Cryptocurrencies are minting new millionaires faster than any other asset class in history.

Blockchain, the backbone of cryptocurrency and expected to become the biggest market disrupter we have ever seen, is creating incredible wealth for some investors and generating massive returns.

A $1,000 investment in Bitcoin in 2010 would have earned you $35 million by mid-2017, although that would have dropped back a bit since then.

FOMO (fear of missing out) is an epidemic at this point, but most investors don’t understand crypto... or the blockchain... or even how to invest in these new assets.

But those who missed the first crypto run up are dying to get in on the most exciting market sector of our time can now do it in their portfolio.

How? (CSE: BLOC; OTC: BLKCF) is a publicly traded blockchain “private equity fund” and “incubator” that you can purchase with a few clicks in your online brokerage account.

It doesn’t get any easier than this, but it does get better:

The company, Global Blockchain Technologies Corp. (CSE: BLOC; OTC: BLKCF), is the brainchild of the same man who co-created the $100 BILLION dollar Ethereum project, Steven Nerayoff.

Not only are they investing in crypto projects (as one expects a private equity fund to) ...

But they are also incubating blockchain companies.

Again...

You don't need to know anything about Bitcoin... blockchain... or have your own crypto investing system...

Because you can add Global Blockchain to your portfolio with just a few clicks, and let the only publicly traded crypto investment team do the work for you.

This is a stock not many people know... but will soon. Here’s why...

5 Reasons to keep a close eye on Global Blockchain Technologies (CSE: BLOC; OTC: BLKCF) right now:

#1 How Blockchain Works (for YOU)

Tech heads can explain how the blockchain works until they’re blue in the face, but for many would-be investors it still seems complicated.

Knowing that helps, but this fact helps even more: You don’t need to be a blockchain expert to reap the rewards.

Global Blockchain has put together a core team that aims to be “incubating” 12 or more new digital currencies every year. This means that Global Blockchain will be providing the funding for these new currencies in return for an equity stake and a significant percentage of the founders tokens.

And it isn’t just any team: There is some serious blockchain power at work here.

Again, this is all headed up by the Nerayoff, the co-creator of Ethereum.

If you’ve been living under a rock, it’s time to crawl out: Ethereum has gained over 357,000 percent since its launch, with Nerayoff as its advisor. He was also a senior advisor to the Lisk Cryptocurrency project which now has a market cap of over 2 billion dollars.

And he’s not alone:

- Global Blockchain’s Rick Willard is the co-founder of the Silicon Valley Blockchain Society and an advisor to Luxembourg on blockchain initiative.

- Kyle Kemper is the executive director of the Blockchain Association of Canada.

- Jeff Pulver has consulted and invested in 350 startups.

- Michael Terpin is the managing partner of the first blockchain incubator in the world and founded Marketwire, which sold to Nasdaq in 2006 for $200 million.

Bottom line? Let the experts do everything for you.

You don’t have to conquer the blockchain, figure out how to “mine” any coins by solving math problems with a computer “rig”, or even try to wade through the risky sea of 1,400 cryptocurrencies or questionable ICOs.

But you will get exposure to what could turn out to be the top tokens...

#2 Average Gains of Top Tokens Will Blow Your Mind

Large-cap cryptocurrencies, or tokens, like Bitcoin, Ethereum and Ripple will continue to lead the crypto space for now. And the path to leadership has been unbelievably rewarding.

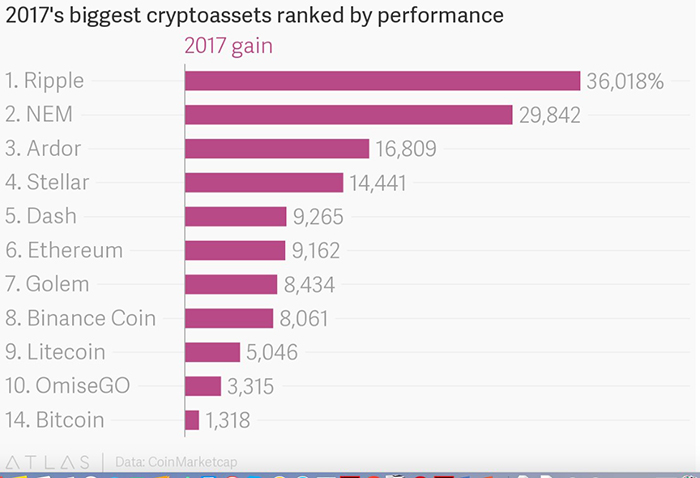

Bitcoin gained over 1,300 percent last year; Ripple gained a whopping 36,000 percent, and Ethereum gained over 9,000 percent.

That means that if you had made a $1000 investment at the beginning of last year in Ripple (which is only around $1 per coin compared to Bitcoin’s $10,000+), your investment would have increased half a million by year’s end.

#3 Diverse Investment Flanks Crypto on All Sides

But it’s not just about getting exposure to the potentially top tokens…

Global Blockchain’s (CSE: BLOC; OTC: BLKCF) strategy goes beyond that. In fact, it’s key attraction is exposure to even bigger potential gains.

Not only does it give you exposure only to the top trading tokens, but also early-in, exclusive access to the tokens that are expected to trade in the future. It invests in large-cap, small-cap and pre-ICO/ICO tokens all at the same time.

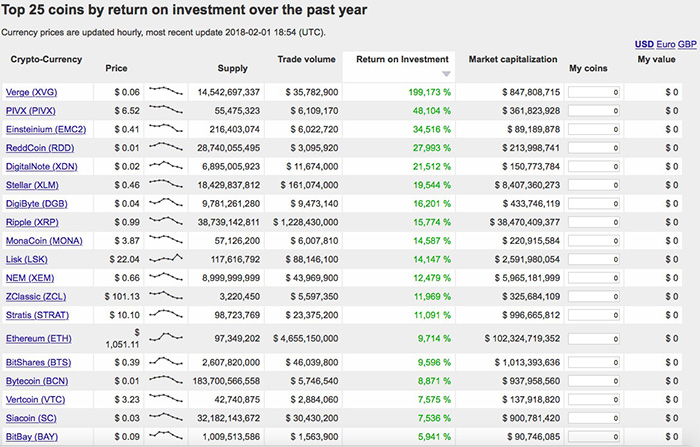

The returns on investment for small-cap tokens have been extraordinary, and this is just a snapshot of some of the top 25:

(Source: Cryptocurrencychart.com)

And beyond this, there is huge potential for future growth.

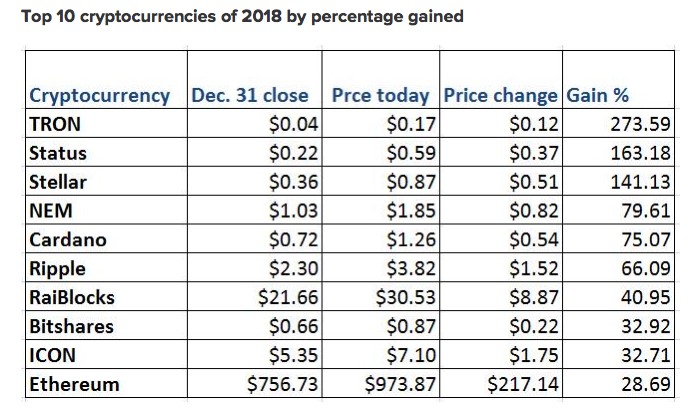

So far this year, some small-caps have been outpacing large-cap gains:

(Source: Coindesk.com) (NOTE: “Price Today” in chart above refers to an article from Coindesk.com dated January 4, 2018, after market close).

These are the precisely the types of tokens Global Blockchain is targeting. Bitcoin is the ‘gateway drug’ to other cryptocurrencies, and to Bitcoin-sized returns for early-in investors.

But Global Blockchain’s team have special insight because of their connections in the industry.

Exposure gets even juicier through Global Blockchain with access to pre-ICO and ICO tokens.

ICOs (initial coin offerings—the crypto world’s answer to the initial public offering, or IPO) exist in a murky world that is difficult to navigate without the expertise of people like Nerayoff and his core team.

ICOs are sort of the “wild west” of the cryptocurrency world and are best left to the connected experts in the crypto space... and Global Blockchain knows the difference. After all, they are ICO masters with Ethereum and others to back them up.

#4 Way Beyond Coin: A Major Blockchain Upside

Even tokens and ICOs doesn’t represent the entire game here: Global Blockchain (CSE: BLOC; OTC: BLKCF) is also building a portfolio of startups focused on blockchain-based services. That means acquiring … and tokenizing software that could further benefit blockchain.

One of the first projects they invested in that gained international exposure was Kodak One, a blockchain solution for this age-old company that needed serious resuscitation.

The result? The stock price of Kodak jumped an astounding 321 percent.

And then there’s their partnership with Overstock.com (NASDAQ:OSTK) and its tZero subsidiary.

Blockchain—and its rewards—are only limited by the imagination.

Every industry in the world is about to be upended by blockchain, and the gaming industry is just one of them: Exciting things are afoot as Global Blockchain plans to tokenize gaming platforms too.

And with a game like Second Life having a virtual economy of $500 million, there is plenty of opportunity for an ‘incubator’ looking to bring the best blockchain startups to the market.

We have seen big announcements from Global Blockchain over the past weeks.

#5 Expect Announcements from Global Blockchain

Headed up by Ethereum’s co-creator, Global Blockchain (CSE: BLOC; OTC: BLKCF) is aiming to become a multi-billion dollar crypto hedge fund and incubator...

And you can’t get this kind of market exposure anywhere else.

So, judging by the past few weeks of announcements, not only can you expect a series of announcements on portfolio purchases, ICO investments and blockchain acquisitions...

But you can also expect series of announcements on exclusive token deals you can’t get access to through any other instrument.

A couple clicks with your online broker, and you’ve got a piece of the crypto universe hand selected by some of the brightest and most connected minds in crypto.

The potential in this current US$64 million market cap company is truly unparalleled for diversity in this industry.

The time to pay attention is now because over the coming weeks, with each new announcement, this company could become an industry darling.

In short: Global Blockchain (CSE: BLOC; OTC: BLKCF) should be on the radar of anyone who wants intelligent exposure to the crypto space.

Honorable Mentions:

The Descartes Systems Group Inc. (TSX: DSG): Descartes is a Canadian technology company specializing in supply chain management software, logistics software, and cloud-based services for logistics businesses. The company is becoming a giant in the tech industry with its visionary leadership and futuristic projects.

Its market cap of over 2.5 billion is evidence of just how big a player this giant is in the space, and should give investors confidence in its ability to take advantage of the coming developments in the technology market.

Kuuhubb Inc. (TSXV: KUU): While its headquarter is in Helsinki, Finland, Kuuhubb operates in the U.S. and Asian market. This international company is active in the acquisition and development of lifestyle and video game applications. It looks for undervalued but proven applications and extracts long term growth for its shareholders.

Mogo Finance Technology Inc. (TSX:MOGO): The FinTech sector is one of the hottest sectors for investors right now, but finding the right company can be tough. Moho may well be one of those company, taking a new approach to unsecured credit. It provides loan management and the ability to tack spending, stress free mortgages and even credit score tracking. The online movement to assist users with finances is one of the fastest growing out there, and Mogo is one of the best in the space.

Its software analyzes clients financial habits instantly, reducing the notoriously arduous process of underwriting loans. The overhead for this company, as with many new FinTech companies in the space, is remarkably low, meaning more upside for investors and more liquidity for dealing with other issues.

EXFO Inc (TSX:EXF): There long term growth potential for this tech company is hard to argue with. It has come a long what since its inception in 1985, when it was producing testing products for optical networks. It has acquired and built products including 3G, LTE, IMS and others.

Its new baseband unit offers operators a faster revenue stream and reduces cost, two advantages that can prove priceless in this competitive environment.

Power Financial Corp (TSX:PWF): Power Financial Corp is not new to the industry, having been founded in 1984 and creating a market cap of over $23 billion. This giant has the added bonus of providing investors with a nice dividend to hold the stock, giving shareholders financial upside while the company moves to take advantage of the latest opportunities in the space.

Power Financial Corp operates three segments: Pargesa Holding SA, Lifeco and IGM. It is these holdings, which span the United States and Europe, that this giant grew its dominance in the financial services sector.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable securities laws. Generally, any statements that are not historical facts may contain forward-looking information, and forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" "intends" or variations of such words or indicates that certain actions, events or results "may", "could", "would", "might" or "will be" taken, "occur" or "be achieved". Forward-looking information includes, but is not limited to the rate of cryptocurrency and blockchain technology adoption and the resultant effect on the growth of the global cryptocurrency and tokens market capitalization; Global Blockchain Technologies Corp.’s (“BLOC”) anticipated ability to reduce risk for investors and give investors exposure to a broad cross-section of the blockchain ecosystem; BLOC’s projected asset allocations, business strategy and investment criteria, including the anticipated contributions of BLOC’s incubator program; the expected strengths and contributions of BLOC’s management and advisors; and the rate of cryptocurrency adoption and the resultant effect on the growth of the global cryptocurrency market capitalization. Readers should be aware that BLOC has no assets except cash from a recently completed financing and its business plan is purely conceptual in nature: there is no assurance that it will be implemented as set out herein, or at all. Forward-looking information is based on certain factors and assumptions about BLOC believed to be reasonable at the time such statements are made, including but not limited to: statements and expectations regarding the adoption and growth of the global cryptocurrency and tokens market capitalization; BLOC’s ability to reduce risk for investors and give investors exposure to a broad cross- section of the blockchain ecosystem; BlOC’s ability to acquire a basket of cryptocurrency assets and pre-ICO and ICO financings on favorable terms or at all, successfully create or incubate its own tokens and ICO's, and execute on future investment and M&A opportunities in the cryptocurrency space; BLOC’s ability to capitalize on the skills and expertise of its management and advisors; and such other assumptions and factors as set out herein. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of BLOC to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks related to changes in cryptocurrency prices; the estimation of personnel and operating costs; that BLOC will receive required regulatory approvals; the availability of necessary financing; permitting of businesses that BLOC intends to invest in; general global markets and economic conditions; uninsurable risks; risks associated with currency fluctuations; risks associated with competition faced in securing experienced personnel with appropriate industry experience and expertise; risks associated with changes in the financial auditing and corporate governance standards applicable to cryptocurrencies and ICO's; risks related to potential conflicts of interest; the reliance on key personnel; financing, capitalization and liquidity risks including the risk that the financings necessary to fund continued development of BLOC's business plan may not be available on satisfactory terms, or at all; the risk of dilution through the issuance of additional common shares of BLOC; the risk of litigation; the risk that BLOC’s management and advisors may not contribute as much as expected to the company’s success; the risk and the risk that cyber crime may severely damage the value of any or all of BLOC’s investments. There may be many other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. We undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by law. Investors are cautioned against attributing undue certainty to forward-looking statements.

BLOC has no assets except cash from a recently closed financing and this article is based on the business plan of BLOC which at this point is purely conceptual in nature. There is no assurance that the business plan will be implemented as set out herein, or at all.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is not a recommendation to buy or sell securities. This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. In most cases we are paid by the issuer or a third party to profile the issuer. In this case, BLOC is paying to Safehaven.com eighty thousand US dollars for this article and certain banner ads. We have not investigated the background of BLOC. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur. Our emails may contain forward looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company(s), in communications, writing and/or editing.

DISCLOSURE. Safehaven.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) does not make any guarantee or warranty about what is advertised above. The Company is not affiliated with, any specific security. While the Company will not engage in front-running or trading against its own recommendations, The Company and its managers and employees reserve the right to hold possession in certain securities featured in its communications.

The opinions expressed in this article are exclusively those of the author and have in no way been approved or endorsed by BLOC. This article and the information herein are provided without warranty or liability.

SHARE OWNERSHIP. The owner of Safehaven.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Safehaven.com will not notify the market when it decides to buy more or sell shares of this issuer in the market, but will not trade on material information that has not been disclosed to the public. The owner of Oilpatch.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing the Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.