LEDE

Sometimes an earnings beat is more than just a company executing well. Sometimes it's a signal of the future, beyond one quarter, beyond one-year, and with the latest earnings release from Apple Inc (NASDAQ:AAPL) , we may have just that.

RESULTS

Before we dive into the details of the earnings release, here are the headline numbers:

* Apple reported $1.67 in earnings per share (EPS) versus expectations of $1.57 per forecast from Thomson First Call.

* Apple reported revenue of $45.4 billion versus First Call estimates of $44.9 billion.

(note: while we are members of First Call we did not turn in estimates).

Apple sold 41 million iPhones, above estimates and, more importantly, reminding the world that there would be no 'demand drop-off' effect ahead of the new iPhone cycle. Even further, Tim Cook noted on the earnings call that Apple Inc also reduced channel inventories by 3.3 million units. A surprise to the upside in sales while reducing inventory ahead of a new cycle is no small feat, and one which Apple looked totally incapable of achieving just one-year ago.

Here is a quick snippet from the earnings call from CEO Tim Cook:

If you look across the world, we had several markets in Asia, in Latin America, and the Middle East which grew more than 25 percent year on year.

If you look at [iPhone] 7 in the [iPhone] 7 Plus, we grew strong double-digit year on year compared to the 6S plus a year ago. So, iPhone was terrific.

Source: CNBC

Apple also saw iPad sales increase for the first time in several years with 11.42 million units sold versus expectations of just 9.03 million. Tim Cook also noted that Apple Watch sales rose 50% year-over-year, although he continues to hide the actual number.

But all of that is standard data for a quarterly beat. First, it was the forward guidance and the news that followed that made this earnings cycle a piece of the future, rather than the past.

* Apple guided revenue for the current quarter in the $49 billion - $52 billion range versus First Call estimates of $49.2 billion.

Apple's lifted guidance was a hint that amid all of the heated speculation that supply constraints would prevent the new iPhone from hitting shelves before the quarter end (Sep. 30) that the new iPhone will likely get into people's hands in the last week (ish) of the quarter ending in September.

Second, Apple Services broke yet another record in revenue, topping $7.26 billion in the quarter, which is a 22% increase year-over-year. Doing a little math proves that Services now accounts for more than 16% of total revenue. The Apple Services segment alone is now the size of a Fortune 100 company according to Tim Cook.

Even better, it appears that Tim Cook's goal of doubling Apple Services by 2020 is still on track (a 20% CAGR is required to hit that number).

Now, let's turn to the future in greater detail:

THE FUTURE

iPhone revenue can be backed out by using the average selling price (ASP), which was $606, and multiplied by the units sales of 41 million. That gives us $24.846 billion, which we can round up to $25 billion assuming the company didn't sell exactly 41 million units, but some number slightly higher.

With total revenue of $45.4 billion, that makes the iPhone 55% of sales. If that sounds crazy high, it actually isn't.

In the one-year ago period, the iPhone accounted for 56.7% of revenue (ASP $595 and 40.4 million units) and in the two-year ago period iPhones accounted for (ASP $660 and 47.5 million units on total revenue of $49.6 billion) 63% of revenue.

Back in 2014-2015 Wall Street and the main stream media grumbled that Apple was in fact turning into a phone company rather than a broad technology company. Here is one of many high profile articles, this one from The Atlantic:

But we don't mean to pick on that publication, there are endless urgent and sometimes dire notes with the same narrative – the same false narrative. Here is one from Quartz: Apple earnings prove it: This is a phone company

Of course, instead, Apple has created a juggernaut Services division that is close in size to all of Facebook, yet represents only 16% of total revenue, so far. For a full and detailed read on why Services revenue matters and why it is valued substantially higher than hardware sales (read: iPhone sales), we encourage a read of the CML Pro dossier Apple's Seismic Shift Could Double the Stock.

In that dossier we detail how Apple Services could mean a doubling of Apple's stock – or in English, a 100% stock rise. That was written on January 19th 2016, when Apple was trading at $96. As of this writing the stock is up 62% at $156.39. We believe there's more to come.

It's also important to note that while Apple Services grew 22% year-over-year, this in on the back of iPhone units sales growth of essentially zero. Apple sold 41 million iPhones in the last quarter and 40.4 million in the same quarter one-year ago.

Services is a different form of revenue and does not depend on iPhone growth, although it does ever better when sales in hardware are also growing.

But, after two-years, the main stream media has caught on to the Apple Services story, what it has not caught onto is the hardware story that may trump all of it.

APPLE WATCH

The Apple Watch has been one of the most successful launches of hardware in the history of technology, but as a part of Apple, it's nearly impossible for it to make a dent in the revenue and earnings machine. Wall Street has hated the Watch from its first ever announcement and the cacophony has grown louder with each passing quarter.

Here are a few of our favorites:

Why the Apple Watch is a 'Newton-Like' Failure (Inc., Jun 15th, 2015).

Apple has failed to prove the usefulness of smartwatches (Marketwatch, Jan 31, 2016).

The Apple Watch has been a failure (The Motley Fool, Apr 16, 2016).

Of course, our take was simply:

Apple Watch is Winning (Mar 1, 2016).

Breaking: Apple Watch is Winning, and it Really Matters (Mar 2, 2017).

So, who is right? Well, here is a historical view and then breaking news of the future.

APPLE WATCH - HISTORY

This is from our dossier back in 2016:

Benzinga reported on a JPMorgan analyst report this morning that reported that Apple sold more than 5 million of its Apple Watches in the fourth quarter of 2015.

Further the report noted that total global smartwatch shipments rose to 8.1 million units marking the first time ever that smartwatches have out-shipped Swiss watches.

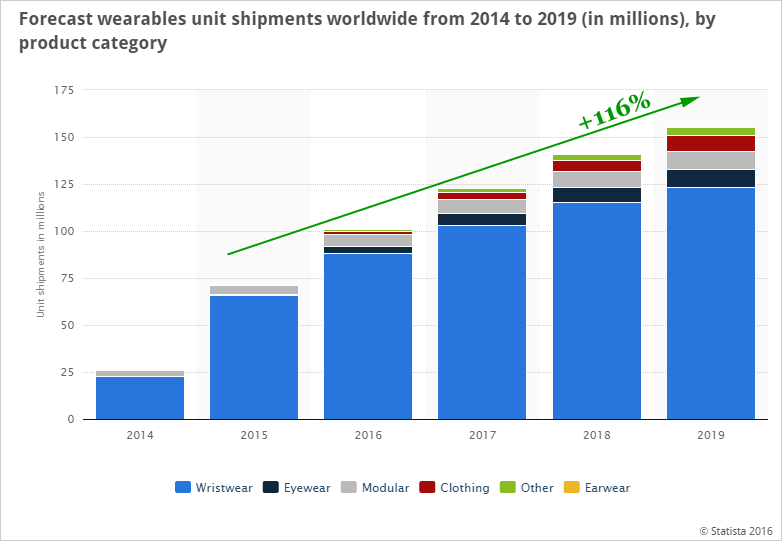

Here's the market for wearables as forecasted by Statista:

That bright blue color dominating the bar chart – those are smartwatches. Best estimates put Apple at a staggering 63% of the smartwatch market. Samsung, based on Alphabet / Google's (GOOG, GOOGL) Android operating system came in second at just 16%. As a point of reference, Apple holds about 30% of the smartphone market.

But this isn't the stunning news.

MORE CONTEXT

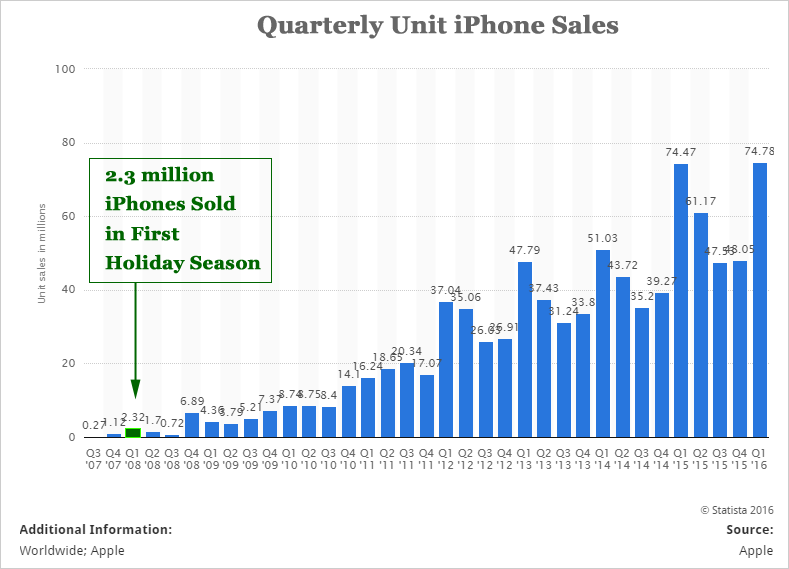

Apple's iPhone sold a total of 2.3 million units in its first holiday season. In fact, here's the all-time iPhone unit sales chart by quarter from Statista.

Apple Watch's 5 million unit sales in its first holiday season crushed the early days of the iPhone. In fact, iPhone only broke the 5 million mark once it its first two-years.

But this isn't the stunning news.

STUNNING NEWS: WATCH 2 The soon to be released Apple Watch 2 will have Wi-Fi capabilities so that users will have connectivity when they're not near their smartphone. Further, though there has been no confirmation yet, it appears the new Watch will have a FaceTime camera.

Read this carefully: The Apple Watch will become a stand alone product – untethered from the iPhone. It's not a defense of the iPhone any more than the iPhone was a defense of the iPod.

And now the future bears the truth that we preached in 2016.

APPLE WATCH – RIGHT NOW

This story was just published 23 hours ago:

Apple Plans to Release a Cellular-Capable Watch to Break iPhone Ties.

In that story, we learned:

Apple Inc. is planning to release a version of its smartwatch later this year that can connect directly to cellular networks, a move designed to reduce the device's reliance on the iPhone.

Apple is already in talks with carriers in the U.S. and Europe about offering the cellular version.

AT&T Inc., Verizon Communications Inc., Sprint Corp. and T-Mobile US Inc. in the U.S. plan to sell the device.

The new device could still be delayed beyond 2017.

I would say 'what a surprise', but ya know...

And for the record, the Apple Watch is still growing. Here is Tim Cook from the most recent earnings call (our emphasis added):

Sales of Apple Watch were up over 50% in the June quarter, and it's the number one selling smartwatch in the world by a very wide margin.

Watch and AirPods are doing incredibly well.

And, while Apple doesn't break out sales for the Watch alone, it does have an "other products" category where it does break out sales, and we got these numbers from its latest earnings release:

Apple other products grew 5% sequentially and 23% year-over-year to $2.73 billion. Other products, include the Apple TV, Apple Watch, Beats headphones, Air Pods, and Apple branded accessories.

When we put AirPods and the independent (un-tethered) Apple Watch together, Apple has created likely the most powerful wearables ecosystem in the world, one that could near the size of the iPhone and one that will create a wave of new App store revenue. Wearables are very much alive because Apple says so.

MORE

There's yet more we learned about the future of Apple from the earnings release.

We have already gone long winded so we'll wrap it up with a reminder that the opportunity in India is enormous. In fact, to quote Tim Cook from the earnings call in response to a question from Brian J. White of Drexel Hamilton: "I'm very, very bullish and very, very optimistic about India."

We have several full blown dossiers detailing India.

Apple is Getting Serious About India (Apr 2, 2017).

Apple Gets Very Good News from India (Jun 20, 2016).

Apple is Pushing for Success in India (May 16, 2016).

India is Turning into a Huge Success for Apple (Apr 23, 2016).

And on, and on...

The quick takeaways:

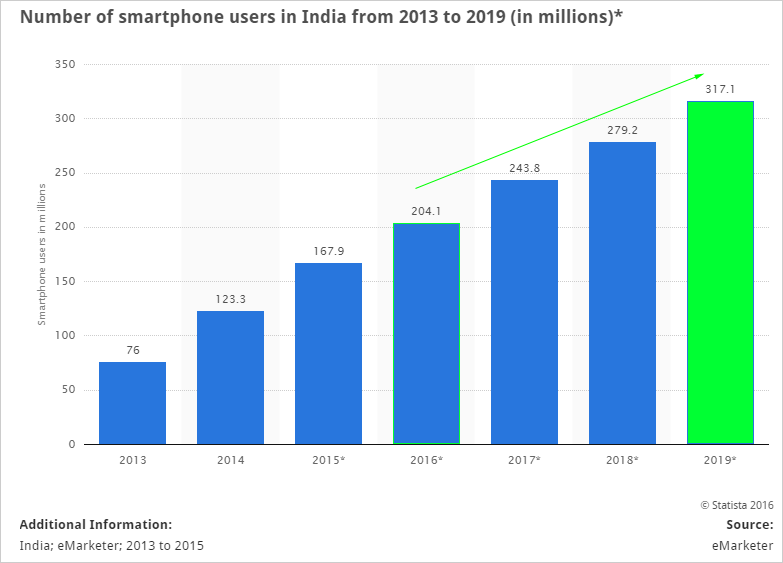

India will represent the second largest smartphone market to China as of this year, overtaking the United States. Here's the growth via Statista

SMARTPHONE USERS IN INDIA

That's 204 million smartphone users in India in 2016. By 2017, India will be larger than the United States.

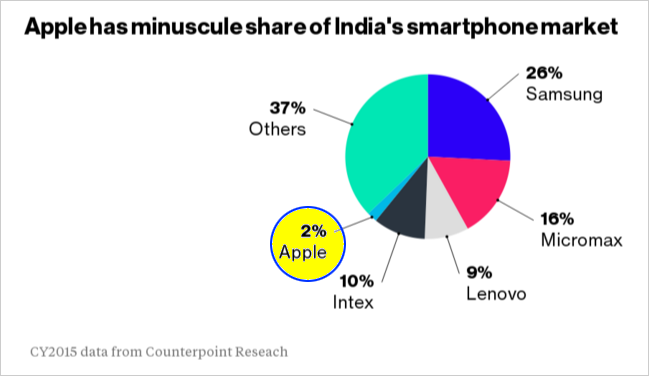

Until recently Apple had no footprint in the country because of a national law that protects home grown manufacturers. In fact, here's Apple's miniscule market share as of mid 2015:

SMARTPHONE USERS IN INDIA

But now everything is changing, and we direct you to the most recent dossiers on the subject to see why.

FINALLY

You'll note that while we have waxed rhapsodic about Apple, we have not (yet) mentioned the new iPhone cycle, so now we will. The 10th generation iPhone will a revolution for the hardware.

So many leaks are out, including one from the company itself, that there seem to be no secrets left, so we'll just leave it at this:

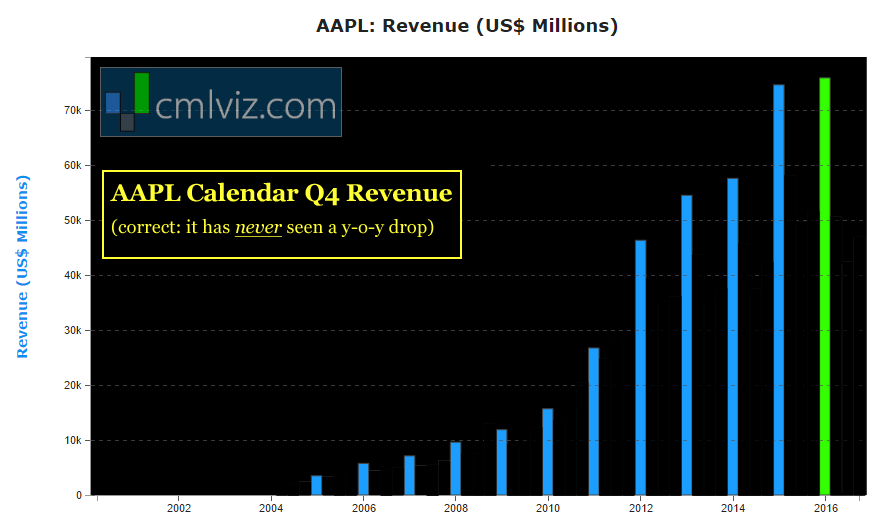

Apple has reported the largest net income (after tax income) for any public company ever in the last three calendar Q4's (the quarter from Oct 1- Dec 31). Yes, the streak has not been broken even though every headline you have read would state otherwise.

Here is a snapshot of revenue for those quarters:

That streak will be extended. And this time, it will have a wave of Services and 'other products" behind it. The Apple Watch is winning, and soon it very well may win on the "scale of Apple."

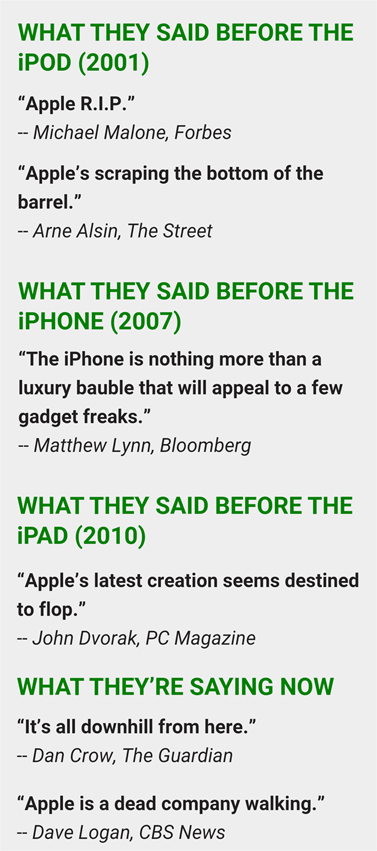

Our first ever dossier on Apple is so aptly titled that we commonly finish our analysis with the title as our conclusion. Here it is again: Apple's Growth Will Humiliate the Skeptics.

Yes it will.

SEEING THE FUTURE

It's understanding technology that gets us an edge in finding the gems that can turn into the 'next Apple,' or 'next Amazon.' This is what CML Pro does.

Each company in our 'Top Picks' has been selected as a future crown jewel of technology. Market correction or not, recession or not, the growth in these areas is a near certainty. We are Capital Market Laboratories. Our research sits next to Goldman Sachs, JP Morgan, Barclays, Morgan Stanley and every other multi billion dollar institution as a member of the famed Thomson Reuters First Call. But while those people pay upwards of $2,000 a month on their live terminals, we are the anti-institution and are breaking the information asymmetry.

The precious few thematic top picks for 2017, research dossiers, and alerts are available for a limited time at an 80% discount for $19/mo. Join Us: Discover the undiscovered companies that will power technology's future.

Thanks for reading. The author is long AAPL shares.

Please read the legal disclaimers below and as always, remember, we are not making a recommendation or soliciting a sale or purchase of any security ever. We are not licensed to do so, and we wouldn't do it even if we were. We're sharing my opinions, and provide you the power to be knowledgeable to make your own decisions.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.