Tesla has said that manufacturing bottlenecks have hobbled production of its Model 3 electric vehicle, a problem it expects to resolve in the near future. However, over the longer-term, there could be a bottleneck for one crucial material that is needed to build tens of thousands of electric vehicles.

One of the most important ingredients in the electric vehicle revolution is graphite, a substance that allows for the production of graphene. Graphene is the strongest known material in the world, 200 times stronger than steel. But it also withstands extremely high temperatures without changing its chemical composition. Even better, it is highly flexible. These striking characteristics make it one of the most exciting stories across all technology, not just electric vehicles (EVs).

For the purpose EVs, graphene is critical to extending the life of batteries, making them more powerful, allowing them to recharge faster, and ultimately allowing the vehicle to travel further distances on a single charge.

This is why Elon Musk is desperate to lock down a stable and secure supply of graphene. There has been a lot of hype about lithium and cobalt as the keys to Tesla’s future, but graphene is even more important.

However, there is no commercial production of tech-grade graphite, the material that is made up of layers of graphene.

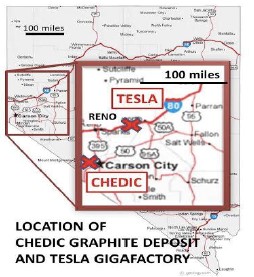

But there is one company strategically located within a few miles of Tesla’s gigafactory in Nevada. Global Li-Ion Graphite Corporation (CSE: LION; OTC: GBBGF) is the only company with graphite assets close to Tesla’s operation, and its fortunes are set to rise as Tesla continues to ramp up operations.

Here are 5 reasons why investors need to watch Global Li-Ion Graphite Corporation (CSE: LION; OTC: GBBGF):

#1 Graphite demand set to skyrocket

Demand for graphite is expected to more than triple by 2020, from 80,000 tonnes per year to 250,000 tonnes per year, according to data from Benchmark Mineral Intelligence. That figure could reach an eye-popping 400,000 tpa in the most bullish case, which assumes that there won’t be any supply restrictions.

The thing is, the lithium-ion batteries that are the central component of the EV revolution actually require more graphite than they do lithium. In fact, they require 10 to 20 times more. Elon Musk has clearly stated that he relies more on graphite than he does lithium.

"Our cells should be called Nickel-Graphite, because primarily the cathode is nickel and the anode side is graphite with silicon oxide [there's] a little bit of lithium in there, but it's like the salt on the salad," Elon Musk told Benchmark Mineral Intelligence. "The main determinants on the cost of the cell are the price of the nickel in the form that we need it and the cost of the synthetic graphite with silicon oxide coating."

Tesla needs incredible quantities of graphite on its quest to dominate the EV market. But it isn’t just Tesla. A Who’s Who of automakers have announced aggressive plans to radically transform their vehicle lineups to include more EV models. Ford, GM, BMW, Nissan, Volkswagen, Renault, among others, are all rolling out new EV models in the next few years. And that is even before we get to China, the largest automaker in the world and already a top destination for EV sales.

The roll out of EVs will be supercharged by government regulation. The UK and France have announced a ban on fossil fuel vehicles by 2040, while China is considering similar measures. That will force automakers to retool their factories to churn out more EVs.

What does all of this mean? The demand for graphite is set to absolutely skyrocket.

#2 Graphite used in everything

The rise of EVs will be a central theme for graphite producers, but graphite (or, more specifically, the graphene extracted from graphite) is used in a long line of applications beyond transportation. As a crucial element in batteries, it is also ubiquitous in consumer electronics, smart phones, computers and tablets. It is useful in manufacturing steel and glass because of its ability to withstand extreme temperatures.

Meanwhile, because of its durability and flexibility, graphene is used in sports equipment and other high-grade super-strength materials. Graphene will make airplanes lighter, allowing them to become safer and more fuel efficient at the same time.

Graphene plays an important role in desalination technology, a sector that will grow substantially over time. And if that is not enough, graphene is a vital material used in medicine, helping build artificial hearts and retinas.

What is interesting about graphite is that scientists were only able to separate out the individual 2-D layers of graphene in 2004. Since then, graphene has captured the imagination of scientists, engineers and investors alike, as it seems to offer an endless number of ways to transform a variety of sectors.

Still, it is still relatively new. The problem up until now is that it has been difficult to produce graphene at a reasonable cost and in large volumes.

#3 Graphite producer gears up in Nevada

Most graphite production is located in China, but even China does not have enough supply. The U.S, for its part, does not mine graphite. But that is about to change as Global Li-Ion Graphite Corporation (CSE: LION; OTC: GBBGF) scrambles to profit off of the EV boom underway in Nevada.

LION has a graphite assets near Carson City, not too far from Tesla’s gigafactory. LION has an option to acquire the Chedic project, which used to produce graphite for pencils back in the 1920s. LION wants to bring the mine back into operation and recent analysis shows an excitingly high concentration of carbon. LION is working with GeoXplor, a geological consulting service with mining and data analysis expertise in Nevada, to secure permits and carry out a drilling exploration program.

When LION brings new graphite supply online, it will be perfectly positioned to be the principle supplier for the gigafactory. If LION can produce it, Elon Musk will definitely gobble it up.

#4 LION has made some bold moves

LION (CSE: LION; OTC: GBBGF) has made a handful of eye-raising moves that illustrate the company’s ambitions. Just days ago it announced plans to acquire BEGO Technologies Ltd., a Hong-Kong based company that uses a unique technology to render out graphene from graphite.

The move is significant for several reasons. First, there are a growing number of companies rushing to develop and patent the best and lowest-cost method of producing graphene from graphite. There are chemical processes that can be dirty and dangerous, or complicated synthetic approaches that are expensive. BEGO is the only company that uses a low-impact bioelectric process that relies on naturally occurring microbes to produce graphene oxide from graphite. BEGO’s process is peer-reviewed and it has already filed for patent protection, and the company says the patents will be robust.

The move is also important because LION already has plans to produce graphite. With BEGO’s technology in hand, it will have the graphite supply plus the ability to produce graphene – creating a small but somewhat vertically integrated company.

LION also made news recently with its announcement that it has an option to purchase 100 percent of the Neuron Graphite Project in Northern Manitoba from Callinex Mines Inc. The acquisition is important because Callinex completed a 12-hole drilling program at the Northern Manitoba project, yielding a carbon content (graphite) of up to 78.3 percent. That figure means that LION will bring in a third crucial supply of graphite under its roof, after its Nevada mine as well as the company’s graphite assets in Madagascar.

To sum up, LION is making moves, building up its graphite supply while also acquiring graphene production technology. These catalysts have led to a spike in the company’s share price – up more than 50 percent in October.

#5 Graphite prices set to soar on strong demand

Energy storage and the rise of EVs means that demand for lithium-ion batteries will surge by more than 200 percent over the next four years. Because of the central role that graphite plays in those batteries, graphite demand will also spike.

The global graphite market is expected to reach $29 Billion by 2022, translating into a CAGR of 5.2 percent from 2017 to 2022, according to a report by MarketsandMarkets.

But with supply inelastic in the short run, prices will need to rise. Add to that the fact that China has actually shut down some graphite supply as a side effect of its pollution crackdown, taking a sizable chunk of global supply off of the market. That has led to a ninefold increase in prices to over $16,000 per tonne in China. But at the global level, spot prices have jumped to $35,000/tonne.

The price increases will work to the benefit of graphite producers. As of now, there are very few suppliers – and even fewer that offer exposure to investors.

Moreover, few people know about graphite, and even fewer know about LION. Everyone has been focused on lithium and the rapidly growing number of lithium miners. As the lithium space has become crowded, investors are starting to look towards cobalt, another critical metal used in batteries.

But the rush for graphite is only at the beginning stages. LION (CSE: LION; OTC: GBBGF) is a pure-play on graphite, and has assets strategically positioned near Tesla’s gigafactory. It has acquired more acreage to expand its graphite supply, while also taking stakes in a company with graphene production technology. Graphene is the unsung hero of the EV revolution. But at some point in the near future, the secret of graphite and graphene will get out.

Other major players taking advantage of the current tech frenzy:

Ballard Power Systems (TSX:BLDP; NASDAQ:BLPD) Ballard develops and produces hydrogen fuel cell products for markets such as heavy-duty motive, portable power, material handling and transportation.

Ballard’s stock price jumped a whopping 27% in September as the company announced a new way to manufacture fuel cell batteries, reducing the need for platinum in its production process by some 80%.

Ballard expects to start producing the new fuel cells at the end of this year.

While Ballard looks at bit expensive compared to its peers, the stock should be on investors’ radars as this is one of the most exciting fuel cell stocks.

Hydrogenics (TSX:HYG; NASDAQ:HYGS): Hydrogenics Corp is a Canadian firm, which designs and manufactures hydrogen generation products based on water electrolysis technology, and fuel cell products based on proton exchange membrane (PEM) technology.

Hydrogenics’ stock had quite a spectacular run and peaked in June, analysts now see the stock as fair valued. Elon Musk may disagree, but the future of fuel cell technology remains promising despite current the cost/benefit model.

Turquoise Hill Resources (TSX:TRQ; NYSE:TRQ) is a mid-cap Canadian mineral exploration and development company headquartered in Vancouver, British Columbia. Its focus is on the Pacific Rim where it is in the process of developing several large mines.

The company mines a diversified set of metals/minerals including Coal, Gold, Copper, Molybdenum, Silver, Rhenium, Uranium, Lead and Zinc. One of the fortes of Turquoise hill is its good relationship with mining giant Rio Tinto.

Going forward, Turquoise’s success at the giant Oyu Tolgoi project in Mongolia will be crucial to boost its lagging share price.

Pretium Resources (NYSE:PVG) (TSX:PVG): This impressive Canadian company is engaged in the acquisition, exploration and development of precious metal resource properties in the Americas.

Pretium has an impressive portfolio and if you can catch the stock while the price is right, there could be huge opportunity for upside. Additionally, construction and engineering activities at its top location continue to advance, and commercial production is targeted for this year.

With Pretium’s variety of assets, this mining giant is a key figure in Canada’s resource realm. Investors know a good thing when they see it, and have definitely taken note of this company’s ambitious and forward-looking drive.

Cameco Corporation (TSX:CCO; NYSE:CCJ) Cameco is one of the largest global producers and sellers of uranium and nuclear fuel. Its operating uranium properties include the McArthur River/Key Lake, Cigar Lake, and Rabbit Lake properties located in Saskatchewan, Canada; the Inkai property situated in Kazakhstan; the Smith Ranch-Highland property located in Wyoming, the United States; and the Crow Butte property situated in Nebraska.

While many analysts see low uranium prices as a problem for miners, an OPEC like move from world uranium leader Kazakhstan to bump prices could benefit Cameco and its peers.

A strong push towards nuclear power from China, India and the Middle East could create further upside for this promising miner.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This news release contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include that LION will complete its announced transaction to purchase the Nevada carbon exploration property; that graphene will have all applications and will be as much in demand in future as currently expected; that LION can fulfill all its obligations to exercise its Nevada property option; that LION’s Nevada property can achieve drilling and mining success for graphite; that LION will close its MOU to buy a Madagascar mining licenses; that production can go online in the near term in Madagascar; that LION will apply for and obtain drilling permits on its Nevada and Madagascar properties; that the graphite in Nevada and Madagascar when produced will be high quality suitable for the tech industry; and that LION will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company may not agree on the final terms for the Madagascar property, even if it agrees it may not be able to finance its acquisitions of Nevada or Madagascar, it may not get regulatory approval for these acquisitions, aspects or all of the properties’ development may not be successful, mining of the graphite may not be cost effective, LION may not raise sufficient funds to carry out its plans, changing costs for mining and processing; increased capital costs; the timing and content of upcoming work programs; geological interpretations and technological results based on current data that may change with more detailed information or testing; potential process methods and mineral recoveries assumptions based on limited test work with further test work may not be viable; additional high value mineral properties may not be available for LION to acquire, or LION may not be able to afford them; competitors may offer better technology than graphite technology for technology; the availability of labour, equipment and markets for the products produced; and despite the current expected viability of its projects, that the minerals cannot be economically mined on its properties, or that the required permits to build and operate the envisaged mines cannot be obtained. The forward-looking information contained herein is given as of the date hereof and the Company assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by LION forty thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. We have been compensated by LION to conduct investor awareness advertising and marketing for CSE:LION and OTC:GBBGF. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non- compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor awareness efforts. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company, in communications, writing and/or editing.

DISCLOSURE. The Company does not make any guarantee or warranty about what is advertised above. This article and the information herein are provided without warranty or liability.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc., discussed in this message and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher.