Written by Ophir Gottlieb

PREFACE

Average selling prices (ASP) for the Apple Inc iPhone are set to rise, even though the mix of cheaper phones its selling relative to expensive iPhones is rising.

STORY

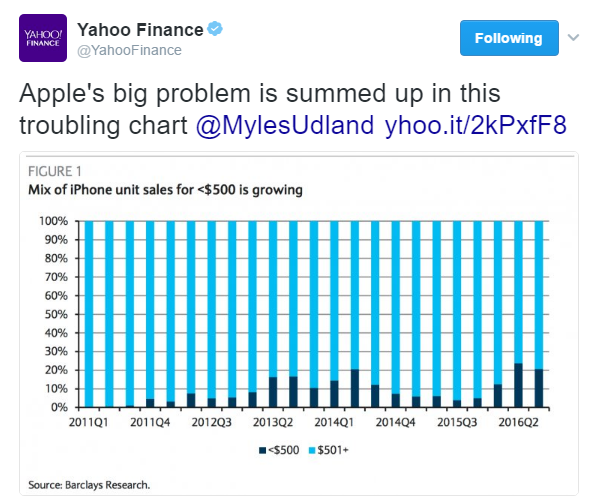

Yahoo! Finance published a nice piece today, Apple's big problem is summed up in this troubling chart.

Here is the chart that was presented:

The point of the chart is that a larger percentage of iPhone sales are below the $500 level than, say, a year ago. Totally a fair point and I assume the data is correct. So what's the problem?...

NOT GOOD ENOUGH

The tweet reads "Apple's big problem is summed up in this troubling chart." Friends, while Apple has problems, this is not one of them. The article reads like this (our emphasis added):

To parse this analyst-speak a bit, trends indicate people don't really care about buying the latest and great from Apple. As a result, consumers are buying Apple products that are cheaper than they used to be.

OK, so now we have to stop. While a little bit of that is true, there is overwhelming evidence that it is not the real story, and here it is:

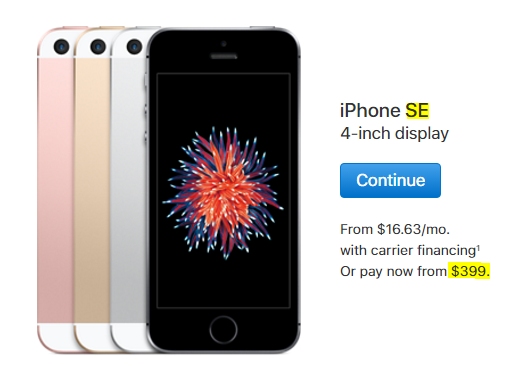

Apple Inc introduced its iPhone SE, which, oddly, has a reduced screen size similar to the old iPhones. The SE has beefed up hardware but it's small and so is the price. Apple Inc (NASDAQ:AAPL) currently lists the iPhone SE device for $399. Here it on the Apple store website:

And, of course, we must look at the success of the SE. We get this from digital trends authored by Kyle Wiggers on August 10, 2016 (our emphasis added):

The SE's traction - as much as 23 percent of total iPhone sales, market research firm RBC Capital Markets estimated

And, from that same article, we get this (our emphasis added):

the handset accounted for 5.1 percent of all smartphone sales in the U.S. - an amount that saw Apple's year-on-year market share climb 1.3 percent to 31.8 percent.

Remember also what Apple's CFO, Luca Maestri said in regard to iPhone SE demand:

We were not able to fulfill iPhone SE demand throughout the quarter.

Friends, while there is certainly evidence that some consumers are choosing an older and less expensive iPhone model to a new one, which is the thesis presented by Yahoo! Finance, that's not really what's going on. Or, if you prefer, it's not everything that's going on and an omission of the rest is a problem.

THERE'S ACTUALLY MORE

The iPhone's ASP has dipped to $595, but across the board Wall Street has pegged iPhone ASPs to return above $650 for calendar Q4 (aka the holiday quarter). The rationale behind the giant leap back to "normal" levels is of course... a new iPhone.

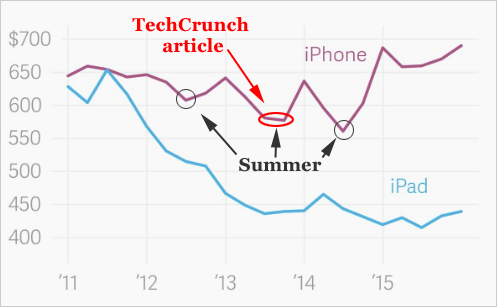

You see, this happens pretty often with technology companies. Not the price changes, the incomplete media coverage. This is actually a headline, I kid you not, from 2013 via TechCrunch (emphasis added):

Apple's Average Selling Price On iPhones In Q3 Suggest Promotions Are Moving Devices, Older Models Popular

At the time of that writing, the ASP for the iPhone was $580, but, of course, the ASP rose with new iPhone releases and in fact, the "older iPhone" phenomenon was a non-event. Here is the chart of Apple Inc (NASDAQ:AAPL) iPhone ASPs through time:

We have highlighted the timing of the TechCrunch article with a red ellipse. Not surprisingly to actual technology analysts and financial professionals, the ASP rose. There is commonly a slump in iPhone ASPs during summer as people wait to buy the new iPhone that's about to be released. Or, said like this (via Kantar):

Anticipation for the newest iPhone, usually released in late September every year, typically means a weaker summer period for iOS.

Today, three and a half years later, we have the same story, with the same reasoning. While the story definitely has veracity -- that bar chart above is correct -- friends the reasoning is at least incomplete and at worst wrong. Most of the main stream media simply cannot keep up with technology in a way that helps you make informed decisions about your investments.

There was no discussion of the iPhone SE in the article from Yahoo! Finance. There was no discussion of this same phenomenon back in 2013. There wasn't even a mention that Wall Street analysts across the board have ASP's rising back above $650. The article isn't wrong -- it's just incomplete, and in that incompleteness, it could hurt you.

IS IT EVERYONE?

The good news is that there are tech journalists that are crazy good. We're talking about people like Mike Isaac of the New York Times. There are primary researchers that are off the charts good, like Ben Bajarin. There are several others.

THE POINT

The headline should read "Apple iPhone Prices Set to Rise," not "Apple's big problem is summed up in this troubling chart." The latter is just not complete -- and if we really dig into it, Apple's "big problem" has nothing to do with the analysis provided.

But fear not -- this summer, the same headline will come back.

The author is long shares of Apple Inc (NASDAQ:AAPL).

WHY THIS MATTERS

If this kind of research interests you then what we offer may be up your alley: Our research sits side-by-side with Goldman Sachs, Morgan Stanley, Barclays, JP Morgan, and the rest on professional terminals as a part of the famed Thomson First Call group. We do this research several times a week and we also have a list of spotlight companies.

Each company in our 'Top Picks' portfolio is the winner in an exploding thematic shift like self-driving cars, mobile data and connectivity, health care tech, artificial intelligence, Internet of Things, drones, biotech and more. For a limited time we are offering CML Pro for $19/mo. with a lifetime guaranteed rate. Get the most advanced premium research along with access to visual tools and data that until now has only been made available to the top 1%.