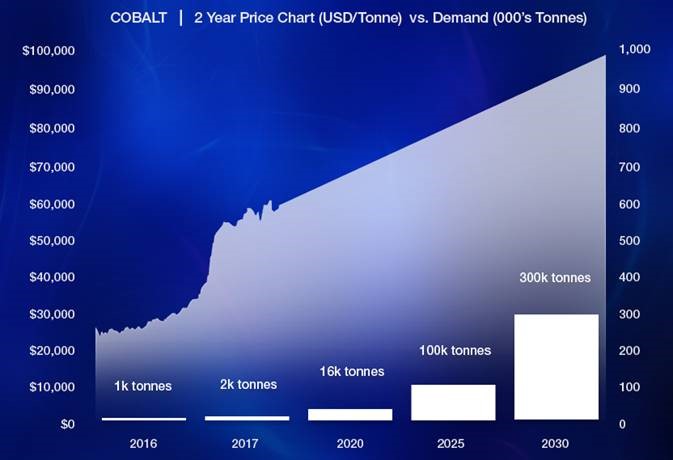

Pay close attention to this cobalt chart. Demand could be about to surge from 2k tonnes today... to over 300k tonnes in 2030. That's a 14,900% increase in demand.

This cobalt chart is the only one you really need to understand. Simply: Cobalt is never going to be cheap again, thanks to the electric vehicle revolution and a massive supply chain bottleneck coming out of Africa.

Data Source: Bloomberg New Energy Finance

Not only will investors never find cheap cobalt again, but all indications suggest that cobalt prices could go even higher. Smart investors are now looking for the small cobalt miners whose share prices will likely go up in tandem with cobalt's underlying price.

And one little-known company is bursting out of the gate with impressive finds of 'safe cobalt'—not the 'conflict cobalt' under major scrutiny in the Democratic Republic of Congo (DRC).

Amid a pending supply squeeze, as major buyers move away from conflict cobalt from the DRC, Quantum Cobalt Corp. (CSE:QBOT; OTC:BRVVF) (formerly Bravura Ventures Corp.) is sitting on North American resources in the heart of Ontario's cobalt belt. And its two past-producing mines have already shown impressive exploration upside.

Here are 5 reasons to keep a close eye on Quantum Cobalt (CSE:QBOT; OTC:BRVVF) at a crucial moment when cobalt prices seem to be going in one direction only:

#1 Demand Surge is Simple Math

Two million and counting … that's the number of EVs already on the world's roads, and we're just getting started. And the $2 trillion global auto industry has completed a dramatic shift, and the shift depends on cobalt—which makes up some 35 percent of the lithium-ion battery mix.

Every single vehicle manufacturer will have to build their own cobalt pipeline, and at some $60,000 per metric ton, cobalt is the most expensive of the battery metals.

The auto industry is definitively about EVs now, and everyone's playing a furious game of catch-up with Tesla. Even car shows are all about plugging in now. The shift is irreversible:

- Tesla will pump out 500,000 EVs a year

- General Motors (NYSE:GM) has announced an 'all-electric' future, announcing plans to launch 20 EV models by 2023

- Renault is planning to double its EV offerings in the next five years

- Germany's Volkswagen made major headlines just recently in announcing a strategic shift to EVs, with plans to invest more than $24 billion in zero-emission vehicles by 2030, and plans to challenge Tesla in creating a mass market. By 2025, it says it will be making up to 3 million EVs a year.

- VW Group (Volkswagen, Audi, Porsche) plans to invest a whopping $84 billion in EV development (over half going to battery production) and a target of bringing 300 electric vehicle models to market by 2030.

- Ford has the newly created "Team Edison" focusing on EV development, pledging $4.5 billion in investment over five years and 13 new models by 2023.

- Toyata and Mazda are teaming up with Senso parts maker for a new EV tech company, and are slated to select a location for a joint $1.6 billion U.S.-based plant by 2021.

- Daimler (which owns Mercedes-Benz) will put $1 billion into an all-electric SUV plant and battery facility in Alabama, and another $10 billion into total EV development. They plan to have 50 models by 2022.

- Volvo is going all electric by 2019 and anticipates selling one million EVs by 2025.

- By 2022, Renault, Nissan and Mitsubishi, collaboratively, plan to have 12 EVs by 2022.

And those are just the car manufacturers … Battery gigafactories are popping up at an accelerated pace:

- Tesla is ramping up its Nevada battery gigafactory from 35 GwH to ramp up to 150 GwH

- Northvolt is planning a similar plant in Sweden

- Dyson is building a $1-billion gigafactory

- LG plans to open Europe's largest EV battery factory in Poland next year

- Panasonic just announced the start of automotive lithium-ion battery production at a plant in Himeji, Japan from 2019 (adding to its existing five plans in Japan, which supply Tesla).

All in all, these immense EV efforts take more cobalt than the world can currently supply. That's why Volkswagen, for one, has just moved to secure long-term supplies of this vital battery component, seeking a 10-year secured pipeline beginning in 2019, according to Reuters.

Volkswagen alone, Reuters estimates, will need more than 150 gigawatt hours of battery capacity every year by 2025 to support its EV plans. It's enough cobalt for just one carmaker to be labeled one of the largest procurement projects in history. In fact, the total order volume is over $58.7 billion at today's soaring cobalt prices.

The entire car industry is switching to EVs, and planning battery gigafactories to go along with them. According to Forbes, in 20 years, EVs could represent 40% of all car sales.

The shift is comprehensive. It's complete. The only thing missing? Cobalt. And investors expect what CNBC calls "inexorable" growth in the EV industry to generate a major supply squeeze for cobalt.

#2 China, China, China

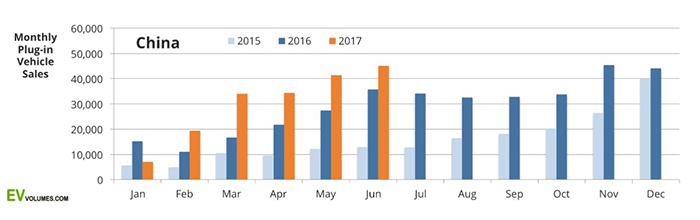

Big automakers may be playing catch-up with Tesla, but it's China that's the real beast, and it alone will seriously challenge global cobalt supplies. We knew this before, but now it's becoming even more clear.

Right now, China is the largest consumer of cobalt in the world. In 2016, Chinese cobalt consumption rose by 5.3% year-on-year, hitting 45,900 tons—equal to over 44% of all global consumption. From this year to 2021, China is expected to see a 12% increase in cobalt consumption, on the back of EV and battery growth.

Cobalt spot prices have seen a 150% price surge this year, thanks to the China-led EV growth spurt, and China leads the way with super restrictions on conventional vehicles to crack down on pollution. China is the largest market for plug-ins, and it's also the largest producer. It's not just about passenger EVs: It corners the market on commercial EVs and even electric buses.

Last year alone, 507,000 EVs and PHEVs were sold in China--a 53% increase from 2015, and double the number sold in Europe and triple the number sold in the U.S.

Even more lucrative for the fantastically tight cobalt supply equation is the fact that China—the largest auto market in the world—produced 28 million vehicles last year and is expected to produce 40 million by 2025. Because of tight restrictions on conventional cars, the bulk of these are going to have to be EVs.

According to Wood Mackenzie, demand for cobalt in EV batteries alone is expected to grow fourfold by 2020 and 11-fold by 2025.

One of the biggest beneficiaries in the EV supply chain will be cobalt miners, and particularly those smaller, new entrants who are developing new supplies that are safe and ethical like Quantum Cobalt Corp. (CSE:QBOT; OTC:BRVVF

#3 Tight Supply for Best-Performing Metal of the Year

The global cobalt market is already facing tight supply, and analysts see no release through 2021, when the supply gap is expected to reach 12,000 tons, according to Research and Markets.

It's a contradiction that is set to keep cobalt prices swelling this year and beyond.

Future supply is uncertain, at best. Some 60% of the world's cobalt is source from the DRC, where it's mined by children under inhuman conditions.

Buyers are under massive pressure to look elsewhere because it's mined by children under inhumane conditions.

Ask Apple Inc. (NYSE:AAPL). The tech giant recently announced it would stop buying unethical DRC cobalt for its iPhones—so it's looking for new suppliers.

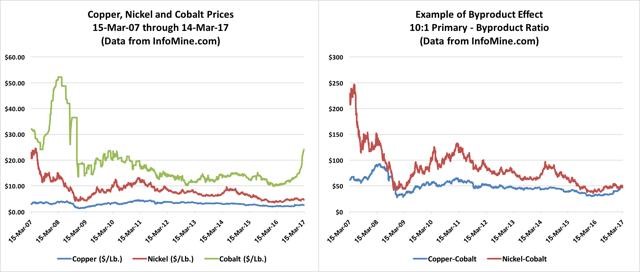

It gets worse: Some 98% of the world's ethical cobalt is produced as a byproduct of copper and nickel mining. This means that cobalt supply is dependent on copper and nickel mining, and if they aren't worth it, we have no cobalt.

With this tight supply situation, even without the DRC uncertainty, prices are poised to continue their upward momentum.

One of these emerging cobalt players is Quantum Cobalt (CSE:QBOT; OTC:BRVVF) …

#4 Demand is Understated

Even with this clear contradictory supply and demand picture, many believe that demand remains understated.

For investors, though, it's hard to get in on the cobalt game. Purchasing shares of miners is tricky because the big miners only dabble in cobalt as a byproduct of copper and nickel, so exposure is skewed and diluted. And copper and nickel prices aren't great performers right now.

As Wealth Research Group noted recently, in looking for positions in the sector, without any ETFs for futures exchanges, investors looked at exploration stocks for exposure, and could only find 24 cobalt-related stocks on North American exchanges. Worse, while the 60 lithium stocks they found were primarily focused on lithium, 19 of the 24 cobalt-related stocks were really focused on copper, nickel, gold or silver.

China alone is a huge factor in the supply/demand equation, and what many investors don't know is that this goes far beyond EVs.

China's has introduced a new 5-Year Plan to push for up to 15% of power to come from non-fossil fuels—that will be another huge push for electric, and another huge consumer of cobalt, even beyond Beijing's recent plan to ban all fossil fuel cars.

Even Tesla's success in the area of energy storage takes us far beyond this cobalt supply equation for EVs.

This isn't just an electric car story—it's an energy revolution story, and right now, the most critical metal is cobalt.

Both China and the US view cobalt as a metal of strategic importance. The hoarding has already begun.

#5 Three Cobalt Plays, Made in North America

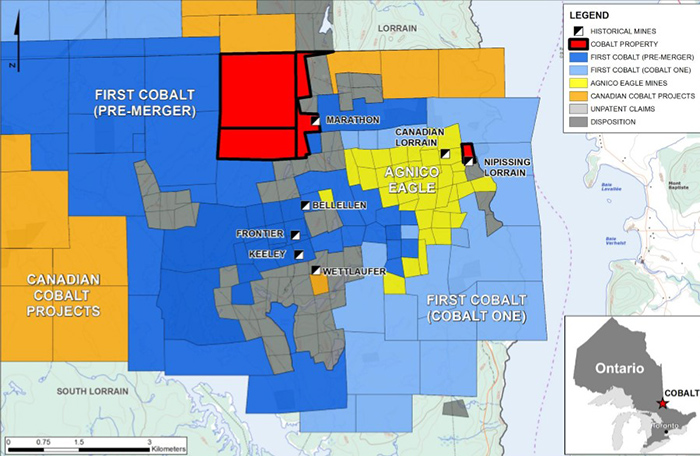

In Canada, all the talk is about Cobalt, Ontario. Cobalt was instrumental during the industrial revolution and it is now becoming superhot again, and Canada is sure it will lead the country into the next industrial revolution.

But it's not just Canadian talk. Everyone wants cobalt, but as Quartz notes, "few want to get tangled up in the world's largest producing nation"—the Democratic Republic of Congo.

So, they're heading to Canada, and specifically to Cobalt, Ontario, the site of a historical silver rush. That was a century ago, and everyone forgot about it when Africa started emerging as a metals bonanza. But now they're back…in droves. Africa is too hot to handle.

"The whole situation is a cobalt-style rush, just like an old fashioned staking rush," said Gino Chitaroni, president of the Northern Prospectors Association and a geologist from the area, told Canada's CBC.

And right in the heart of Ontario's cobalt belt, Quantum Cobalt (CSE:QBOT; OTC:BRVVF) has the Nipissing Lorrain Cobalt Project, which has in the past produced over 1,650 tons of the critical metal.

Source

According to the company, the cobalt mineralization here is striking. Past production of five tonnes of material was reported to be an unusually high grade of 22% cobalt. That's impressive when you consider that most projects are deemed valuable with as little as 0.05% cobalt, says CEO Greg Burns. (its 14.75% on Nipising property)

And that's just one project in this massive cobalt belt. The company has already launched exploration to identify targets in two other projects in the heart of this cobalt belt: Rabbit and Kahuna. (Kahuna project has 22 percent showings)

The Rabbit project is just 55 kilometers north of Ontario's prolific Cobalt district, with historic work returning an assay of 8.76% cobalt.

The Kahuna Cobalt-Silver property, covering 77 claims over 1,200 hectares, has also seen mineralization of cobalt discovered in past work.

The company has mobilized field crews to carry out first-pass exploration on both of these properties, and we expect rapid news flow on prospecting, geologic mapping, geochemical mapping, geochemical surveying and sampling to locate and delineate mineralized structures.

Nearby, First Cobalt Corp.(CVE:FCC)—which pulled out of the DRC to expand in safer Canada, has past-producing assets and a market capitalization of CAD$39 million, which is expected to reach CAD$156 million pending an acquisition transaction. It all suggests that Quantum Cobalt, with its three cobalt projects at ground zero--may be undervalued.

The past production on these properties suggests that Quantum Cobalt has significant exploration and development potential, and it could be coming into this game right at the edge of the cobalt cliff. And it's got the team to back it up.

Jerry Huwang, a Quantum Cobalt director, is an instrumental player in Energold Drilling Corp., a leading drilling solutions company servicing the mining and energy sectors in the Americas, Africa and Asia. With experience from Energold, which is internationally recognized for its social and environmental approach to drilling and operating 270 rigs in 24 countries worldwide, Jerry bring a wealth of knowledge and expertise in exploration and drilling.

CEO Greg Burns, Director of Mergers and Acquisitions at Capital Investment Partners—a multi-billion-dollar fund out of Australia—has lead multiple large-scale deals, including the development of Coalspur Mines into a billion-dollar market cap company at one point.

Quantum Cobalt is also backed by big institutional money, most notably that of Haywood, arguably the most respected institution in Canada. Haywood, a clearing house for 4 Canadian dealers with more than CAD$5.5 billion in assets under administration, will be advising on financing and mergers and acquisitions.

With cobalt at all-time highs, we expect news flow on this one to take quantum leaps. They're putting boots on the ground right now and hope to be drilling at the start of the New Year.

And with the demand in cobalt about to rise 14,900% by 2030... investors finding the top cobalt miners could be rewarded with incredible gains. And short term...

This year is shaping up to be the year that cobalt left Africa and relaunched in Canada. It's the year of North American Cobalt. Lithium producers are already feeling the pressure, now it's cobalt's turn—and the pressure to produce safe new resources could be even greater.

Quantum Cobalt (CSE:QBOT; OTC:BRVVF) is right there in the heart of the Canadian cobalt belt, and it's right at the heart of a cobalt rush that could shift continents.

Other companies to watch within the space:

Magna International (TSX:MG) (NYSE:MGA) is based in Aurora, Ontario. The global automotive supplier is gutsy and innovative--and definitely tuned to the obvious future--clean transportation. A great catalyst is its development of a combo electric/hydrogen vehicle--a fuel cell range-extended EV (FCREEV). It's not going to produce them (for now, at least) but plans to use the model to show off its engineering and design prowess and produce elements of the electric drivetrain and contract manufacturing.

The company's auto parts are distributed to heavyweights such as General Motors, Ford, Tesla, BMW, Toyota, Volkswagen and Chrysler. These huge deals provide a safe and steady profit stream for the company. It's insightful, forward-thinking and smart value/low cost for shareholders.

Pretium Resources (NYSE:PVG) (TSX:PVG): This impressive Canadian company is engaged in the acquisition, exploration and development of precious metal resource properties in the Americas.. Additionally, construction and engineering activities at its top location continue to advance, and commercial production is targeted for this year.

The company's modest market cap and stock price make it an appealing buy for investors. Pretium has an impressive portfolio and if you can catch the stock while the price is right, there could be huge opportunity for upside.

Endeavor Silver (NYSE:EXK) (TSX:EDR) operates three silver-gold mines in Mexico, but it's also got three attractive development projects. Production has dropped and all-in sustaining costs have risen, leading to a negative cash flow. But the company has significantly reduced its debt, so it's future is anything but bleak.

By 2018, with development in the pipeline, this stock might be prohibitively expensive again because there is plenty of near-term growth potential here. It's also got further upside with zinc and should get a boost in this coming bull market. Catalysts include positive reserve estimates for its fifth mine, the Terronera silver/gold project in Mexico's Jalisco state.

Teck Resources (NYSE:TECK) (TSX:TECK): Zinc hasn't been Teck's best friend of late, but that looks set to change in the medium term, as supply continue to dwindle and as we hear news that the world's top producer of the metal—Glencore—isn't planning to bring shuttered mines back online. Supply will remain tight.

Keep in mind this, though: Teck's Q1 earnings and revenue fell short of expectations because of weaknesses at its zinc unit, sending it shares down about 6% in late April. In particular, there's been a 23% drop in production at its Red Dog mine due to lower grades of zinc.

eCobalt Solutions (TSX:ECS) is an established mineral exploration and development company based in Canada. It is a leader in the cobalt industry which is just as important as the lithium space in this energy revolution. Moreover, eCobalt prides itself on providing ethically sourced commodities. Its primary asset is in prime territory in Idaho.

Backed by strong leadership and a forward-thinking attitude, eCobalt is expecting feasibility study results in Q2. This is shaping up to be one of the most exciting belts in the US, and investors are definitely taking notice.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This communication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include: that cobalt demand will increase in the future, and potentially by 14,900% by 2030; that cobalt supply will not be able to catch up to future increases in demand; that one of the biggest beneficiaries in the EV supply chain will be cobalt miners and, specifically, new entrants that develop new supplies that are safe and ethical; that cobalt prices could go even higher than current levels; that rapid news flow on prospecting, geologic mapping, geochemical mapping, geochemical surveying and sampling to locate and delineate mineralized structures can be expected from Quantum Cobalt Corp. ( "Quantum Cobalt"); and that this year will be the year in which cobalt leaves Africa and is relaunched in Canada. Risks that could change or prevent these statements from coming to fruition include: that cobalt demand will not increase, as expected, in the future; that cobalt supply will be able to catch up to future increases in demand; that one of the biggest beneficiaries in the EV supply chain will not be cobalt miners or that new entrants developing new supplies that are safe and ethical will not benefit from the EV supply chain; that cobalt prices will not go higher than current levels; that rapid news flow on prospecting, geologic mapping, geochemical mapping, geochemical surveying and sampling to locate and delineate mineralized structures will not be forthcoming from Quantum Cobalt; and that this year will not be the year in which cobalt leaves Africa and is relaunched in Canada. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. The forward-looking statements contained in this communication reflect the current expectations, assumptions and/or beliefs of the writer based on information currently available to the writer. In connection with the forward-looking statements contained in this communication, the writer has made assumptions about: future increases in cobalt demand; the ability of cobalt supply to catch up to future increases in demand; the biggest beneficiaries in the EV supply chain, going forward; future cobalt prices; Quantum Cobalt's future news flow; and the fact that this year will be the year in which cobalt leaves Africa and is relaunched in Canada. The writer has also assumed that no significant events will occur outside of Quantum Cobalt's normal course of business. Although the writer believes that the assumptions inherent in the forward-looking statements are reasonable, the forward-looking statements are not a guarantee of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. The forward-looking information contained herein is given as of the date hereof and the writer assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively, "we" or the "Company") has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Quantum Cobalt ninety thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is not a recommendation to buy or sell securities. This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. We have not investigated the background of Quantum Cobalt. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. These non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor awareness efforts. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company's website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company, in communications, writing and/or editing.

DISCLOSURE. The Company does not make any guarantee or warranty about what is advertised above. This article and the information herein are provided without warranty or liability.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc., discussed in this message and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher.