production through the streaming agreements. Forward-looking information is based on the opinions and estimates of Cannabis Wheaton at the date the information is made, and is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Forward looking statements involve known and unknown risks and uncertainties which may not prove to be accurate. Actual results and outcomes may differ materially from what is expressed or forecasted in these forward-looking statements. Matters that may affect the outcome of these forward looking statements include that markets may not materialize as expected; marijuana may not turn out to have as large a market as thought or be as lucrative as thought as a result of competition or other factors; Cannabis Wheaton may not be able to diversify or scale up as thought because of potential lack of capital, lack of facilities, regulatory compliance requirements in Canada or outside of Canada or lack of suitable employees or contacts; partners of Cannabis Wheaton may not be granted licenses or additional capacity under existing licenses for them to grow for the cannabis market; and other risks affecting Cannabis Wheaton in particular and the cannabis industry generally. The forward-looking statements in this document are made as of the date hereof and the Company disclaims any intent or obligation to update such forward-looking statements except as required by applicable securities laws.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Cannabis Wheaton ninety thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. If we own any shares we will list the information relevant to the stock and number of shares here. We have been compensated by Cannabis Wheaton Income Corp. to conduct public awareness advertising and marketing for [TSX:CBW.V]. Oilprice.com receives financial compensation to promote public companies. This compensation is a major conflict of interest in our ability to be unbiased. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non- compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated public awareness efforts. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of public awareness marketing, which often end as soon as the public awareness marketing ceases. The public awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur. Our emails may contain forward looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, The Company often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LEGAL ADVISORY. Investing in companies associated with the cannabis industry may be illegal in the jurisdiction where a reader resides. Before investing in any public company involved in the cannabis industry, potential investors should check with their legal advisor as to whether an investment will breach local law.