For years, some smart investors have been making money from the healthcare sector...

Cutting-edge healthcare technologies and trends such as CRISPR, RNA, AI, and Cannabis all provided smart investors with major opportunities.

Over the last decade, the biotech sector has been making profits and minting some millionaires, with the sector’s best-known benchmark SPDR Biotech ETF(XBI) even outgunning the red-hot tech sector’s Technology Select Sector SPDR ETF(XLK) with a 460% vs. 420% return.

But now the global pandemic has created a surge in demand for products addressing immunity and cognitive support.

We think the next big trend in 2021 is a new class of therapeutics focused on the big 3 mental disorders…

Depression, PTSD, and anxiety.

The behavioural health market is predicted to grow into a $240 billion market by 2026.

And a new compound that works well could take a big market share… much like the Cannabis (CBD and THC) market did over the stretch of a few years.

Why?

Because more and more people are growing increasingly concerned with the side effects of conventional medicines, leading to widespread non-adherence to treatments such as antidepressants.

Many people are now turning to natural remedies to help manage their overall health.

This could be the beginning of a New Era of Medicine, with alternative medicine such as cannabis and psychedelics being decriminalized and made accessible for patients across North America.

The Institute for Health Metrics and Evaluation has reported that more than 10% of the global population suffers from mental health issues.

350 million people worldwide suffer from depression, leading to a staggering $1 trillion in lost productivity every year.

But now a breakthrough compound study has confirmed rapid improvements in anxiety and depression for cancer patients…

It’s also found that four-and-a-half years down the line, 71-100% of participants credited this “miracle compound” with life-long improvements.

The science is beginning to build.

In fact, the US military just initiated a study on this compound as a PTSD treatment… after decades of rejecting it.

In short: This naturally occurring “miracle compound” could soon be helping solve a huge problem.

And some companies -- just like in the cannabis sector--could succeed in helping bring this solution to consumers.

THE NEXT APHRIA?

HELPING WITH THE BIG 3 MENTAL DISORDERS OF DEPRESSION, PTSD AND ANXIETY

As the naturally occurring cannabis compounds of CBD and THC are now scientifically proven to be of benefit to millions…

This “new” “miracle compound” is following the same path.

And one little-known company aims to become “the next Aphria” to the market.

The hopes are that just like the decriminalization of cannabis…

Cities and states across the US are admitting this “miracle compound” not only helps with depression, PTSD, and anxiety…

But in many cases does it more effectively and without the side effects of the current slate of manufactured drugs.

The California cities of Oakland and Santa Cruz… Ann Arbor, Michigan… Denver, Colorado…

The states of Oregon and Washington now allow its use.

Much like cannabis…

Many states, including Florida, Connecticut, Vermont, Washington DC, Hawaii, New York, Virginia are considering psychedelics and drug policy reform bills for the 2021 session.

Just like CBD and THC… this natural compound--psilocybin--has been used by humans for thousands of years.

Just like the cannabis market has been projected to grow 9x…

The psychedelic drugs market is projected by some to grow from just over $2 billion in 2019 to $6.8 billion in 2027.

And one little-known--and already looking successful--stock is one of the first movers in the space.

HAVN Life Sciences (CSE: HAVN; OTC:HAVLF), a fast-rising natural health food & nutraceuticals company, is developing product formulations for microdosing of novel psychoactive compounds, including psilocybin and psychedelic drugs.

HAVN Life Sciences has hit the ground running and managed to develop its first seven formulations set to launch in the spring of 2021.

And now HAVN Life Sciences has trained its sights on its first major revenues...

Armed with a wealth of talent, a clear roadmap to its goals and ample growth runways.

HAVN: ON THE PATH TO SUCCESS:

1) Executive Chairman is the former CEO of Aphria

Vic Neufeld, co-founder and former CEO of cannabis heavyweight Aphria Inc. (NASDAQ:APHA,TSX:APHA), has been announced as a director of HAVN Life Sciences (CSE: HAVN; OTC:HAVLF).

Neufeld understands exactly what it takes to grow a company from an idea to a billion-dollar pharmaceutical with global brand appeal.

“It’s very demanding, it’s all-consuming. You put aside all of your other family type of priorities because business takes over and it’s all-consuming. The last five years, going from an idea in some greenhouses in Leamington, Ont. to a global player in a major new industry have been an incredible journey for entrepreneurs like myself and Cole,” Neufeld has said about his unique experience building Aphria from the ground-up with co-founder Cole Cacciavillani.

And a real odyssey Neufeld has had with Aphria.

In his five years at Aphria, Neufeld was able to build the company from a nondescript marijuana startup to a legal cannabis giant with annual revenues of $175 million and a market cap of $2.3B--good for up to 2,400% share returns for the investors who got in at the very beginning.

And he now wants to replicate that success at HAVN Life Sciences.

“It’s something that we really need to have a better understanding of--the standardization, the efficacy, the safety (of psychedelics) so researchers...can take it to the next level,” Neufeld has said about the need to invest and develop work on novel drugs based on psychedelic substances.

While very early on in its financial markets development, psychedelics are already attracting attention from the pharmaceutical space, according to several experts and observers of the industry.

Neufeld’s vast expertise and industry connections could attract big-name acquisitions for HAVN Life Sciences.

During his time in cannabis, Neufeld was witness to deals that allowed Fortune 500 companies to enter the space, along with pushing potential acquisitions and investment deals.

Neufeld has an acute grasp of the finicky nature of patented intellectual property (IP) and products when it comes to the cannabis plant--and is ready to leverage his experience and skills in the psychedelics space.

Neufeld is also a former CEO of Jamieson Laboratories, Canada’s largest manufacturer and distributor of natural vitamins, minerals, and concentrated food supplements.

During his 21-year stewardship of Jamieson Laboratories, Neufeld was able to grow the company’s market share nearly fourfold, from 7% to 27%.

Despite his undeniable talent, experience, and expertise at growing young companies into global brands, HAVN Life Sciences (CSE: HAVN; OTC:HAVLF) isn’t counting on Neufeld as its only expert voice...

2) CEO led his previous company from Zero to $1 billion Market Cap

Also at the helm of HAVN Life Sciences is Chief Executive Officer Tim Moore, also a former CEO of Green Growth Brands (OTCMKTS: GGBXF), a global provider of medical and retail marijuana products.

Tim is an accomplished business leader with a significant record of achievement as an executive in consumer packaged goods in Canada and the USA where he has spearheaded teams to capture market share, improve profitability and build robust customer relationships.

Tim formed Xanthic Biopharma Inc. in 2017 and in less than 12 months went public, and completed a reverse takeover with Green Growth Brands Ltd, one of the most dynamic cannabis companies in the world! Tim led the merged entity to become a $1B company (market cap).

However, Tim has spent the majority of his working life--1985 to 2003--as President and General Manager of international Health and Wellness product manufacturer, the Clorox Company (NYSE:CLX).

3) First-Mover Advantage

Currently, there are 0 formulas standardized across clinical studies of psychedelic compounds with access to research-informed formulations severely limited. In other words, companies and institutions that are studying psychedelics in research studies and academia rely on products that are developed on an ad hoc basis for each project.

HAVN Life Sciences (CSE: HAVN; OTC:HAVLF) is one of the few companies that have been licensed to develop psilocybin and psychedelic products.

That puts the company in the rarefied air of the likes of Champignon Brands Inc., Mind Medicine Inc, Compass Pathways, and Field Trip Health Ltd.

HAVN Life Sciences is one of very few companies in the psychedelic space that are focusing on drug development and unique delivery mechanisms, a particularly underserved niche in the past decade. Those areas encompass life-disrupting psychiatric and neurological conditions such as major depressive disorder (MDD), addictions, and other mental illnesses.

And if there’s anything that Aphria and Canopy Growth Corp. have taught us is that being on the right side of a megatrend like marijuana legalization can yield huge dividends for early investors in the right companies.

Aphria stock has surged 1,217% over the past five years while Canopy Growth is up 1,163% over the timeframe.

We think the psychedelic sector is right where the marijuana sector was five or six years ago…

With a predicted wave of legalization, investments, and potential massive user growth beginning to power what we think will become a massive psychedelic boom.

4) Unlocking other compounds for research

Mushrooms are the key ingredient in all of HAVN Life Sciences’ (CSE: HAVN; OTC:HAVLF) products.

Mushrooms are packed with antioxidants that help fight free radical cell damage and prevent illness.

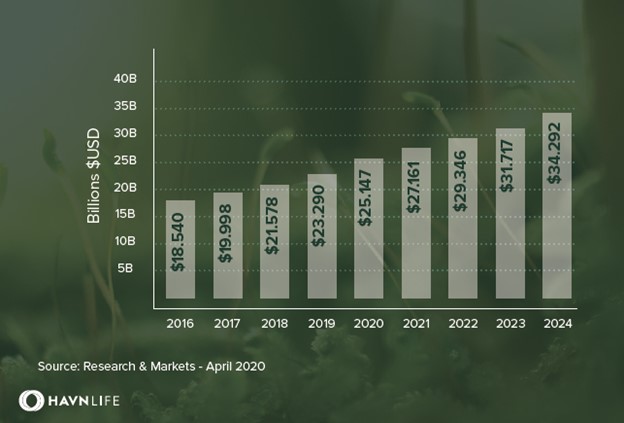

It’s the key reason why the demand for mushrooms is expected to keep rising, with the global functional food market expected to balloon to $34.3 Billion USD by 2024

However, unlike most companies in the psychedelic space, HAVN Life Sciences is conducting intense research on other compounds in psilocybin mushrooms.

The company’s mission is to unlock human performance using evidence-informed research. They are focused on standardized, quality-controlled extraction of psychoactive compounds from plants and fungi, and the development of natural health care products from novel compounds.

That’s lifting a page from highly successful marijuana companies such as Aphria and Tilray which also sell a wide range of products derived from CBD and THC.

HAVN Life Sciences has already developed and patented a line of 7 naturally-derived mushroom formulations to support mental health and performance.

- MIND MUSHROOM--An immune system and energy booster.

- BACOPA BRAIN--Memory and nervous system stimulant.

- RHODIOLA RELIEF--Relieves mental health fatigue and stress.

- CORDYCEPS PERFORM--Improves Energy levels and provides immunity support.

- CHAGA IMMUNITY--Anti-inflammatory and immune stimulator.

- REISHI RECHARGE--Energy, liver, stress, and immune system stimulator.

- LION’S MANE--Immune stimulator

The seven formulations are planned to launch in the spring of 2021 through the company’s e-commerce platform and across Canadian retailer Nesters and its 11 retail chains.

From there the company will be expanding into additional retailers and affiliate sites expected in the second and third quarter, with its range of custom formulations targetted to launch in the United States in the fourth quarter of 2021.

To understand how all of this comes together, consider that HAVN Life Sciences (CSE: HAVN; OTC:HAVLF) operates through two core pillars: HAVN Labs and HAVN Retail.

HAVN Labs:

- A GMP laboratory that will be dedicated to growing and developing extraction methodology of psychoactive and psychedelic compounds.

- Standardized supply of psychedelics to support innovative therapies.

- First Health Canada License received.

- Development of formulations that allow veterans and frontline workers to optimize their mental health.

HAVN Retail:

- HAVN Life has developed seven natural health formulations that will be launching online and in stores with retail partners this spring.

- Leveraging a highly experienced and proven management team with a track record of building NHP brands.

- HAVN Life will be developing custom formulations that will deliver natural health products with increased bioavailability to support better quality outcomes.

- Retail will expand into additional retailers in Canada and the U.S. by Q4 of 2021.

Clearly, HAVN Life Sciences has hit the ground running, with a war chest of well-researched and highly differentiated wellness products that should hit the market in the current year.

Only a handful of companies including Champignon Brands Inc., Mind Medicine Inc, and now HAVN Life Sciences can boast such capabilities; this should automatically make the company a global authority in advanced psychedelics.

5) Getting in on a HUGE new trend

Looking at HAVN Life Sciences (CSE: HAVN; OTC:HAVLF) and developments in the psychedelics sector you will immediately notice a rare convergence of forces.

1) Global productivity concerns and mental health’s interference with it are on the rise and our current treatments are not where they need to be to support human optimization, especially during these stressful times due to the global pandemic. Nearly 11% of the global population suffers from mental health issues. This opens up a New Era of Medicine and alternative treatments such as psychedelics and cannabis.

2) Psychedelics are being decriminalized and access for patients likely across North America. The State of Oregon and Washington have decriminalized. Denver, Oakland, Santa Cruz, and Ann Arbor and Somerville have all decriminalized psychedelics. Meanwhile, Canada has granted terminally ill patients and those suffering from long-term illness permission to use psilocybin.

3) Just like the cannabis market is projected by some to grow 9x, the psychedelic drug market is projected to grow from just over $2 billion to $6.8 billion in just 8 years, offering massive growth runways for first movers like HAVN Life Sciences.

HAVN Life is a part of a global community taking an active part in supporting research for microdosing therapies in treating mental health disorders utilizing psychedelics. Working with Veterans and thought leaders in the military, HAVN Life is developing innovative clinical trial formulations to aid in the recovery of PTSD and other trauma-related disorders. Through end-to-end research, extraction, formulation, and delivery, HAVN Life Sciences aspires to define and standardize the future of modern medicine by formulating the next generation of medicine using psychoactive compounds.

In short, HAVN Life Scienceslies smack in the middle of a projected $7 billion market with high barriers to entry and minimal early competition.

Virtually zero formulas standardized across clinical studies of psychedelic compounds with access to research-informed formulations severely limited.

With an extensive team of industry leaders with 20+ years of experience in this space…

At least 7 psychedelic formulations set to launch in the spring of 2021…

And a relatively unknown company that’s still flying under Wall Street’s radar.

HAVN Life Sciences could very well become a leader in the psychedelic drug mental health treatment market…

A small-cap company presenting what we believe to be an asymmetrical risk/reward profile with risk capped to the downside thanks to product line about to be launched and top-shelf management but upside potential due to the major growth projected for the psychedelic market.

Watching this penny stock at this juncture closely could very well turn out to be rewarding.

Following In The Footsteps Of The Cannabis Boom

The legalization boom in the cannabis sector didn’t just stop at cannabis. It has even led to brands from outside of the sector jumping on the bandwagon. Constellation Brands (NYSE:STZ), a beverage conglomerate with a stake in everything from Corona to Modelo, shook up the pot world in 2017 when it invested $191 million for a 9.9% stake in Canopy Growth, and followed it up a year later sinking an additional $4 billion into Canopy Growth Corp.

It didn’t stop there, either. Just last year, Constellation raised its stake in Canopy Growth once again, investing another $174 million into the pot giant, raising its stake to 55.8%. A move that has solidified its stance on the industry. David Klein, CEO of Canopy Growth, noted “This additional investment validates the work our team has done since attracting the initial investment in 2017. It also strengthens our ability to pursue the immense market and product opportunities available to Canopy in Canada, the US and other key global markets.”

Since the beginning of the year, Constellation has seen its stock price rise and fall based on a string of wider economic influences, but it’s still sitting pretty at today’s price of $232, a full 52% higher than its price this time last year.

Molson Coors (NYSE:TAP, TSX:TPS-A) is another beverage giant with its eyes on the looming marijuana explosion. With brands that are recognizable across the United States and Canada, Molson is no stranger to industry dominance. And it’s not going to be left behind in the adoption of cannabis, either. Molson Coors is already developing its own line of non-alcoholic cannabis-based beverages with its partner, the HEXO Corporation.

"While we remain a beer business at our core, we are excited to create a separate new venture with a trusted partner that will be a market leader in offering Canadian consumers new experiences with quality, reliable and consistent non-alcoholic, cannabis-infused beverages," Molson Coors Canada president and CEO Frederic Landtmeters explained.

Last fall, Molson Coors unveiled its cannabis drinks in its joint venture with HEXO. The lineup includes five new beverages containing CBD and THC. “We’re thrilled to be introducing Canadians to new beverage options and leading the cannabis beverage category with our variety of products,” adding, “this well-rounded portfolio is designed to bring adult Canadians products that taste great and provide the consistent experience they need to enjoy responsibly,” CEO Scott Cooper, CEO of Truss Beverage, the product of the joint venture, noted.

Though much of the pot stock boom is taking place in Canada, the U.S. is also producing a few noteworthy contenders. Curaleaf Holdings (NASDAQOTH:CURLF, TSX:CURA), for example, is an up-and-coming American cannabis company with an ambitious vision. And it’s not just limited to marijuana production, either. The multi-faceted company has its hands in all levels of the cannabis game, where it cultivates and manufactures a wide range of products (concentrates, edibles, tinctures, capsules, vaporizer cartridges, dry natural marijuana, etc.), operates dispensaries, and much more.

Since its Initial Public Offering, the Massachusetts-based company has seen significant growth, in what the Motley Fool called “the largest cannabis debut in history.” And it’s lived up to the hype. Curaleaf has had a stellar year, with its stock price bouncing from a low of $5 back in May of 2020 to today’s price of $14.50, representing a near-200% gain in just a year’s time.

And as President-Elect Joe Biden prepares to restructure America’s cannabis policies, the idea of a federal ban on marijuana could soon be history. While legalization on a federal front is still up in the air, the change in climate has been a breath of fresh air for domestic producers, with more and more states opting for localized legalization and decriminalization.

The Green Organic Dutchman (TSX:TGOD) is primarily a research and development company focusing on cannabinoid-based products. Most of its products are dried organic cannabis, oils and edibles, but it also is involved in breeding plants to create new strains and distributing seeds for medical applications.

Recently, the Canada-based Dutchman announced that it has been approved to export medical cannabis to Europe. Sean Bovingdon, Interim CEO of TGOD, commented, "This is an important milestone as we get ready to begin the international shipping of our certified organically grown medical cannabis products. Germany is the first of several markets that we are planning to supply. Other countries that we anticipate shipping to in the future are Australia and Mexico.”

Namaste Technologies Inc (TSX.V:N) through its subsidiaries, operates as a retailer of a variety of marijuana products, including vaporizers and other smoking accessories. The company sells its goods through e-commerce sites operating in 26 countries. In addition to its accessory business, Namaste also engages in product development and the distribution of medical cannabis products in Canada.

This month, Namaste announced that it will be taking 100% ownership of CannMart Labs. Meni Morim, Chief Executive Officer of Namaste, noted of the transaction, "Acquiring the remaining interest in CannMart Labs is another important milestone achieved in establishing Namaste as a leading company within the Canadian cannabis sector,"

The Hexo Corporation (TSX:HEXO), as previously mentioned, made major waves with its partnership with Molson Coors to develop cannabis beverages. In Hexo’s fourth-quarter press release, the company shared some optimistic news regarding Truss’ progress, with Sebastien St-Louis, Hexo CEO and co-founder, explaining, “We are commanding significant market share in Quebec and this year we made major strides by launching Truss cannabis infused beverages in Canada in addition to our initial foray into the U.S. with Molson Coors, a world-class partner,”

The world is currently in the midst of a mental health crisis. Everything that could possibly go wrong, has. And to make matters worse, millions, if not tens of millions of people are stuck in isolation. It's never been more important to support the field of mental health. And the FDA seems to agree. Not only have they fast-tracked psilocybin, they've also approved other exciting new approaches to tackling mental health issues.

By. Gunner Andersen

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the global wellness market will continue to increase and that demand for mushroom based supplements and nutraceuticals will grow; that the market for psychedelic mushrooms will continue to increase for research purposes focused on alternative mental health treatments; that psychedelics will gain regulatory, medical, commercial and social acceptance as a potential treatment for various mental and other illnesses; that HAVN can be a supplier of functional and psychedelic mushroom products; that HAVN can be a leader in scientific research and achieve a new standard in naturally derived psilocybin; that HAVN can successfully build out supply agreements with researchers and obtain supply agreements to create commercialized products; that HAVN will develop fungi-based nutraceutical products for the wellness market that will achieve Health Canada approval and be sold on e-commerce sites and by retailers; that HAVN can produce products using specialized extracts which have a greater therapeutic effect for patients; the projected timing of product launches and availability through retailers; that psychedelic mushrooms will be decriminalized and gain acceptance as a viable medical treatment for mental illness; that HAVN will develop a state-of-the-art research lab and become a supplier for the psychedelic and functional mushroom markets; and that HAVN can carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the global wellness market may not increase as anticipated and that demand for supplements, and in particular mushroom based supplements and nutraceutical based products may not increase; that the market for psychedelic mushrooms does not increase; that psychedelic mushroom based treatments are found to be dangerous, ineffective or have unwanted side effects; that psychedelics will fail to gain regulatory, medical, commercial and social acceptance as a potential treatment for various mental and other illnesses; that HAVN may be unable to develop its business as a supplier of functional and psychedelic mushroom products; that HAVN may fail to become a leader in scientific research or achieve a new standard in naturally derived psilocybin; that HAVN may fail to achieve supply agreements with researches or obtain supply agreements to create any additional commercialized products; even if they do successfully produce products, competitors may offer better and cheaper products; that HAVN’s products may prove not effective; and that its intellectual property may be challenged as infringing on others’ IP. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. FinancialMorningPost.com and its owners and affiliates (“FinancialMorningPost.com”) are being paid ninety thousand USD for this article as part of a larger marketing campaign for CSE:HAVN. The information in this report and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner and affiliates of FinancialMorningPost.com own shares of HAVN and therefore have an additional incentive to see the featured company’s stock perform well. FinancialMorningPost.com is therefore conflicted and is not purporting to present an independent report. The owner and affiliates of FinancialMorningPost.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of FinancialMorningPost.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. FinancialMorningPost.com is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation, nor are any of its writers or owners.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.