A junior mining company has just raised the stakes in our pick for the most exciting gold exploration play in Canada’s massive Quebec province.

Just weeks after a reporting a new discovery at depth (and not just of gold), Starr Peak Mining Ltd. (TSX:STE.V; OTC:STRPF) has again announced high-grade results from its ongoing 2021 drilling campaign.

And now it’s its drilling program from 20,000 meters to 40,000 meters, in a huge campaign that is fully funded.

What Starr Peak reported it found in its first discovery announcement on May 4th wasn’t just gold.

It was evidence of something that’s been eluding huge miners for a century: A VMS (Volcanogenic Massive Sulphide) deposit with rock containing multiple base metals, including zinc, copper, silver, and gold.

Now, we think it’s just been de-risked further.

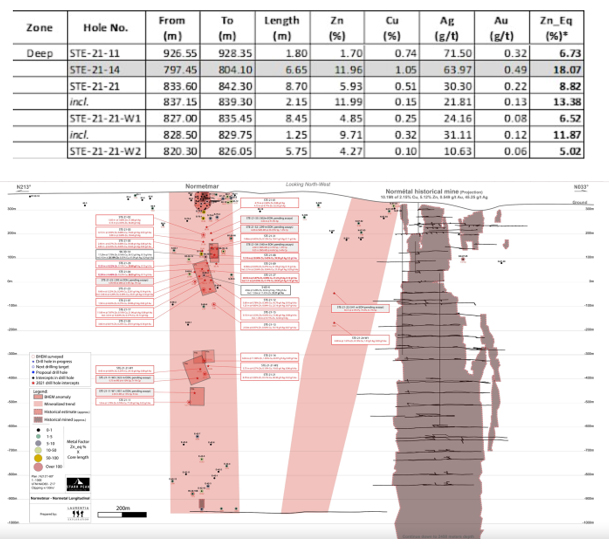

The latest results released on July 6th from drilling on Starr Peak’s NewMétal property in the Abitibi Greenstone Belt—which includes the past-producing Normétal mine—just extended this play’s Deep Zone mineralized zone by 175 meters, from a vertical depth of 680 meters to almost 850 meters.

The Company reports that nearly all of the drill holes in its campaign have intersected significant mineralization.

The Deep massive sulphide zone discovered more than 650 meters vertically below the historic Normetmar open pit zone, has returned multiple zinc, copper, silver and gold rich intervals to date:

And the presence of a VMS zone gets us even more excited here, as well:

Starr Peak didn’t just release Deep Zone drilling results …

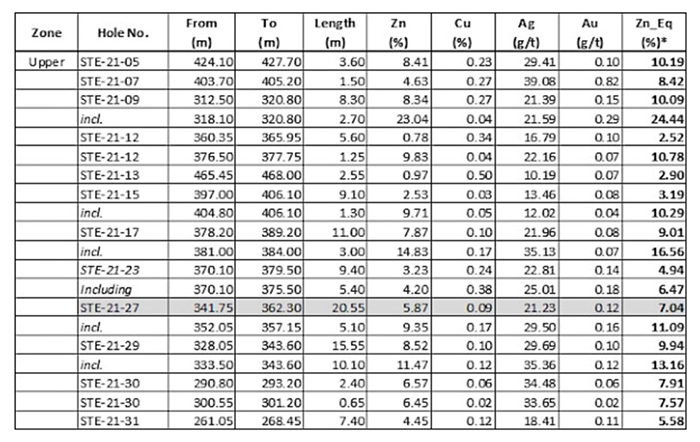

Multiple drill holes targeting the Normetmar Upper zone, which is above 400 meters, intersected wide mineralized intervals up to 20.55 meters, “indicating the presence of a significant VMS zone”.

Results like this were enough for Starr Peak to significantly expand its drill program, almost immediately.

On July 8th, Starr Peak increased its fully funded drilling program from 20,000 meters to 40,000 meters on the NewMétal project.

Now, in our view there’s no better gold exploration story out there, and we expect the news flow to pick up the sort of momentum that only a discovery of this nature can achieve.

Our Pick For The Best Gold Narrative of the Decade

We’ve always been interested in Quebec’s wildly untapped potential for precious and base metals.

After all, Quebec is a massive province covering 1.7 million km² and known for hosting one of the most diverse collections of metals in the world. And, of course, it has one of the best chances of coming across the highly-sought-after VMS deposit--a collection of gold, silver, iron, nickel, titanium, niobium, copper, and zinc.

Only 1% of Quebec is being mined, and only 5% is covered by mining rights.

Our interest was more than piqued last year, when Amex Exploration (TSX:AMEX) made a high-grade gold discovery right next to the past-producing Normetal Mine, which has historically produced ~10.1 million tonnes of 2.15% copper, 5.12% zinc, 0.549g/t of gold and 45.25 g/t of silver.

Right before that discovery, Starr Peak (TSX:STE.V; OTC:STRPF) moved to acquire a its position adjacent to Amex, and then it bought the Normetal Mine itself.

Amex made a big discovery on its Perron Property, right next to Normetal, and investors found themselves with returns of up to 7,000%, depending on when they had jumped in.

Then we watched some Amex shareholders jump on board Starr Peak, too, hoping to maintain the exploration momentum.

By the time that Starr Peak announced its first results from maiden drilling, Amex chairman and founder Dr. Jacques Trottier, PhD, was appointed Starr Peak’s Chief Technical Advisor.

He’s not only a industry recognized geologist …

He has previous experience with VMS type deposits.

VMS discoveries are rare. Such deposits were formed on the ocean floor during ancient underwater volcanic activity and then ended up on land that was once underwater due to tectonic plate movements. And they are exactly what major miners are looking for.

Why?

Because evidence of a VMS deposit is a major de-risking factor, potentially offering up a basket of valuable commodities that reduce dependency on gold alone. And these commodities, which may include copper and zinc, are said to be the backbones of our multi-trillion-dollar energy transition and heavy industry, in general.

We think that means that Starr Peak might not just be sitting on a new, high-grade gold discovery …

Results so far show signs of a deposit of multiple metals that, if proved up and commercially viable, could position this tiny junior for diversified stardom.

Is Time running out on this gold+ narrative?

In our view the timeline here has been incredibly dynamic.

In February, Starr Peak started its drill campaign.

In early May, it released its first drill results that went beyond our expectations: not just gold, but evidence of a VMS deposit.

Immediately, they brought in a third rig and expanded their drill program to 20,000 meters.

In the first week of July, Starr Peak (TSX:STE.V; OTC:STRPF) came out with even higher-grade results in the Upper and Deep Zones, returning multiple zinc, copper, silver and gold rich intervals.

Two days later, they expanded their drilling program from 20,000 meters to 40,000 meters.

And they’re fully funded for this drill campaign.

When a small miner is fully funded for an expanded drill program and keeps returning high-grade results that may de-risk exploration, we think they could start to gain the attention of big money.

When they keep returning high-grade results not only on gold but on copper, zinc and silver, too, then they might even start gaining the attention of big miners.

In our view there is no better narrative than a fully-funded junior miner making a discovery and looking to de-risk in the exploration phase. When a big miner makes a discovery, it doesn’t move the needle on the valuation that much because it’s dependent on various operations all over the world, and various commodities prices. It’s low-risk and low-reward.

A tiny junior sitting on a single exploration play is high-risk, high-reward potential because, unlike a big miner with varied operations all over the world, it can go from 0% to possibly 1,000% and back again, depending on their ability to prove out results and demonstrate commercial viability. Remember, the Amex exploration that started off a new Quebec gold rush and earned investors up to 7,000% gains.

We think the next press release could be the one that sets Starr Peak in motion, and could make this the biggest summer of a Quebec gold rush.

Other companies looking to capitalize on the bullish gold market:

Kinross Gold Corp. (NYSE:KGC, TSX:K) is a gold mining company that operates in North and South America, Africa, Asia, and Australia. Kinross has two operating mines - the Tasiast mine in Mauritania and the Dvoinoye mine in Russia - with significant exploration potential at its other properties. The Company also owns 100% of the Round Mountain gold mine located near Tonopah, Nevada which is currently on care and maintenance due to low metal prices.

The Company's strategy includes maintaining key assets; developing new projects; exploring for new reserves; discovering opportunities through acquisitions or joint ventures; investing in people by training them to be leaders of tomorrow while delivering value today

Kinross, one of the world’s largest gold producers, is constantly looking to expand its operations and has found success in many regions. The company mines for gold across six continents, with operations in Brazil, Ghana, Mauritania, Russia and the United States. It also operates a joint venture with AngloGold Ashanti Limited that provides mining services at two sites in West Africa—one of which was recently awarded an environmental permit from the government of Guinea. Kinross Gold Corporation is a profitable company--consistently. It’s a safer bet, if not one that will deliver you stunning upside. This is for the more cautious gold investor.

Kirkland Lake Gold (NYSE:KL, TSX:KL) is an international mining company with a strong presence in Canada. It has been operating since 1983, and currently employs over 1000 people. Kirkland Lake produces gold at low production costs and offers investors the opportunity to participate in the growth of their company through its dividend reinvestment plan (DRIP).

This company has a lot to offer investors who are interested in diversifying their portfolios with gold stocks. They have opportunities for both long-term holders and short-term traders as they produce high quality, low cost gold products that can be found on major stock exchanges around the world.

Kinross is another one of Toronto’s finest gold miners. Though not quite as established as Barrick or Newmont, Kirkland is no stranger to striking headline grabbing deals in the industry. In fact, just recently, Kirkland and Newmont signed a $75 million exploration deal that could wind up being a game-changer for the industry. The two companies have agreed to split the cost 50/50 over five years with each company investing $15 million every year into joint projects between both companies for exploration purposes only - at this point it seems like a win. According to a joint press release in late 2020, “Newmont has acquired an option from Kirkland on the mining and mineral rights subject to a royalty payable by Newmont to Royal Gold, Inc. (the Holt Royalty) in exchange for a $75 million payment to Kirkland Lake Gold. Newmont can exercise the Option only in the event Kirkland intends to restart operations at the Holt Mine and process material subject to the Holt Royalty”

In the past thirty years, Barrick Gold (NYSE:GOLD; TSX:ABX ) has had a profound impact on the global economy. The company is an international gold mining corporation with headquarters in Toronto, Canada. With operations in more than 20 countries around the world, they are currently ranked as one of the largest gold producers worldwide and have been awarded multiple accolades for their contribution to reducing poverty through sustainable development.

Barrick is a top-tier gold miner with a global footprint. The Toronto-based gold giant operates in 13 countries, including Argentina, Canada, Chile, Côte d'Ivoire, Democratic Republic of the Congo, Dominican Republic, Mali, Papua New Guinea, Saudi Arabia, Tanzania, the United States and Zambia. Though Newmont surpassed Barrick as the largest gold miner when it acquired Goldcorp, Barrick is still a force to be reckoned with.

It’s even drawn the attention of one of the world’s most renowned investors. After years of anti-gold rhetoric,, Warren Buffett, has finally changed his stance on precious metals. In an announcement last year, Berkshire Hathaway said it was buying half a billion dollars’ worth of Barrick Gold shares at a time when gold nearing its all-time highs This change in attitude towards gold by Buffett could affect how many other investors view it as an investment opportunity. Buffett’s investment in Barrick and change in tune on the gold front shouldn’t come as much of a surprise, however. As the future of the economy looks more-and-more uncertain, and the Federal Reserve continues to print money at a record rate, solid gold miners like Barrick have drawn a lot of attention for investors, especially considering the healthy 0.96% dividend per share that comes with the purchase.

Newmont (NYSE:NEM, TSX:NGT ) is a global mining company with operations in the United States, Australia, Peru and Ghana. They are one of the world's largest gold producers and they have been operating for over 100 years. Newmont has its headquarters in Greenwood Village, Colorado (a suburb of Denver) where it was founded in 1921 by William Boyce Thompson.

Following its acquisition of Goldcorp, Newmont became the single biggest gold company in the world, but that doesn’t mean it doesn’t still have some room to run. As far as management goes Newmont doesn't have any weak spots. Its board includes veteran mining executives like Bob McAdam of Barrick Gold Corp., Tom Albanese of Rio Tinto plc (NYSE:RIO), Joe Jimenez of Dow Chemical Company (DOW) and John Wiebe of Kinross Gold Corporation (KGC). The company has a solid balance sheet with little debt and it’s still growing. Founded in 1916, and based in Greenwood Village, Colorado, Newmont is a veteran miner with one of the top executive teams in the business, and its operations span 11 countries, including gold mines in Nevada, Colorado, Ontario, Quebec, Mexico, the Dominican Republic, Australia, Ghana, Argentina, Peru, and Suriname.

Yamana Gold (NYSE:AUY, TSX:YRI) the largest gold producer in South America and one of the top five global producers, has a long history that spans over 100 years. In 1905 they were founded when two mining engineers from Chile teamed up with an Englishman to create Compania Minera de Los Andes. The company grew rapidly and by 1940 became a major player in the gold market with its headquarters located in Santiago, Chile. Yamana Gold is now headquartered in Toronto but maintains operations all around the world including Canada, Brazil, Australia and Argentina.

Earlier this year, Yamana signed an deal with industry giants Glencore and Goldcorp to develop and operate another Argentinian project, the Agua Rica. Initial analysis suggests the potential for a mine life in excess of 25 years at average annual production of approximately 236,000 tonnes (520 million pounds) of copper-equivalent metal, including the contributions of gold, molybdenum, and silver, for the first 10 years of operation.

Osisko Gold Royalties Ltd (TSX:OR) has been particularly busy this year, scrambling to make the most out of gold’s unprecedented rally. It’s made headlines with a string of deals, especially surrounding its Cariboo gold project in central British Columbia. In fact, in early October it announced multiple new high grade discoveries at the project managed by Barkerville Gold Mines, a wholly owned subsidiary of Osisko.

The success at the Cariboo project also highlights the company’s commitment to working with the community in a sustainable fashion. Just recently, it signed an agreement with the Lhtako Dene Nation to ensure the protection of the land and water near the drilling locations.

Chris Pharness, Barkerville Gold Mines VP Sustainability and External Relations of BGM noted, “It has been an honor and a privilege to be welcomed in the community and to hear the hopes and aspirations that LDN leadership and members have for their people. Our core belief as a company is based in reciprocity and the understanding that projects of this scale require mutually beneficial relationships, opportunities and outcomes to succeed. Our agreement is a key underpinning of that philosophy and an example of what respectful, honest dialogue can achieve.”

Sandstorm Gold Ltd (TSX:SSL) is a gold royalties company that follows in the footsteps of Wheaten Precious Metals, Franco-Nevada and the aforementioned Osisko Gold Royalties, giving investors a chance to cash in on this year’s gold boom while still maintaining some aversion to risk. Though it has not had quite as an impressive of a year as some of its pure-mining peers, it has still posted some moderate returns, especially considering the state of the wider resource market.

Like other gold and resource companies, Sandstorm took a hit when it saw a number of its assets temporarily halt operations to prevent the further spread of COVID-19, but it has since clawed back some of its losses, and is on track to see further gains as its operations return to normal. In addition to its upwards trajectory, it’s also sitting on a healthy balance sheet. Nolan Watson, President and CEO of Sandstorm, explained, “We're excited at Sandstorm to have a strong balance sheet, a strong portfolio, and significant growth ahead. As at this moment, we are entirely debt-free. We have $52 million in the bank. These are good times for Sandstorm and I genuinely think they'll keep getting better."

By. Dennis Cogan

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ

CAREFULLY**

Forward-Looking Statements /

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that prices for gold, silver, copper, zinc and other base metals will retain their value in future as currently expected, or could continue to increase due to global demand and political reasons; that Starr Peak can fulfill all its obligations to acquire its Quebec properties; that Starr Peak’s property can continue to achieve drilling and mining success for gold and other metals; that historical geological information and estimations will prove to be accurate or at least very indicative; that high-grade targets exist; that Starr Peak will be able to carry out its business plans, including future exploration and drilling programs; that the preliminary drilling results will be confirmed as further exploration continues; that the lab results from Starr Peak’s initial exploration program will confirm evidence of a significant VMS deposit; that Starr Peak’s exploration results will gain the attention and interest of larger mining companies and investors; that Starr Peak’s exploration results will continue to show promising results justifying ongoing exploration and possible development efforts. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that politics don’t have nearly the strong effect on gold and other base metal prices as expected; that demand for base metals may not continue to increase; that the Company may not complete all its announced mineral property purchases for various reasons; that the Company may not be able to finance its intended drilling and exploration programs; Starr Peak may not raise sufficient funds to carry out its business plans; that geological interpretations and technological results based on current data may change with more detailed information or testing; that the lab results from Starr Peak’s initial exploration program may not support evidence of a significant VMS deposit; that the preliminary drilling results may not be confirmed during further exploration efforts; that Starr Peak will fail to gain the attention and interest of other mining companies and investors; that Starr Peak’s exploration results may fail to find additional promising results justifying ongoing exploration and/or development efforts; and despite promising results from drilling and exploration, there may be no commercially viable minerals or ore on Starr Peak’s property. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated by Starr Peak but may in the future be compensated to conduct investor awareness advertising and marketing for TSXV:STE. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of Starr Peak and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.