Written by Ophir Gottlieb

Lede

With the market's direction becoming tenuous, we can explore option trading opportunities in Apple Inc (NASDAQ:AAPL) that do not rely on stock direction. There is such an opportunity trading options right before earnings announcements in Apple Inc, and really many stocks, that benefits from stock movements in either direction but avoids the risk into the actual earnings release and is totally free of stock direction risk.

Preface

It turns out, that over the long-run, for stocks with certain tendencies like Apple Inc, there is a clever way to trade market anxiety or optimism before earnings announcements with options.

Note: Apple Inc has announced that it will release its next earnings report on August 1, 2017.

The Trade Before Earnings

What a trader wants to do is to see the results of buying an at the money straddle a few days before earnings, and then sell that straddle just before earnings.

The goal, is benefit from a unique period where over a very short time frame when the stock might move 'a lot', either due to earnings anxiety (stock drops before earnings) or earnings optimism (stock rises before earnings) but taking no actual earnings risk.

Here is the setup:

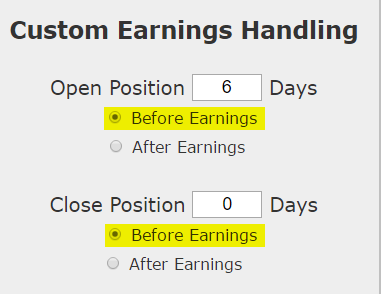

We are testing opening the position 6 days before earnings and then closing the position the day of earnings, but before the news. This is not making any earnings bet. This is not making any stock direction bet. Since Apple Inc releases earnings after the market closes, we can use the '0' days before earnings setting, otherwise we would use '1' day before earnings.

We see a 59.3% return, testing this over the last 9 earnings dates in Apple Inc. That's a total of just 54 days (6 days for each earnings date, over 9 earnings dates). That's an annualized rate of 400.8%. We note that one of the trades was break even, so it does not show up in either the win or loss column.

We can also see that this strategy hasn't been a winner all the time, rather it has won 7 times and lost 1 time, for an 87.5% win-rate, or 77.8% if we include the trade that was breakeven.

Note on Risk Reduction

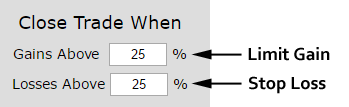

As a point of note, when we run this back-test using a limit gain of 25% and a stop loss of 25%, or in English, we close the position if it is ever up 20% in six-days or down 20% in the six-days:

WHAT HAPPENED

This is it – this is how people profit from the option market – finding trading opportunities that avoid earnings risk and work equally well during a bull or bear market.

To see how to do this, and so many other similar option trades for any stock and for any strategy with just the click of a few buttons, we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

The author is long Apple Inc (NASDAQ:AAPL) stock as of this writing.