Since the middle of 2019, we have been in a precious metals bull market, with gold prices hitting a new all-time high of $2079 on August 3, 2020.

And silver prices have also been climbing steadily since the beginning of 2Q 2020, sending investors on the search for the best way to play this precious metals bull run for maximum upside potential.

In the search for high upside in this bull market, many investors smartly turn to the junior exploration sector, as companies in that space tend to offer the biggest potential bang for the buck.

But it’s important to understand that not all junior exploration plays are created alike.

Seasoned investors in the space know that the key to success in the junior market is investing in the right people – and the right properties – at precisely the right time.

In the midst of today’s ongoing precious metals bull comes Sentinel Resources Corp. (CSE:SNL; OTC:SNLRF) an under-the-radar exploration company that now seems poised to take advantage of a significant potential high-grade opportunity in Australia.

Australia is home to the largest and most cost-effective gold reserves on earth...as well as a number of outstanding recent junior exploration success stories, including Fosterville South Exploration (TSXV: FSX) and Kirkland Lake Gold (TSX:KL).

Kirkland Lake Gold’s super-high-grade Swan Zone rapidly became the lowest-cost, highest-grade mine in the world...and propelled the company’s share price more than 40 times higher in just four years.

Now a similar scenario for significant potential growth could be unfolding again with Sentinel Resources.

The company combines a highly experienced exploration team with a proven track record of success in the region of Victoria. This veteran team now has its sights set to the North and their impressive collection of fifteen recently acquired gold & silver projects in New South Wales, Australia.

These projects include at least 200 historic gold and 23 historic silver mines and exploration prospects which have been shown by historic production and exploration records to include numerous high-grade, historic gold mines and showings.

Here are 5 reasons to look closely at Sentinel Resources Corp. (CSE:SNL; OTC:SNLRF) right now:

#1: The Australian Gold Market is the World’s Largest and Most Cost-Effective

The Australian gold market is an attractive one for investors thanks to both its ranking as one of the world’s top gold producers as well as its track record of junior gold exploration success.

Industry expert Resource Monitor recently proclaimed that, “(Australia) will overtake China next year as the world’s largest gold producer.”

Estimates call for Australia to produce an estimated 383 tonnes of gold in 2021, surpassing the production of China, which has annually produced the most gold since 2007.

According to Nikkei Asian Review, “today, Australia has the world’s largest economically viable gold resources and some of the world’s biggest mines.”

This is due in large part to Australia’s cost effectiveness, offering high margins to explorers. All-in sustaining costs in Australia are among the lowest in the world...so today’s gold bull market means more capital available for development of new mines and expansion of existing operations.

But perhaps more important to investors in the junior exploration sector than a region’s overall level of production is its ability to produce junior mining success stories – and Australia has delivered several notable recent examples:

- Fosterville South Exploration (TSXV:FSX) soared from $1.48 in May to a peak of $5.38 this summer...

- Regis Resources Limited (ASX:RRL) climbed 72.54% in just five months this past summer...

- Capricorn Metals (ASX:CMM) soared 136.56% in the six months between March and September 2020...

- Musgrave Minerals Limited (ASX:MGV) – with a high-grade discovery in Western Australia –shot up 560.87% in just three months earlier this year and remains significantly higher year-to-date.

- And in south-central Australia, Kirkland Lake Gold (TSX:KL) enjoyed great success with its super-high-grade Fosterville gold mine which drove the company’s share price 40 times higher in just four years.

That project’s Swan Zone became a 2,000,000-ounce deposit at almost one ounce per ton literally becoming the lowest cost, highest grade mine in the world and propelled the company’s share price more than 40 times higher.

Now along comes Sentinel Resources Corp. (CSE:SNL; OTC:SNLRF) in the midst of this sustained gold bull market with an impressive collection of new acquisitions in Australia that could help the company become the next junior mining success story Down Under.

#2: A World-Class Caliber Leadership Team Has Been Assembled

Just as world class athletes like to work with the “best of the best” – and elite actors and musicians tend to collaborate with each other – the very best executives in the exploration space often prefer to work only with the very best in the industry.

That means only the best properties...only the best geologists...only the best finance executives...all working together to create the very best opportunities.

So when you see a smaller company assembling a team of exploration veterans – each with several decades’ of successful experience – chances are good there are projects with significant potential in the company’s arsenal.

After all, veterans with 20- and 30-year track records can essentially name their own opportunity...and when they assemble together with an under-the-radar company it is worthy of investor attention.

That’s precisely what has happened with Sentinel Resources Corp. (CSE:SNL; OTC:SNLRF). Led by company President & CEO Rob Gamley, Sentinel Resources Corp. boasts a “Hall of Fame” caliber team of mining industry veterans, including:

* Dr. Peter Pollard, Chief Geologist and Director – Dr. Pollard has more than 30 years of global research and mineral exploration consulting experience and is a recognized expert in intrusion-related mineralized systems. He has presented short courses on ore geology to the industry for more than 25 years and has consulted for the top 20 companies on the biggest projects in the world.

* Danny Marcos, Exploration Manager – With over 25 years as a field-oriented exploration geologist. Mr. Marcos was a key member of the WMC technical team behind the discovery of the Tampakan deposit, the large copper and gold orebody located in the south Philippines (15 million tonnes of copper and 17.6 million ounces of gold.)

* Greg Bronson, Geologist and Director – Possessing more than 29 years of senior geologist experience, Mr. Bronson has excellent technical skills and his experience covers all aspects of mineral exploration project management and property acquisition.

* Dr. Chris Wilson, Senior Advisor – Dr. Wilson is an innovative exploration geologist with over 30 years in area selection and prospect generation experience. Dr. Wilson was previously an Exploration Manager for Robert Freidland’s Ivanhoe Mines Mongolia, and was responsible for an 11-million-hectare portfolio and he has worked in over 75 countries on most commodities and deposit styles.

#3 Strategically Located Gold Projects within Historically Prolific Locations in New South Wales, Australia

Sentinel Resources Corp.’s world-class leadership team recently announced key acquisitions in Australia that are likely to grab the attention of investors looking to play this market...and for good reason.

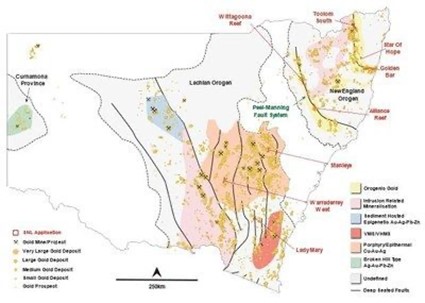

The company acquired eight gold-focused exploration concessions totaling approximately 94,500 hectares located in New South Wales, Australia.

New South Wales, located in southeast Australia, has significant gold endowment with past production exceeding 40 million ounces and with current in-ground gold resources exceeding 68 million ounces.

Much of New South Wales remains hugely under-explored...and the mining-friendly jurisdiction offers a wide range of opportunities for new discoveries.

The concessions acquired by Sentinel Resources Corp. (CSE:SNL; OTC:SNLRF) include at least 198 historic gold mines and gold exploration prospects and historic production records indicate that gold grades were often multi-ounce.

The concessions acquired are known as Star of Hope, Golden Bar, Alliance Reef, Stanleys, Lady Mary, Waddery West, Wittagoona Reef and Toolom South.

The concessions are located with the prolifically mineralized Lachlan and New England orogenic terranes (pieces of crust) and will be 100% owned with no royalty obligations or back-in rights.

These acquisitions offer Sentinel Resources the possibility of drill-ready targets with just a small amount of field work and sampling, and they include numerous high-grade historic gold mines and showings.

With a high level of focus on acquisition in the New South Wales area – and the increasing number of companies now moving into the region – acquiring such an impressive collection of targets is an extremely positive sign or Sentinel Resources Corp. (CSE:SNL; OTC:SNLRF).

And they were acquired at a remarkably low cost – just AUD$10,000 per concession, plus required exploration expenses amounting to $25,000 in the first year and $50,000 in the second.

These potential high-upside acquisitions – in a mineral-rich region of what could soon be the world’s largest gold producer – could put the company in position to deliver multiple, sizable, low-cost, high-grade gold projects.

Investors looking for the next great story in the junior resource sector are likely searching for the next Fosterville South / Kirkland Lake Gold-style success story...and Sentinel Resources Corp. (CSE:SNL; OTC:SNLRF) offers as strong a potential for that title as any other junior resource play in the space.

In addition to Sentinel’s gold exploration projects in New South Wales, the company also recently announced that it has acquired, by staking, seven silver-focused exploration concessions totaling approximately 38,600 hectares in New South Wales.

These concessions are known as: Wallah Wallah, Stony Creek, Carrington, Dartmoor, Glens Skarn, Broken Hill West and Goongong.

At least 23 historic silver and 3 historic gold mines and exploration prospects are present across the Silver Projects. Historic production records indicate that silver grades were generally high-grade and exceeded 1 kg/t Ag in some instances (see News South Wales Department of Planning, Industry and Environment).

This acquisition of seven strategically located silver projects, within the prolifically mineralized Lachlan orogenic terrane and the world famous Broken Hill Block, serves as an excellent complement to the Sentinel Resources gold projects in New South Wales. A significant historic database (held by the New South Wales Department of Planning, Industry and Environment) provides a robust foundation to help the company rapidly advance projects and generate high-value drill-ready targets.

#4: Sentinel’s Waterloo, British Columbia Offers Robust Silver and Gold Potential

While the company’s recent acquisitions in Australia are the properties grabbing most of the attention, Sentinel Resources’ portfolio also includes attractive opportunities in both Canada and Peru.

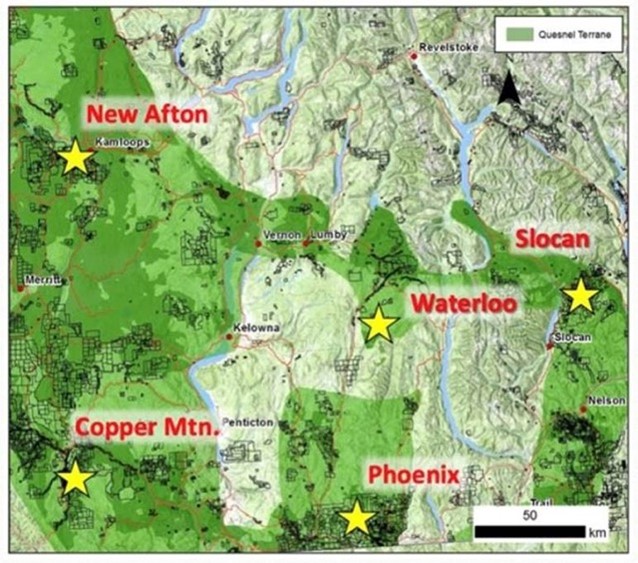

In Canada, the company’s Waterloo Silver Project is located in British Columbia, home of one of the world’s largest, most productive mineral trends.

The 1,000 kilometer belt in north central British Columbia known as the Quesnel Trough has seen significant placer gold production.

This production includes very large-scale mining operations such as the Kemess gold-copper mine which produced 303,475 ounces of gold as recently as 2004.

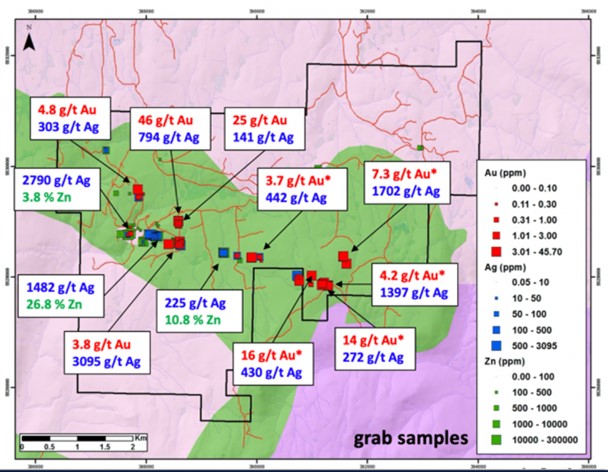

Sentinel Resources 3,130-hectare Waterloo project includes the historic Waterloo Mine, which has seen sporadic production of high-grade silver since 1903 and is road-accessible with developed infrastructure nearby.

Grab samples from historic workings came back at 2,790 g/t silver and 45.70 g/t gold.

Waterloo also hosts even more exploration potential as the area was never systematically drill-tested with numerous defined, yet untested, targets.

Historic work on the project – including geological mapping and prospecting – has produced compelling results of high-grade silver and gold, according to the company.

#5: Sentinel Also Recently Acquired Mining Concessions in Western Peru

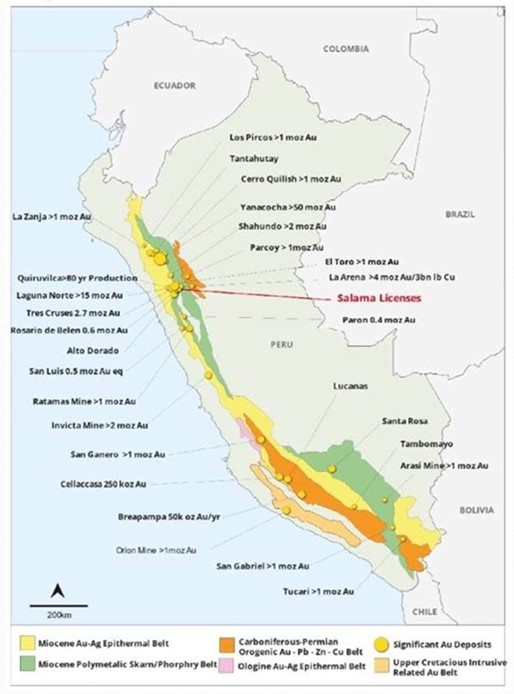

Sentinel’s Salama Gold Project consists of four gold focused mining concessions totaling approximately 2,700 hectares, located in the Anta province of western Peru.

Preliminary review shows that this region offers extensive areas of quartz veins with localized silicified breccias, that have been the focus of historic production by artisanal and small-scale miners.

These miners targeted high grade areas where oxidation of bedrock resulted in formation of free gold amenable to gravity recovery.

Sentinel (CSE:SNL; OTC:SNLRF) projects that there is potential on these properties for high and low sulfidation epithermal gold mineralization and breccia pipe stock-work style gold-silver deposits.

The Salama Gold Project is situated within the prolific gold-polymetallic Miocene skarn and porphyry belt – one of several coastal metallogenic belts that host the larger and more significant Peruvian deposits.

These include the Lagunas Norte Gold Mine, Rasario De Belen Gold Mine, La Arena Gold Mine and La Virgen Gold Mine, that together host over 20 Moz gold within a 45 km radius of the Salama Concessions.

Sentinel's field team will initially comprise three in-country geologists, allowing for rapid first pass reconnaissance and rock-chip grab sampling.

The field team has robust project review and target generation experience, especially with respect to Peruvian low and high sulphidation epithermal deposits, such as Lagunas Norte, La Arena and Rosario De Belen.

This will allow mineralization at Salama to be placed within the wider context of an epithermal deposits geological, structural and hydrothermal evolution, and thus allow key controls on mineralization and high value targets to be rapidly established.

Bottom Line

- Sentinel Resources Corp. (CSE:SNL; OTC:SNLRF) is a potential high-upside junior exploration play positioned perfectly to take advantage of the ongoing precious metals bull market

- Entry into the Australian exploration market at precisely the right time, as Australia seems poised to become the world’s largest gold producer

- An impressive land package in Australia – with high-grade showings – in a region that has been overlooked for decades

- A collection of recently acquired silver-focused explorations in New South Wales that provide an excellent complement to the company’s gold properties

- A “Hall of Fame” caliber leadership team that has been assembled to pursue only the highest-upside opportunities...seeking to replicate the success they’ve enjoyed individually over the past 30 years as a new team

- Recently acquired potential high-grade gold deposits in western Peru in a region with historic production

- With such a sizable package of assets – including existing mines and historical data – the company offers outstanding spinout potential for any one of its gold- or silver-focused projects

Honorable Mentions

Other companies to watch in the gold and silver exploration space include:

Great Panther Mining Limited (TSX:GPR)

Great Panther has had a stellar year despite the global COVID-19 pandemic impacting its production back in March. In fact, since its yearly low, the company has seen its share price rise from $0.43 to $1.13, representing a 162% return for investors that got in at the right time.

In its most recent production report, Great Panther announced that its production had increased from the second quarter and is on track to meet or exceed its 2020 full year guidance. In addition to its growing production, the company also reported a fairly healthy balance sheet, giving investors some more confidence to hold the stock as this year’s gold rally continues.

"The combination of a strong rise in the gold price and record production at our flagship Tucano mine, leading to a substantially lower AISC, drove a significant increase in cash flow from operating activities to a record $19.5 million for the second quarter of 2020," stated President and CEO Rob Henderson.

Alamos Gold Inc (TSX:AGI)

Alamos Gold is another billion-dollar miner having a notable year. It’s recently corrected from its 5-year high of $10.60, but it has still seen healthy returns this year, thanks in part to its promising exploration push and record high gold prices.

In September, Alamos announced new results from surface exploration drilling at the Island Gold Mine. John A. McCluskey, President and Chief Executive Officer explained, “These new high-grade results over much greater widths include the best surface exploration hole ever drilled at Island Gold and further extend mineralization from one of the highest grade portions of the ore body. They not only demonstrate the significant potential for additional growth in Mineral Reserves and Resources but further validate our decision to install a shaft as part of the Phase III Expansion.”

In addition to its strong performance and great exploration results, Alamos also pays dividends, making it an attractive bet for investors looking to ride out this gold boom for a longer amount of time.

Osisko Gold Royalties Ltd (TSX:OR)

Osisko Gold has been particularly busy this year, scrambling to make the most out of gold’s unprecedented rally. It’s made headlines with a string of deals, especially surrounding its Cariboo gold project in central British Columbia. In fact, in early October it announced multiple new high grade discoveries at the project managed by Barkerville Gold Mines, a wholly owned subsidiary of Osisko.

The success at the Cariboo project also highlights the company’s commitment to working with the community in a sustainable fashion. Just recently, it signed an agreement with the Lhtako Dene Nation to ensure the protection of the land and water near the drilling locations.

Chris Pharness, Barkerville Gold Mines VP Sustainability and External Relations of BGM noted, “It has been an honor and a privilege to be welcomed in the community and to hear the hopes and aspirations that LDN leadership and members have for their people. Our core belief as a company is based in reciprocity and the understanding that projects of this scale require mutually beneficial relationships, opportunities and outcomes to succeed. Our agreement is a key underpinning of that philosophy and an example of what respectful, honest dialogue can achieve.”

Sandstorm Gold Ltd (TSX:SSL)

Sandstorm is a gold royalties company that follows in the footsteps of Wheaten Precious Metals, Franco-Nevada and the aforementioned Osisko Gold Royalties, giving investors a chance to cash in on this year’s gold boom while still maintaining some aversion to risk. Though it has not had quite as an impressive of a year as some of its pure-mining peers, it has still posted some moderate returns, especially considering the state of the wider resource market.

Like other gold and resource companies, Sandstorm took a hit when it saw a number of its assets temporarily halt operations to prevent the further spread of COVID-19, but it has since clawed back some of its losses, and is on track to see further gains as its operations return to normal. In addition to its upwards trajectory, it’s also sitting on a healthy balance sheet. Nolan Watson, President and CEO of Sandstorm, explained, “We're excited at Sandstorm to have a strong balance sheet, a strong portfolio, and significant growth ahead. As at this moment, we are entirely debt-free. We have $52 million in the bank. These are good times for Sandstorm and I genuinely think they'll keep getting better.“

By. Stephen Bloom

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT. This article is a paid advertisement. GlobalInvestmentDaily.com and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Sentinel Resources Corp. to conduct investor awareness advertising and marketing. Sentinel paid the Publisher to produce and disseminate five similar articles and additional banner ads at a rate of seventy thousand US dollars per article. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The Publisher owns shares and/or stock options of the featured companies and therefore has an additional incentive to see the featured companies’ stock perform well. The Publisher has no present intention to sell any of the issuer’s securities in the near future but does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The Publisher will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies impacting the company’s business, the degree of success of identifying mineral-rich areas to explore, the degree of success of drilling excursions, geopolitical issues in the various parts of the world in which the company operates, the size and growth of the market for the companies’ products and services, the ability of management to execute its business plan, the companies’ ability to fund its capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://GlobalInvestmentDaily.com/terms-of-use. If you do not agree to the Terms of Use http://GlobalInvestmentDaily.com/terms-of-use, please contact GlobalInvestmentDaily.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. GlobalInvestmentDaily.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.