Blockchain innovators are riding the tailwinds of a global crypto industry that’s reached $1.4 trillion.

And now, if you’re not jumping on the blockchain bandwagon, you’re not jumping on the future’s most tantalizing profits.

Whether you’re following the traditional credit card giants …

Or the first wave of the payments services innovators …

And the backend picks and shovel virtuosos who bring the lucrative world of crypto mining, wallets, banking and exchanges all together under one understandable umbrella …

The money is in the blockchain.

Last year marked the start of the “blockchain decade”, according to Deloitte.

There’s no industry that it won’t affect--significantly.

And it’s so much more than just crypto. It’s a virtual ledger that can process unthinkable volumes of data in a corruption-proof way. It records every single transaction into a “block” of information, in a chain. It’s exactly why Bitcoin has become what it has … a digital currency that managed to top $58,000 in February.

Its power is massive, the profits are potentially astounding, and these three companies are just jumping on the bandwagon … they’re leaders and innovators, with varying degrees of upside still to take advantage of:

#1 Square (NYSE:SQ)

Square, of Twitter/Jack Dorsey fame, absolutely soared in early May when the fintech company officially brought its industrial banking operations online, less than a year after it was approved to do so by regulators.

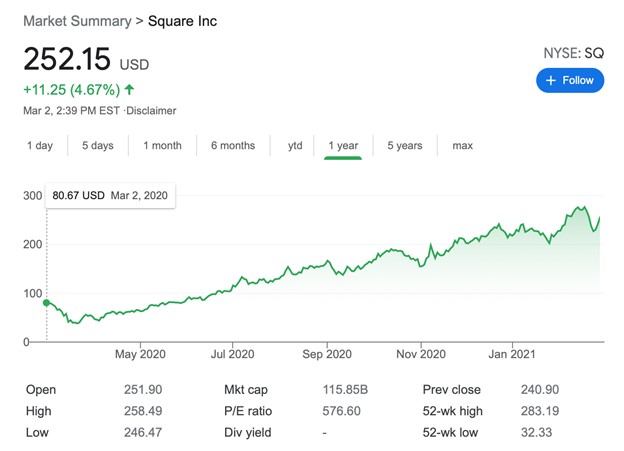

Square stock is up over 200% in 12 months, and it’s all about the lucrative point between blockchain and fintech.

Square is the fintech darling of card readers and point-of-sale solutions. But on March 1st, it started operations on its industrial bank, Square Financial Services, based in Utah. The new bank will offer business loan and deposit products, starting off with underwriting and origination of business loans for Square’s own lending product.

That’s a huge leap forward from its original two components: a business payment-processing system for small businesses and the Cash App person-to-person payment platform, complemented by business lending, a stock trading platform, and an online store for e-commerce merchants.

But make no mistake: This is a blockchain stock. How? Because Cash App, for one, allows users to buy and sell bitcoin seamlessly. In Q3 2020 alone, Square saw over $1.6 billion in bitcoin purchases. The company even has its own bitcoin developers in the form of “Square Crypto”.

And 2020 was a pretty good year ...

Square reported a 140% increase in net revenue and a nearly 60% increase in gross profit year over year.

One of the biggest boosts setting the foundation for a stellar 2020 was Square’s move to allow users to trade bitcoin in 2018. So not only did Cash App generate more than 10X in Q3 2020 as it did the year before, but Square has also bought $170 million in bitcoin.

Now, with an industrial bank actually newly operating, Square--one of the biggest innovators and earliest beneficiaries of blockchain technology--is set for even bigger potential gains in 2021.

It’s a true believer in the future of blockchain, and that’s clearly paying off already.

#2 Cloud Nine Web3 Technologies (CSE:CNI; OTCMKTS:CLGUF)

These are the real picks and shovels of the blockchain bonanza … and that’s why market caps are soaring.

This is a crypto-currency craze that makes the tools of the trade--from mining apps to secure crypto wallets--the incredibly lucrative backend of our blockchain future.

And things are changing. Fast.

Through their acquisition of Limitless Technologies, Cloud Nine (CSE:CNI; OTCMKTS:CLGUF) is now offering what might be the most all-inclusive setup anyone’s seen in this space, yet. It’s a VPN, a crypto mining tool that makes it easy enough for anyone to do it, an AirBnB-like crypto and digital asset storage system, and an altcoin marketing tool …. All in one platform.

And the VPN’s mining algorithms are proprietary and patent-pending, which is the real gold in the blockchain space.

Canada’s Cloud Nine whose stock price has soared by over 2,200% in a 52-week period, just made a massive--and perfectly timed pivot ...

It made its name in the development of the cutting-edge Cloud Nine ESL Program for student mobility …

Now, it’s moving in on the crypto business in a big way … It recently signed an LOI (Letter of Intent) with Victory Square Technologies Inc. (CSE:VST) (OTC:VSQTF) to acquire cryptocurrency and blockchain assets. These aren’t just any assets, and this isn’t just any blockchain company. It incubated the very first publicly traded blockchain company in Canada and has been at the forefront of the blockchain & crypto space. It’s a global name in this space.

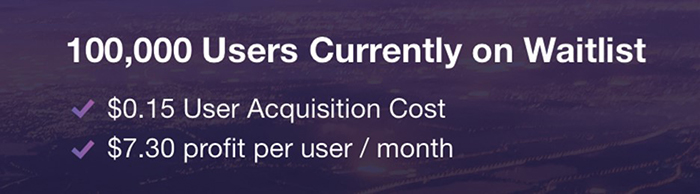

They now boasts a massive blockchain ecosystem that includes Desktop LimitlessCrypto™ Miner, a VPN-based patent-pending user-based Bitcoin, Ethereum, and Altcoin miner for household use with a waitlist of over 100,000 users for post-beta March 2021 launch.

It also includes MicroBlock™ Miner, aka “Crypto in a box”, a crypto-miner that gives users a plug-and-play way to participate in proof-of-work mining protocols like Bitcoin, Ethereum, and other Altcoins, and X2Crypto™ Wallet for Desktop & Mobile, a crypto credit card (VISA™) paired with user-friendly cryptocurrency banking services on desktop, mobile and hardware wallets.

The 3 pieces of IP on this deal are all interconnected. Together, they form a Platform of products that are all driven by the ‘Network Effect’.

With Limitless Cloud Nine offers a fully integrated and closed ecosystem that makes it easy for anybody to mine crypto with no technical expertise required. That means anyone with a computer and an internet connection.

Limitless gives you a plug & play way to mine your favorite cryptocurrencies, which can be then immediately stored in your in-app digital wallet.

Even better, it offers an unmatched level of security of a Closed Crypto Ecosystem.

So, what about revenue? Once launched, the Limitless VPN, which is free to download anywhere in the world, will provide the company with immediate revenue and an immediate foundation of over 100,000 users to leverage across the platform.

It generates revenue from mining altcoins using unused processing power from the Company’s and the Users servers.

All altcoins successfully mined are immediately transferred into bitcoin, and the revenue is then split 50/50 between the Company and the User.

Limitless VPN launched in Beta to 10,000 Users, but it’s hard launching in March and has 100k Users on its waitlist. And the Company predicts it will grow its user base to over one million users by the end of 2021!

There’s an additional revenue vertical as well, with the marketing of new and emerging altcoins that want their coins placed in the Limitless VPN Mining Network Ecosystem.

Cloud Nine Web3 Technologies’ (CSE:CNI; OTCMKTS:CLGUF), at-home crypto-mining machine, MicroBlock Miner, lets anyone mine from the comfort of home, with no prior experience. And they can store it all in the Limitless X2 marquee asset, which very few companies can boast.

It’s the mining enabler, the wallet, and the bank. It’s even the exchange.

Call it what you will … the “Uber” of crypto, or the Airbnb, or that point where Uber meets AirBnB and … Visa, in the blockchain.

It’s a small Canadian company with some of the biggest names in blockchain behind it at the perfect time for crypto and its blockchain backbone, and its all-in-one blockchain crypto offering is likely to start pinging some radar far beyond Canada’s tech triangle--soon.

#3 Visa (NYSE:V)

When it comes to forward-thinking traditional credit card companies, Visa is by far the savviest. What was once its cryptic enemy, is now its biggest ally.

It was the first to jump on the blockchain train back in 2016, seeing the fintech writing on the wall. It met the fintech threat head-on.

In 2016, Visa partnered with Chain blockchain infrastructure company to produce Visa B2B Connect for secure, business-to-business blockchain payments.

Visa has also made it possible to link credit cards and debit accounts to cryptocurrency wallets, converting crypto into cash. By now, Visa has over 25 digital currency wallets connected up.

So, when you think blockchain in fintech, think Visa because it saw the fintech threat as an opportunity and took advantage of it early on. It’s already being rewarded and more rewards are to come.

The credit card giant has already cut deals with dozens of organizations in this space, including BitPanda and BlockFi.

Now, Visa has launched a pilot project for a suite of APIs (application programming interfaces) that will allow banks to offer bitcoin services. The Visa Crypto APIs pilot program is blockchain infrastructure at its best, in partnership with federally chartered digital asset bank Anchorage.

Visa isn’t just prepared for a crypto future, it’s leading the charge among the traditionalists. That’s because it’s seen the opportunity to bank on making crypto safer, smoother and more useful through its “global presence” and “trusted brand”. That makes crypto accessible and applicable to Visa’s 70 million merchants.

Bonus: Other Canadian Companies Revolutionizing The Tech Sector

Blackberry Limited (NYSE:BB; TSX:BB) is a company that is no stranger to the tech world. While it has pivoted away from its iconic cell phones of yesteryear, it is still very much involved in pushing the tech industry further. It’s even building a global digitized healthcare database leveraging blockchain technology. From it’s high-profile partnerships with the likes of Amazon and more, to its key posturing in the Internet of Things explosion, BlackBerry is a great stock that could be trading at a relative discount compared to some of its peers.

BlackBerry recently launched a new research and development arm called BlackBerry Advanced Technology Labs. Charles Eagan, BlackBerry CTO. “Today’s cybersecurity industry is rapidly advancing and BlackBerry Labs will operate as its own business unit solely focused on innovating and developing the technologies of tomorrow that will be necessary for our sustained competitive success, from A to Z; Artificial Intelligence to Zero-Trust environments.”

Though BlackBerry has seen some increased volatility in recent weeks due to its popularity among Redditors, the company has a lot of potential in the long term, and will likely remain as one of Canada’s premiere tech firms for years to come.

The Descartes Systems Group Inc. (TSX:DSG) is a Canadian multinational technology giant specializing in logistics software, supply chain management software, and cloud-based services for logistics businesses. The company is making waves in the tech industry with its futuristic products and visionary leadership.

Recently, Descartes announced that it has successfully deployed its advanced capacity matching solution, Descartes MacroPoint Capacity Matching. The solution provides greater visibility and transparency within their network of carriers and brokers. This move could solidify the company as a key player in transportation logistics which is essential in the world of commerce.

Computer Modelling Group (TSX:CMG) is a software technology company producing reservoir simulation software for oil and gas companies. Computer Modeling Group LTD. Is a tempting trade for investors as it brings together two essential industries - tech and resources- which are going anywhere any time soon. Especially as the need for security grows, a tech company involved in the oil and gas industry has an incredible opportunity to offer other services.

While Computer Modelling Group focuses on the resource industry, its technology is definitely breaking ground. Founded nearly 40 years ago by Khalid Aziz, a renowned simulation developer, the company has proven that it has staying power. As the resource industry meets technology, this will be a stock to pay attention to.

HIVE (TSXV:HIVE) is a company seeing some major backing from the majors via Lionsgate Entertainment and Goldcorp (NYSE:GG) superstar Frank Giustra, a legendary mining figure known for being in the right place at the right time—and always in front of a trend.

The new Great Game is virtual reality, and while governments are busy trying to figure out how they can control it, investors are busy sinking billions into what is fast becoming a story of industrial-scale cryptocurrency mining.

Now that everyone’s seen how resilient Bitcoin is, not only are things moving to the industrial phase, but everyone’s weighing the best venues for mining. Because even though this is virtual reality, location still matters.

Kinaxis Inc (TSX:KXS) is a provider of cloud-based subscription software for supply chain operations. With the complexity of oil, gas and resource transport and storage, Kinaxis has the potential to offer incredible solutions for its clients.

Kinaxis offers RapidResponse as a collection of cloud-based configurable applications. The Company's RapidResponse product provides supply chain planning and analytics capabilities that create the foundation for managing multiple, interconnected supply chain management processes, including demand planning, supply planning, inventory management, order fulfillment and capacity planning.

Kinaxis is a growing company, but the company has already carved out a significant piece of the pie. As a leader in its field, Kinaxis is a force which investors are keeping an eye on.

By. David Huber

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT. This article is a paid advertisement. GlobalInvestmentDaily.com and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Cloud Nine Web Technologies Inc. (“Cloud Nine”) to conduct investor awareness advertising and marketing. Cloud Nine paid the Publisher to produce and disseminate five similar articles and additional banner ads at a rate of sixty thousand US dollars per article. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by Cloud Nine) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The Publisher owns shares and/or stock options of the featured companies and therefore has an additional incentive to see the featured companies’ stock perform well. The Publisher does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The Publisher will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies impacting the company’s business including the regulation of cryptocurrency or affiliated blockchain technologies, the ability of the company to execute against its business plan, the degree of success with respect to bitcoin, various altcoins and cryptocurrency in general, the success of Cloud Nine’s VPN, regulatory and / or exchange approval of any pending or future transactions, the size and growth of the market for the companies’ products and services, the ability of management to execute its business plan, the continuity of management, the companies’ ability to fund its capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://GlobalInvestmentDaily.com/Terms-of-Use. If you do not agree to the Terms of Use http://GlobalInvestmentDaily.com/Terms-of-Use, please contact GlobalInvestmentDaily.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. GlobalInvestmentDaily.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.