Preface

It's been an uncertain time for Qualcomm of late, and that may benefit traders. Apple has pulled its business -- and then Qualcomm sued for patent infringement. Apple then filed a countersuit against Qualcomm, alleging that Qualcomm's Snapdragon mobile phone chips that power a wide variety of Android-based devices infringe on Apple's patents.

Qualcomm made a splash at CES, or at least believes it did. In its own words:

The company that changed everything about the smartphone is about to change everything about everything else. We invite you to join us at CES 2018.

Further yet, the company is attempting a massive takeover of NXP Semi-Conductor.

All of that has Wall Street uncertain, and there is a back-test we can examine that benefits from just that.

This approach has returned 255% with a total holding period of just 56 days over the last year, with 3 winning trades and one losing trade. Further yet, it takes no stock direction risk and no earnings risk. Let's have a look.

The Trade Before Earnings: When it Works

What a trader wants to do is to see the results of buying an out of the money strangle (40 delta) two-weeks before earnings, and then sell that strangle just before earnings.

If the stock is volatile during this period, this generally is a winning strategy, if it does not move, this strategy will likely not be profitable and the complete back-test below discusses that possibility.

Here is the setup:

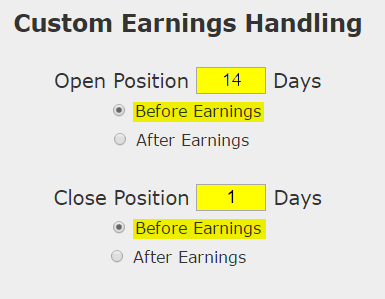

We are testing opening the position 14 calendar days before earnings and then closing the position 1 day before earnings. This is not making any earnings bet. This is not making any stock direction bet.

Qualcomm has earnings due out on 1-31-2018, so 14-days before then is 1-17-2018.

RISK MANAGEMENT

We can add another layer of risk management to the back-test by instituting and 40% stop loss and a 40% limit gain. If the stock doesn't move a lot during this period and the options begin to decay in value, a stop loss can prevent a total loss.

On the flip side, if the stock does move in one direction or another enough, the trade can be closed early for a profit. Here are those settings:

In English, at the close of each trading day we check to see if the total position is either up or down 40% relative to the open price. If it was, the trade was closed.

Returns

If we did this long 40 delta strangle (buy the 40 delta calls and the 40 delta puts) in QUALCOMM Incorporated (NASDAQ:QCOM) over the last two-years but only held it before earnings we get these results:

The mechanics of the TradeMachine™ are that it uses end of day prices for every back-test entry and exit (every trigger).

Setting Expectations

While this strategy has an overall return of 98.3%, the trade details keep us in bounds with expectations:

- The average percent return per trade was 47.2% over 14-days.

- The average percent return per winning trade was 86.1% over 14-days.

- The average percent return per losing trade was -17.7% over 14-days.

That's a nice historical risk:reward ratio. But it's really the most recent year, or even six-months, that has our attention.

Option Trading in the Last Year

We can also look at the last year of earnings releases and examine the results:

In the latest year this pre-earnings option trade has 3 wins and lost 1 times and returned 255%.

- Over just the last year, the average percent return per trade was 71.4% for each 14-day trade.

WHAT HAPPENED

We don't always have to look at bullish back-tests in a bull market -- sometimes a straight down the middle volatility pattern pops up. This is it -- this is how people profit from the option market -- finding trading opportunities that avoid earnings risk and work equally well during a bull or bear market.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.