The biggest demographics in the world are pushing a megatrend at the crossroads of the $1.5-trillion wellness market …

The growth prospects are explosive, and they soar around one simple idea: Plant-based … everything.

Nothing has hit that point home more than the global pandemic, which made many rethink their longevity--and what they’re putting in their bodies.

It’s an opportunity that’s attracting Big Money--in fact, the biggest in the world ...

Amazon’s Jeff Bezos, for one, and Microsoft’s Bill Gates.

They’re both backing alternative protein, with the alternative foods industry skyrocketing in 2020.

It’s a powerhouse industry on a wild growth trajectory, right now led by names like Beyond Meat and Impossible Foods.

It’s thoroughly disrupting the $733-billion U.S. food manufacturing industry, forcing traditional giants like Tyson Food and Hormel to jump on this high-speed train before they get left behind.

AT Kearney says plant-based and cultured foods will steal 60% of the market share for global meat sales by 2040.

Investors already missed the most lucrative early-in ship on this segment ...

But one segment of this rising plant-based dynasty is just heating up, and it promises to be big: Plant-based protein, the future of sports nutrition.

And a rising innovator in this field is PlantFuel Life Inc. (CSE: FUEL; OTC: BLLXF), developers of whole health plant-based supplements and protein for something that goes way beyond mere muscle.

It’s less than a month away from launching, and it will sprint out of the gates with a major deal with giant GNC and an Amazon Launchpad partnership for immediate distribution success, with other big household names and a lineup of celebrities to push it likely to follow.

That’s what happens when you bring together a former NFL player and a former GNC executive.

And they aren’t just planning to simply disrupt the sports nutrition with a new plant-based protein that tackles some of protein powder’s biggest controversies, including the fact that even though it’s packed with sugar, it tastes like dry cement …

PlantFuel, with a portfolio of products backed by science, plans to convert swarms of non-vegan consumers into plant-based loyalists.

With a superstar management lineup and instant distribution deals already secured, we expect the revenue intake to be as fast as the news flow on this one.

They’ve got a killer A-Team, an innovative product that latches onto an emerging mega-trend, fantastic distribution channels, and one of the most exciting marketing campaigns out there, sure to capture the demanding attention of Gen Zers and Millennials.

It’s a recipe for success, backed by clinical trials.

Here are 5 Reasons to keep watch over PlantFuel Life Inc. (CSE: FUEL; OTC: BLLXF) as one of the most exciting markets turns into a megatrend:

#1 Plant-Based or Bust: Full-on Market Disruption

We are talking about a massive market that encompasses everything from vegan and plant-based foods to dietary supplements, sports supplements, fitness and wellness. It’s the lifestyle market, in short.

It’s a $1.5-trillion market.

And according to McKinsey, consumers in every market they’ve researched have reported “a substantial increase in the prioritization of wellness over the past two to three years.”

Retail sales for U.S. plant-based food retail sales skyrocketed 27% last year during the pandemic. That’s twice as much as overall retail food sales rose in the same time period. Make no mistake about it--this is a fundamental shift in nutrition.

It’s a fundamental shift in lifestyle to something that’s far healthier and promises us greater longevity. And there’s nothing that sells better coming off a global pandemic than longevity.

Tons of money is floating around this space in multiple segments:

- Beyond Meat (NASDAQ: BYND) is already an $8-billion market cap company. If you’d invested in it back in May 2019 when it went public, you could have seen a 250% return in less than 3 months.

- Very Good Food Company (TSXV: VERY; OTC: VRYYF) has a $315-million market cap and managed a share price increase of 534% between August and December last year.

- Else Nutrition Holdings Inc. (TSXV: BABY.V; OTC: BABYF, with a $250-million market cap, has increased 432% returns since September 2019.

- Simply Good Foods Co. (NASDAQ: SMPL), which also owns Quest Nutrition and has a $3.5-billion market cap and its share price has increased by 205% since its listing.

- Bellring Brands Inc. (NYSE: BRBR), which owns PowerBar & Premier Protein, is up 95%, over the past two years.

- USANA Health Sciences Inc. (NYSE: USNA), which now has a $2-billion market cap, went from $0.15 in 1995 to $99.90 today for an unfathomable 66,500% increase.

Consumer interest and purchasing power are rising in tandem, says McKinsey, and that means “tremendous opportunities for companies, particularly as spending on personal wellness rebounds” post-pandemic.

But it’s an increasingly crowded space unless companies can be strategic about where and how to compete.

PlantFuel Life Inc (CSE: FUEL; OTC: BLLXF) l has that covered, which is why GNC (Live Well) has already ordered $3.9 million in products from the innovative startup.

PlantFuel is focusing on nutrition supplements for everyone--not just big-time athletes, and certainly not for “dumb jocks”. They aim to find the long-living warrior in you.

The global sports nutrition market hit nearly $45 billion in 2020, and plant-based protein powders alone had a breakout year that saw them capitalize on this trend with a 10% market share boost, narrowing the gap between traditional sports nutrition and premium vegan offerings.

PlantFuel plans to disrupt this further, with an impressive lineup of products already set to go and many more planned.

The trajectory for companies like this is clear--even before it became a megatrend:

In 2016, plant-based protein company VEGA sold to WhiteWave Foods, which later sold for $10 billion to $40-billion-market-cap giant, Danone.

#2 PlantLife Is Pioneering the Sports Protein Revolution

The supplement market is already a $53-billion behemoth, but it’s undergoing a plant-based revolution that presents a huge opportunity for early-in investors.

PlantFuel Life Inc (CSE: FUEL; OTC: BLLXF) is putting traditional whey protein on notice. ‘Traditional’ sports nutrition has no business in the emerging fitness revolution.

As demanded by Gen-Z and Millennials, PlantFuel is seeking to change everything about this space, from its outdated products with their old and tired formulas, to the dull branding, lack of lifestyle and overall vision.

PlantFuel isn’t just a clean fuel for your body. It’s both mental and physical muscle. It’s for the mind, body and soul--and the market demands nothing less to succeed in these times.

These powerful generations want protein that their bodies can use and convert into energy. They want protein that is truly good for them. And they want it to taste good, too--without sugar, and without grit.

In other words, they want it all.

That’s what the “No F***ing Whey” campaign is all about.

PlantFuel Life Inc (CSE: FUEL; OTC: BLLXF) seeks to give the world’s biggest plant-based consumer groups exactly what they want … exactly what they demand. And along the way, this TRULY healthy protein is likely to grab a lot of new converts for doing what no one has been able to do yet--taste good.

The product lineup is impressive …

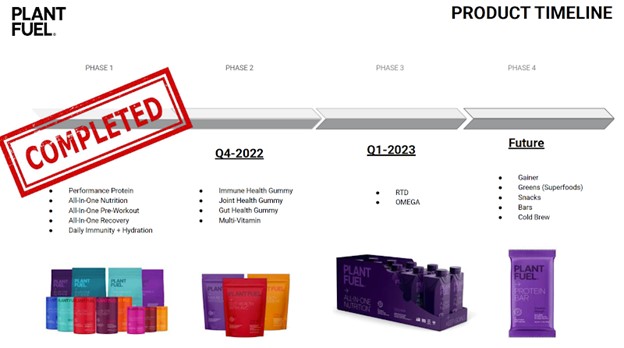

With Performance Protein, All-in-One Nutrition, All-in-One-Pre-Workout, All-in-One Recovery, and Daily Immunity + Hydration, already designed, clinically tested and ready to go out the door to GNC and Amazon …

And a lengthy lineup of new products planned for Q4 2022, Q1 2023 and beyond.

Everything is completely plant-based, with premium products and zero sugar.

PlantFuel Life may have created the next innovation in all supplements with cutting-edge technology. The company already has 5-6 different licensed clinically proven ingredients with exclusive deals.

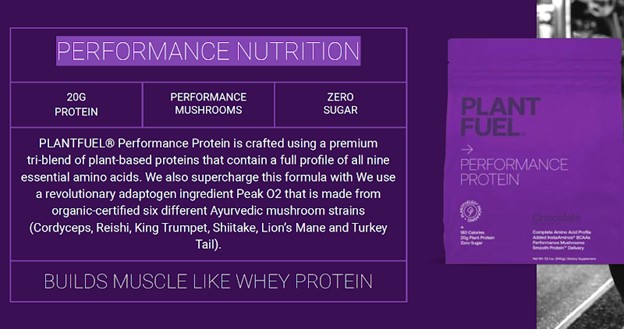

What they’re doing is trying to bridge the lucrative gap between premium vegan offerings and traditional sports nutrition. In other words, they believe they’ve done the impossible. They’ve created a protein powder that can do what no other plant-based supplement can do.

- They’ve made plant-based protein powders actually taste good while using premium ingredients for ultimate effectiveness

- They’ve gotten rid of the controversial high-lactose whey in traditional products

- And they’ve one-upped premium vegan by adding amino acids that match those found in whey

- They’ve also added performance mushrooms

And that’s exactly what led to their first advertising campaign, appropriately tagged: “No F***ing Whey”.

In a upcoming clinical study, PlantFuel aims to demonstrate that it has pioneered the first plant-based protein that is just as good as whey--only healthier, by far.

#3 The Secret Sauce Involves Star Athletes and Celebrities

This is where figures from a giant in the supplement and sports nutrition industry, the NFL and Amazon hotshots come together to change the way we view this segment.

They know sports and they know sports nutrition.

They know powerful distribution and marketing.

And they know millennials. They are millennials.

Former NFL player Brad Pyatt is PlantFuel’s founder and CEO, and he’s done this before.

Pyatt built a $200-million empire with MusclePharm, and created TruWomen with his wife, which was nominated for vegan protein bar of the year in 2020.

His experience as an NFL player means he knows what athletes are looking for in a protein powder, while his experience at MusclePharm and TruWomen means he knows how to bring that product to market.

Chairman Brian Cavanaugh and his GNC connections position PlantFuel brilliantly in the market, with instant distribution.

Cavanaugh represented blockbuster products including Hydroxycut and Six Star Pro Nutrition for Iovate Health Sciences. And as a former senior executive at GNC, he was behind commercializing the wildly successful GNC AMP (which generated $80m in its first year) and Beyond Raw brands that GNC still offers today. Cavanaugh also spent years managing $1.3 billion in business for GNC, hiring the very GNC buyers that PlantFuel Life is working with today.

President and former Amazon star Maria Dane has seven years of experience working on consumable partnerships and business development for Amazon. She led Amazon’s global partnerships with Reckitt Benckiser, Johnson & Johnson, Colgate, Mead Johnson, Kimberly Clark, BISSELL, to name a few, and she knows her way around the digital distribution channels more than most.

Add to this a roster of celebrities that the company expects to jump on board as the marketing campaigns build over the coming months, and you have a superstar team that has a jump start on pretty much everything … including

#4 Huge Distribution Deals Already Secured Ahead of August Launch

Production is underway and PlantFuel says it is less than a month away from launch on the market.

And it’s already secured major distribution deals.

Top supplements retailer GNC has ordered an initial CAD$3.9 million in PlantFuel products for distribution across the United States.

That’s a huge leg up for a company on its launch day, and not many competitors can come close to this on the distribution level.

PlantFuel’s distribution partnership with GNC has now been upgraded to platinum level, which is usually reserved for Tier 1 brands with revenues over $20 million.

"PlantFuel's commitment to creating clinically proven plant-based nutrition that doesn't compromise on performance and taste, while also utilizing eco-conscious packaging, is something that is increasingly relevant and important to consumers today. As the global leader in providing high-quality and innovative supplement solutions, we are excited to enter into this exclusive distribution partnership with PlantFuel to bring GNC consumers new plant-based performance solutions to help them meet their goals,” Josh Burris, Chief Executive Officer, GNC said in a May press release.

That status gives PlantFuel premium in-store exposure, including a Point of Purchase display and full front window display at every GNC at the time of launch.

After the launch period, the advantages may continue to snowball:

- GNC will give PlantFuel a dedicated wall within its stores for premium exposure.

- PlantFuel will be included in GNC’s exclusive, limited marketing campaign which includes targeted emails, retargeted advertising, and social media.

- The brand will also be added to GNC’s Customer Loyalty programs.

- In addition, 100,000 PlantFuel samples will be sent to GNC’s Pro Box customers.

PlantFuel’s strategy from the start has been to target GNC and Amazon because they are the biggest revenue drivers, while retailers such as CVS, Walgreens and Target are low volume and offer little in the way of profits.

With that in mind, we’re not just talking about a deal at launch with GNC … PlantFuel plans to launch directly on Amazon in mid-August.

This is where PlantFuel has another leg up, with a former Amazon superstar leading the push.

The company will work with Amazon on Launchpad, the ecommerce giant’s exclusive invite-only platform. That means millions of dollars in free advertising for PlantFuel which could lead to a fast-paced capture of market share.

#5 This Is a Speeding Protein-Packed Train

This is the best niche narrative right now in the $1.5-trillion wellness industry.

- It’s latching onto the plant-based mega-health trend that’s backed by Bezos and Gates

- It’s managed by a superstar team including a former NFL star, a former GNC exec, and an Amazon hotshot

- It’s fixing everything that’s wrong with plant-based sports nutrition like boring branding and unambitious marketing, with key ingredients that make protein effective and tasty

- It’s put the “cool” back in “muscle milk”, reaching out to Gen Zers and Millennials who all want to be warriors and have an aversion to “dumb jocks”

- It’s already started production of an impressive lineup of products and expects to have an equally impressive future pipeline

- It’s launching in less than a month--so time is running out

- It’s got distribution deals with the biggest name in sports supplements (GNC) and the biggest name in eCommerce (Amazon)

- Right out of the gate, it expects to be distributing multi-millions in product

- Margins look incredible: Brands like PlantFuel would normally spend $24 a pop making a premium-grade product like this, but this company pushed costs down to $18, which means blended profit margins in the mid-40s or 50s.

This is the best-positioned launch we’ve seen in a long time, with deals that include preferential product placement from GNC and inroads with Amazon, blending the convenience of brick and mortar with the ease of online shopping. And it’s moving faster than any new entrant normally could. If you can catch this speeding train, it could be one of the most disruptive things to happen in this space in a decade.

This Trend Is Just Getting Started

Thanks to partnerships with the likes of KFC and others, Beyond Meat (NASDAQ:BYND) has taken the world by storm, locking down its marketing in a way that compelled a new generation of would-be meat eaters to make the switch to a new plant-based alternative. And Wall Street has responded in kind. Since April, Beyond Meat has soared by 111%, quickly becoming a favorite for Robinhood stock traders.

Today, the plant-based meat alternative giant is already worth nearly $12 billion, but new research suggests the market could climb to a whopping $74 billion in just the next few years meaning there is plenty of room for the alt-meat giant to grow.

Beyond Meat’s mission statement speaks volumes, “By shifting from animal to plant-based meat, we can positively impact four growing global issues: human health, climate change, constraints on natural resources, and animal welfare.” It’s a clear-cut example of everything the new generation of investors is looking for in a company. It is combatting social challenges, climate change, and looking to tackle the hurdles facing our growing population.

Though not a producer or distributor of plant-based foods itself, global investment firm UBS (NYSE:UBS) sees major potential in the developing market. And as a key frontrunner in the worldwide push for a more sustainable future, its stance on the market makes sense.

In a release on the company’s site, UBS notes that “Our base case forecasts the global plant-based meat market reaching USD 51 billion in size by 2025, implying a threefold increase in penetration from 2019 levels. The pace at which consumers respond will have major ramifications for investment portfolios on a global basis.”

And with over $300 billion in assets under management, its holdings definitely tell a story. From it’s exposure to sustainable tech giants like Microsoft and Apple to its positions on retailers building up their own plant-based portfolio like PepsiCo and Walmart, UBS is taking its commitment to sustainability and the future of food seriously.

Oatly Group (NASDAQ:OTLY) is a Swedish company that produces oat-based food products. They are the world’s largest producer of oats and have been producing their brand of oatmeal, milk, creamers, and ice creams for over 30 years. They produce these products in Sweden, Finland, and Denmark.

Their founder was an orphan child who grew up on a farm in northern Europe where he learned to make his own food from oats using traditional methods such as stone grinding into flour, boiling water into porridge or cooking it with cow's milk to create creamy dishes which would be served hot or cold. He later founded Oatly Group after emigrating to Sweden at age 18 when he encountered difficulty finding vegan options for breakfast.

From vegan milk alternatives to vegan icecream and yogurt, Oatly gives consumers an alternative to traditional milk-based products, a market that has absolutely exploded across the globe in recent years. And though its share price has struggled in recent months, Oatly is still a company to watch as this trends continues to gain momentum.

As the world's largest avocado grower, Calavo Growers, Inc. (NASDAQ:CVGW) has been in the agriculture business for over 50 years. They have an expansive orchard of over 1,000 acres and employ a diverse workforce of more than 400 people who work year-round to cultivate avocados. The company specializes in both organic and conventional farming methods which makes them sustainable partners with retailers like Whole Foods Market and Walmart Stores Inc. In addition to their retail partnerships, they also maintain relationships with foodservice distributors such as McDonalds Corporation and Yum! Brands - owner of Taco Bell, Pizza Hut & KFC.

In addition to distributing everyone’s favorite superfood to everyone’s favorite fast food brands, Calavo has a strong focus on growing and distributing its products in a sustainable manner. Using green energy and carbon reduction technologies, Calavo Growers checks all the boxes for ESG investors. Not only does it provide a promising opportunity for investors looking to stay on top of the sustainability trend, it pays a healthy dividend, which is rare in this emerging industry.

Hain Celestial Group Inc (NASDAQ:HAIN) is a multinational food and personal care company with headquarters in Lake Success, New York. Hain Celestial is committed to providing consumers with the best natural and organic products available on the market today. The Company’s product portfolio includes fresh fruit juices; healthy snacks; organic fruits, vegetables, herbs and spices; vegan meals easy-to-prepare frozen foods; gluten-free pasta sauces and pastas; plant protein bars and powders for athletes as well as meal replacement shakes for weight management.

In addition to its commitment to quality ingredients, Hain Celestial has also been recognized by various third parties for its sustainable production practices in areas such as sourcing of raw materials from local farmers or environmentally friendly packaging. Hain Celestial operates under a number of brands including Alba Botanica, Avalon Organics, Health Valley, Spectrum and more.

Over the past year, Hain has seen its stock price climb by as much as 25%. But the organic trend is just beginning to catch fire on a global scale. And that could be huge news for Hain in the coming years.

Maple Leaf Foods (TSX:MFI) is another veteran in the Canadian foods realm. Since 1991, Maple Leaf has been making aggressive acquisitions, supplying high-quality foods, and leading in new innovations to ensure the highest quality products for all of its consumers around Canada. And just last year, it announced its plans to dive head first into the plant-based foods industry with a $310 million facility in Shelbyville, Indiana.

More than that, however, Maple Leaf Foods is also committed to slashing its own carbon footprint. In fact, on November 7, 2019, the company announced that it was the first major carbon-neutral food company – a huge claim to fame in a world racing to go green.

The Very Good Food Company Inc. (CSE:VERY) is a Canadian company that is quickly gaining a lot of ground in the market. With the slogan, “we believe in butchering beans, not animals,” they’re looking to tap into the plant-based niche in a hurry. And it’s resonated very well with investors.

Since its IPO in June, the Very Good Food Company has seen its share price grow by over 70%, and it’s showing no signs of slowing. In just a few short months, the company has opened several new facilities, signed a string of deals, and is quickly carving out its place in Canada’s fast-growing plant-based lifestyle scene.

Modern Meat Inc (CSE:MEAT) is a Canadian company following directly in the footsteps of its American cousin, Beyond Meat. With a focus on Instagram-worthy products that could easily garner the interest of any meat-eater, the company is looking to make the plant-based lifestyle trendy. And consumers are loving it.

The company announced in early October that its stock had sold out for over 15 weeks in a row. "We are pleased to announce that our sellout streak is continuing and there is an obvious demand for our products. Despite the interest in our products we are currently constrained by our production capacity and continuing the set-up of our new facility," stated Tara Haddad, Chief Executive Officer of the Company.

Loblaws (TSX:L) is a Canadian grocery store chain. Loblaws currently operates over 2,000 stores in Canada and the United States, including locations under its namesake banner as well as Atlantic Superstore, Dominion, No Frills, Shoppers Drug Mart (in which it owns 50% of), Joe Fresh Style (which it owns 90% of) and more. The company has been operating since 1919 when it was founded by Theodore Pringle Loblaw who opened the first store in Toronto.

Loblaws is one of Canada's largest private sector employers with around 135,000 employees world-wide and continues to be one of North America's leading food retailers thanks to its low prices on everyday items.

Metro Inc (TSX:MRU) is a Canadian company that was founded in 1964 with the goal of bringing people together to meet their needs for transportation and food. Metro has grown from one store to over 200 stores, including grocery stores, convenience stores, gas stations, pharmacies and more! They currently employ thousands of Canadians across the country and are expanding.

Metro started as a small grocery store in Montreal owned by John Murphy Sr., his wife Margaret and two sons John Jr., and Lawrence J.. In 1946 they opened up another location which would become what we know today as Dominion Stores Ltd.

By: Jason Fraser

** IMPORTANT NOTICE AND DISCLAIMER -- PLEASE READ CAREFULLY! **

PAID ADVERTISEMENT. This article is a paid advertisement. GlobalInvestmentDaily.com and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by PlantFuel Life Inc. (“PlantFuel” or “Company”) to conduct investor awareness advertising and marketing. Plantfuel paid the Publisher two hundred and thirty-five thousand US dollars to produce and disseminate four articles profiling the Company. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by PlantFuel) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The Publisher owns shares and / or options of the featured company and therefore has an additional incentive to see the featured company’s stock perform well. The Publisher does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The Publisher will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include, but are not limited to, the size and anticipated growth of the market for the companies’ products, the prospects for success of the GNC and Amazon distribution and marketing relationships, the reported scheduled release of the Company’s products, and the projected profit margins. Factors that could cause results to differ include, but are not limited to, the companies’ ability to fund its capital requirements in the near term and long term, the management team’s ability to effectively execute its strategy, the degree of success of the GNC and Amazon relationships, supply chain constraints, pricing pressures, etc. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://GlobalInvestmentDaily.com/Terms-of-Use. If you do not agree to the Terms of Use http://GlobalInvestmentDaily.com/Terms-of-Use, please contact GlobalInvestmentDaily.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. GlobalInvestmentDaily.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.