PREFACE

There is a powerful pattern of optimism and momentum in NVIDIA Corporation (NASDAQ:NVDA) stock right before of earnings, and we can capture that pattern by looking at returns in the option market.

If ever there was a momentum stock, Nvidia fits the bill. It's historic rise has come on the back of legitimate fundamental growth, but for now, we want to focus on momentum, and there is a fascinating pattern that has emerged.

The strategy won't work forever (it really won't), but in the last 3-years it has won 11 times and only lost once. Over the last two-years it has won 8 times and never lost. But, after we look at this trade, we have a wrinkle which has made it even better for those looking to take less risk.

We see a projected date of 8-10-2017 for Nvidia earnings, but that date is not confirmed. You can stay up to date on this news by looking to Nvidia's investor relations site.

PREMISE

The premise is simple -- one of the least recognized but most important phenomena surrounding this bull market is the amount of optimism, or upward momentum, that sets in the week before an earnings announcement. Now we can see it in NVIDIA Corporation.

The Options Optimism Trade Before Earnings in NVIDIA Corporation

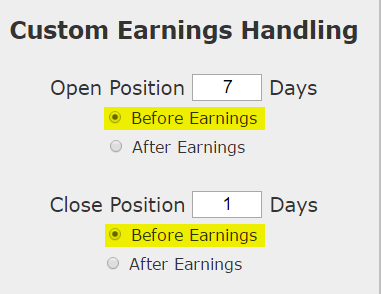

Let's look at the results of buying a monthly call option in NVIDIA Corporation 7-days before earnings and selling the call one day before the earnings announcement.

Here's the set-up in great clarity; again, note that the trade closes before earnings, so this trade does not make a bet on the earnings result.

Now, unlike many of our other set-ups, this is in fact a straight down the middle bullish bet -- this absolutely takes on directional stock risk, so let's be conscious of that before we see the results, because they are mind bending.

Here are the results over the last three-years in NVIDIA Corporation:

We see a 286% return, testing this over the last 12 earnings dates in NVIDIA Corporation. We can also see that this strategy hasn't been a winner all the time, rather it has won 11 times and lost 1 time, for a 91.7% win-rate.

Checking More Time Periods in NVIDIA Corporation

Now we can look at just the last year as well:

We're now looking at 60.1% returns, on 4 winning trades and 1 losing trade. It's worth noting again that we are only talking about one-weeks of trading for each earnings release, so this is 60.1% in just 4-weeks of total trading.

MAKING IT BETTER

Another approach here is to turn that naked long call into a call spread. The win-rates are identical, but the trade simply risks a little less. Here are the results over the last year for the 40/20 debit call spread:

For the record, it also has 11 wins and 1 loss over the last 3-years (Back-test link), just like the naked long call. Also note that this is only "less risk" if size is the same by contract.

So, owning 10 calls is more risky than owning 10 call spreads because there is less capital at risk.

WHAT HAPPENED

Bull markets have quirks, or personalities if you like.

The personality of this bull market is one that shows optimism before earnings -- irrespective of the actual earnings result. That has been a tradable phenomenon in NVIDIA Corporation.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading. The author is long shares of Nvidia at the time of this writing.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.