Recognizing the upside with IMSCQ's proposed merger with Vivos BioTechnologies, a private company, I'm voting my stock FOR the merger. Investors, like me, face some dilution with the merger deal, but the upside from Vivos' sleep apnea device, called the DNA Appliance, is "big league" to quote one of my contemporaries.

1. The DNA Appliance may be a cure for sleep apnea

The DNA Appliance is a night-time oral device for correcting sleep apnea. It is FDA-cleared as a Class II medical device for mild to moderate cases of obstructive sleep apnea. Many of you will be familiar with CPAP devices (continues positive airway pressure) which are worn throughout the night and connected by hose to a pressure device. They're loud and awkward to wear, but they work to improve sleep in apnea sufferers when worn. It's important to realize that CPAP devices don't correct the underlying problem, they just alleviate the symptoms (apnea due to loss of breath). Meanwhile sales of CPAP systems have never been better: ResMed (RMD) sold $1.8 billion of devices and masks in their fiscal 2016 year, a steady clip from the 2012 fiscal year when they did $1.37 billion in sales.

Another lesser-known treatment, but with a history of success, are mandibular repositioning devices. These are worn like a retainer and move the lower jaw into a position that allows air to properly flow through the mouth, over the tongue, and open the XXX airway. They're an OK solution to sleep apnea, and they work while worn, but market penetration is ostensibly low as a result of poor marketing and awareness. They still account for about 10% of sleep apnea treatment in the U.S.

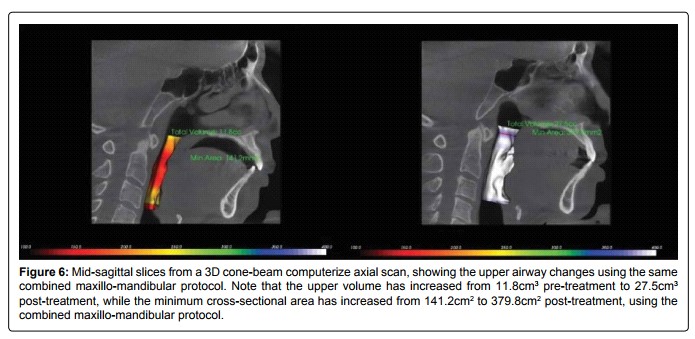

The DNA Appliance is different and could serve as a permanent solution to sleep apnea. While it works similarly to mandibular advancement appliances, the outcome is supposed to be permanent through alteration of the facial muscles and makeup. This is called biomimetic therapy and actually results in midfacial redevelopment. In a case study [ https://clinmedjournals.org/articles/jsdm/journal-of-sleep-disorders-and-management-jsdm-3-014.pdf] of 19 patients published last year (average age of 60 years), the patients had their sleep apnea improve by 51.5% over about 9 months, on average. In more severe patients [https://www.dnaappliance.com/journal_articles.html], the DNA Appliance has improved sleep apnea measures by 60 to 70%. Most importantly, the improvements persisted even after removing the device, signaling that the midfacial redevelopment may be occurring permanently. In fact, many patients have significantly altered jaw profiles after treatment.

Source: Singh and Cress. J Sleep Disord Manag 2017, 3:014

2. Demographic trends make sleep apnea a growing problem

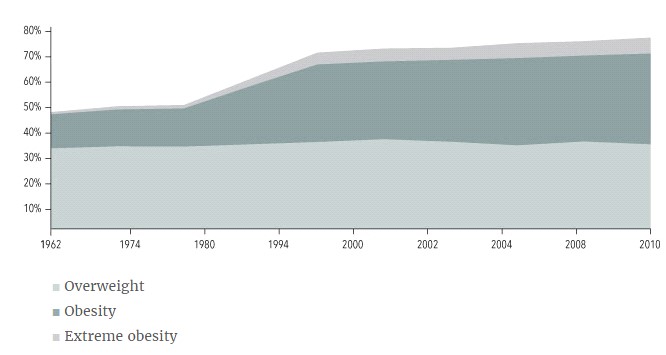

Epidemiology studies from the last few twenty years indicate that 2-4% of the adult U.S. population may be affected by severe sleep apnea, or around 10 to 20 million individuals, not including children. Sleep apnea disproportionately affects overweight and older individuals. As the baby boomers age and America continues on this unfortunate obesity trend, so goes the sleep apnea market. Sleep apnea is a huge market, expanded by the ageing baby boomer generation and the trend towards "larger" Americans in the last 40 years. Both age [https://www.ncbi.nlm.nih.gov/pubmed/9445292] and obesity [https://www.ncbi.nlm.nih.gov/pubmed/16840395] are risk factors for sleep apnea, and weight-loss is a primary goal in the treatment of severe sleep apnea today.

Source: NIDDK/NIH

3. A great business model

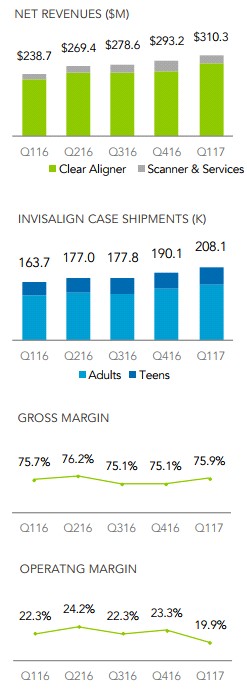

Alone, the market size and impressive results with the DNA Appliance make this attractive, but it's important to understand the business. How Vivos will sell the Appliance is not apparent on their website, so I'll attempt to explain, as it appears to be similar to another public company called Align Technology (ALGN). Align is the company behind Invisalign braces, which have sold over 300 million units since launch. The company makes about 200,000 of them each day, and sales were $310.3 million in the first quarter of 2017. The margins are high because this is just cheap plastic molding, similar to the DNA Appliance, at 70 to 76% in the last 5 quarters.

Source: Align Tech Website

This is a great case study for Vivos and the DNA Appliance, as the business model is almost identical - train and certify providers who charge typical fitting and installation fees to the patient of a few thousand dollars. The dentist or orthodontist purchases the appliance from Vivos for around $1,000. Product margins of 75% mean that Vivos grosses $750 for each patient treated. The financials get better for their own private dental centers that Vivos is launching. This seems to be the entire reason for the merger, so that the company can access more capital to build more centers. Their first center in Utah is on track to do over a million dollars in billings this year. Vivos can then keep the ecosystem of fitting, installation and follow-up (the $5-$10,000 cost), in-house.

The alternative is bleak - find another company or go under. Looking at both Align Tech and the sleep apnea market, I like the prospects with Vivos.

About One Equity Stocks

One Equity Stocks is a leading provider of research on publicly traded emerging growth companies. Our team is comprised of sophisticated financial professionals that strive to find the companies and management teams that will outperform the market and deliver investment returns to our subscribers. We are not a licensed broker dealer and do not publish investment advice and remind readers that investing involves considerable risk. One Equity Stocks encourages all readers to carefully review the SEC filings of any issuers we cover and consult with an investment professional before making any investment decisions. One Equity Stocks was not compensated for this distribution and distributed it on behalf of a shareholder that is long IMSCQ and voted FOR the proposed merger transaction. One Equity Stocks does not have a position in IMSCQ.