Last year a little-known gold miner in Quebec struck it big…

With early investors netting 7,000% returns.

The miner, Amex Exploration, hit the jackpot at its Perron Gold project…but we think that’s nothing compared to what could unfold right next door.

See, it looks like another savvy small-cap was already on the prowl nearby when Amex made its initial announcement…

In fact, it scooped up an older mine that many of its peers had already written off…

The notorious Normetal Mine has already given the market over 10 million tonnes of 2.15% copper, 5.12% zinc, 0.549g/t of gold and 45.25 g/t of silver...

But armed with modern tech, and new desire for the Quebecois hotspot-of-yesteryear, Starr Peak Mining (TSX:STE.V; OTC:STRPF) found something that defied our expectations.

The results of their initial drill didn’t just indicate gold …They had stumbled onto signs of something much bigger.

Something that countless other miners have been searching for over the last 80 years.

A VMS deposit…the holy grail of discoveries.

VMS stands for Volcanogenic Massive Sulphide and they contain base metals such as copper, zinc, silver, gold and other minerals.

More important, however, is that they’re often among the richest deposits in the world.

New VMS-style discoveries have been few and far between over the past decade…

Large-cap miners are desperate for finds like these…so it’s even better when a small-cap explorer finds it for them.

That could be great news for Starr Peak.

It’s essentially found evidence of an accumulation of base metals…Metals whose prices have been increasing…

And that’s not even counting the high likelihood of indicators of large deposits of precious metals like gold and silver.

Even better, Starr Peak reports it is sitting on $5.3 million in cash and ready to start drilling.

The Right Place At Exactly The Right Time?

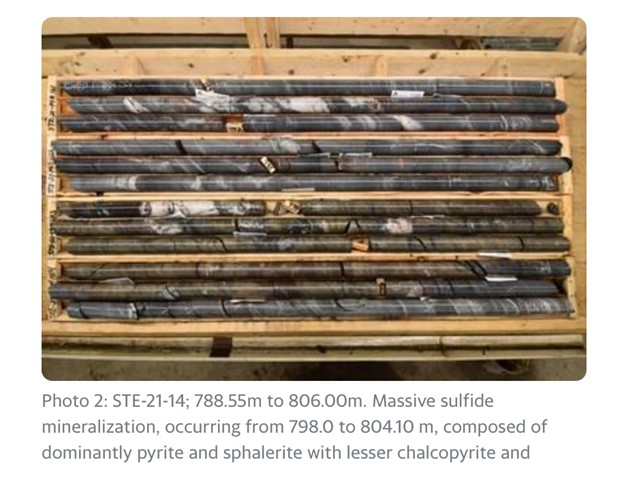

Starr Peak (TSX:STE.V; OTC:STRPF) announced the start of its drill campaign in February this year. Three weeks into drilling, they reported they had brought on a second rig, and on May 21st, they announced they had deployed a 3rd rig to the Newmetal property, “owing to significant [VMS] intercepts in the Company’s first drill holes”.

Starr Peak has also increased their drilling program from 5,000 meters to 20,000 meters and are cashed up with over $5 million in the bank to continue drilling and exploration work.

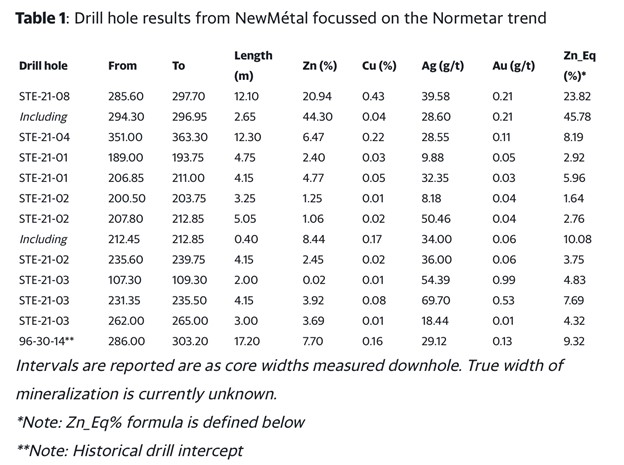

The first batch of drill results that Starr Peak announced this month had highlights of 20.94% Zinc, 0.43% Copper, 39.58 g/t Silver and 0.21 g/t Gold over an intercept of over 12.1 meters. They also highlighted a new discovery at depth with additional massive sulphides.

It wasn’t a single drill hole, either. The company reports they’ve had a dozen hits so far and not a single miss.

The company continues drilling work on its property and expects lab results to continue arriving, and the timing couldn’t be better.

A copper shortage has some analysts predicting prices will soar from around $9,000/metric ton to $13,000 in the coming months.

They’re also extremely bullish on zinc, which has already hit multi-year highs.

Combine that with the gold and silver potential, and we think that Starr Peak (TSX:STE.V; OTC:STRPF) could be even better positioned that Amex was last year because VMS is gold+.

Amex, of course, looks like it has been doing more than just watching this one closely.

Just a week before Starr Peak announced encountering evidence of a potential VMS discovery, the Amex Chairman and Founder was appointed as Starr Peak’s Chief Technical Advisor in a huge vote of confidence.

It may also have helped motivate Amex to keep drilling right next door. And based on everything Amex has already delivered, some analysts are estimating Amex’s market cap could potentially push up to $1 billion as they continue to drill. Amex reports it now has about $30 million in the bank to keep drilling.

Amex is already a major name on the Canadian gold scene thanks to its discovery and the windfall it gave to shareholders.

We think Starr Peak is poised and ready to join these same ranks…

And thanks to a recently announced funding round, they’re all cashed up and ready to get started.

Just last week, Starr Peak reported they closed a strategic private placement, adding a total of $3,755,998 to their treasury, to be used for more drilling and exploration work in their Quebec properties.

The results they’ve encountered so far is something that looks to have eluded big miners for almost a century, setting Starr Peak up to be the next potential big name in Canadian gold. When lab results come in from the maiden drill’s VMS discovery, we expect big investors may be circling around this, just like they did with Amex.

Gold Majors Are Not To Be Ignored, Either

Kinross Gold Corp. (NYSE:KGC, TSX:K), one of the world’s largest gold producers, is constantly looking to expand its operations and has found success in many regions. The company mines for gold across six continents, with operations in Brazil, Ghana, Mauritania, Russia and the United States. It also operates a joint venture with AngloGold Ashanti Limited that provides mining services at two sites in West Africa—one of which was recently awarded an environmental permit from the government of Guinea.

Kinross Gold Corporation is a profitable company--consistently. It’s a safer bet, if not one that will deliver you stunning upside. This is for the more cautious gold investor.

Just like AngloGold, Kinross has been enjoying dramatic improvements in profit margins and cash flow thanks to the surge in gold prices--and this trend appears set to continue with the gold outlook remaining decidedly bullish. With all factors remaining constant, Kinross should be able to realize high single-digit EPS expansion in the current year.

Kirkland Lake Gold (NYSE:KL, TSX:KL) is another one of Toronto’s finest gold miners. Though not quite as established as Barrick or Newmont, Kirkland is no stranger to striking headline grabbing deals in the industry. In fact, just recently, Kirkland and Newmont signed a $75 million exploration deal that could wind up being a game-changer for the industry. The two companies have agreed to split the cost 50/50 over five years with each company investing $15 million every year into joint projects between both companies for exploration purposes only - at this point it seems like a win.

According to a joint press release in late 2020, “Newmont has acquired an option from Kirkland on the mining and mineral rights subject to a royalty payable by Newmont to Royal Gold, Inc. (the Holt Royalty) in exchange for a $75 million payment to Kirkland Lake Gold. Newmont can exercise the Option only in the event Kirkland intends to restart operations at the Holt Mine and process material subject to the Holt Royalty”

This alliance will provide Kirkland with cash flow to evaluate new alternatives for the future of the mining complex, dive deeper into its existing properties, and weigh other opportunities where the two gold companies may be able to find common ground in the future.

After years of anti-gold rhetoric, one of the world’s most famous billionaire investors, Warren Buffett, has finally changed his stance on precious metals. In an announcement last year, Berkshire Hathaway said it was buying half a billion dollars’ worth of Barrick Gold (NYSE:GOLD; TSX:ABX ) shares at a time when gold nearing its all-time highs This change in attitude towards gold by Buffett could affect how many other investors view it as an investment opportunity. Buffett’s investment in Barrick and change in tune on the gold front shouldn’t come as much of a surprise, however. As the future of the economy looks more-and-more uncertain, and the Federal Reserve continues to print money at a record rate, solid gold miners like Barrick have drawn a lot of attention for investors, especially considering the healthy 0.96% dividend per share that comes with the purchase.

Barrick is a top-tier gold miner with a global footprint. The Toronto-based gold giant operates in 13 countries, including Argentina, Canada, Chile, Côte d'Ivoire, Democratic Republic of the Congo, Dominican Republic, Mali, Papua New Guinea, Saudi Arabia, Tanzania, the United States and Zambia. Though Newmont surpassed Barrick as the largest gold miner when it acquired Goldcorp, Barrick is still a force to be reckoned with.

Newmont (NYSE:NEM, TSX:NGT ) is the single biggest gold company in the world, but that doesn’t mean it doesn’t still have some room to run. As far as management goes Newmont doesn't have any weak spots. Its board includes veteran mining executives like Bob McAdam of Barrick Gold Corp., Tom Albanese of Rio Tinto plc (NYSE:RIO), Joe Jimenez of Dow Chemical Company (DOW) and John Wiebe of Kinross Gold Corporation (KGC). The company has a solid balance sheet with little debt and it’s still growing. Founded in 1916, and based in Greenwood Village, Colorado, Newmont is a veteran miner with one of the top executive teams in the business, and its operations span 11 countries, including gold mines in Nevada, Colorado, Ontario, Quebec, Mexico, the Dominican Republic, Australia, Ghana, Argentina, Peru, and Suriname.

The big news for the company in 2019 was its acquisition of Goldcorp. Though it was controversial at the time, the $10 billion acquisition has paid off in a big way. As gold climbed to record highs thanks to investors piling into gold due to the COVID pandemic, Newmont has seen a boom in its share price. Last year, gold soared from $1282 to over $2000 at one point, and Newmont’s stock rose with it, earning investors as much as 90% returns on their original purchase.

Like Barrick, Newmont has struggled in 2021, however, seeing its share price fall slightly from its November highs of $68 to its current price of $67. This path has been very closely related to the price of gold which has also tumbled in the same amount of time. That said, the company still has a lot of upside potential, and with Biden preparing to unleash a new infrastructure bill that will add more debt to America’s $28 trillion bill, investors will likely look into gold again this year.

Yamana Gold (NYSE:AUY, TSX:YRI), one of the world's top gold companies, has seen its share price hit especially hard this year. Yamana had been on an upward trend since February when it announced that three mines were closing and more than 1 billion dollars would be cut from their budgets as part of ongoing austerity measures due to slumping prices for precious metals and weak demand for mining equipment across the industry.

Earlier in 2021, Yamana signed an agreement with industry giants Glencore and Goldcorp to develop and operate another Argentinian project, the Agua Rica. Initial analysis suggests the potential for a mine life in excess of 25 years at average annual production of approximately 236,000 tonnes (520 million pounds) of copper-equivalent metal, including the contributions of gold, molybdenum, and silver, for the first 10 years of operation.

By. Kalani Akana

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ

CAREFULLY**

Forward-Looking Statements /

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that prices for gold, silver, copper, zinc and other base metals will retain their value in future as currently expected, or could continue to increase due to global demand and political reasons; that Starr Peak can fulfill all its obligations to acquire its Quebec properties; that Starr Peak’s property can continue to achieve drilling and mining success for gold and other metals; that historical geological information and estimations will prove to be accurate or at least very indicative; that high-grade targets exist; that Starr Peak will be able to carry out its business plans, including future exploration and drilling programs; that the preliminary drilling results will be confirmed as further exploration continues; that the lab results from Starr Peak’s initial exploration program will confirm evidence of a significant VMS deposit; that Starr Peak’s exploration results will gain the attention and interest of larger mining companies and investors; that Starr Peak’s exploration results will continue to show promising results justifying ongoing exploration and possible development efforts; and that Starr Peak will have sufficient capital to complete its exploration plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that politics don’t have nearly the strong effect on gold and other base metal prices as expected; that demand for base metals may not continue to increase; that the Company may not complete all its announced mineral property purchases for various reasons; that the Company may not be able to finance its intended drilling and exploration programs; Starr Peak may not raise sufficient funds to carry out its business plans; that geological interpretations and technological results based on current data may change with more detailed information or testing; that the lab results from Starr Peak’s initial exploration program may not support evidence of a significant VMS deposit; that the preliminary drilling results may not be confirmed during further exploration efforts; that Starr Peak will fail to gain the attention and interest of other mining companies and investors; that Starr Peak’s exploration results may fail to find additional promising results justifying ongoing exploration and/or development efforts; that despite promising results from drilling and exploration, there may be no commercially viable minerals or ore on Starr Peak’s property; and that Starr Peak may have insufficient capital to complete its exploration plans or otherwise. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated by Starr Peak but may in the future be compensated to conduct investor awareness advertising and marketing for TSXV:STE. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of Starr Peak and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.