Date Published: 2017-06-29

PREFACE

There is an advanced option trade in Amazon.com Inc (NASDAQ:AMZN) before earnings that takes no stock direction risk, no earnings risk, and reduces even the volatility risk. The strategy has won more than 50% of the time, has returned 460% annualized returns, but has also shown a high win-rate of 75%.

This is it -- this is how people profit from the option market. Identifying strategies that don't rely on a bull or bear market.

TRADE TIMING

This is for the advanced option trader, just note that this has a few steps to it. First we start with the timing:

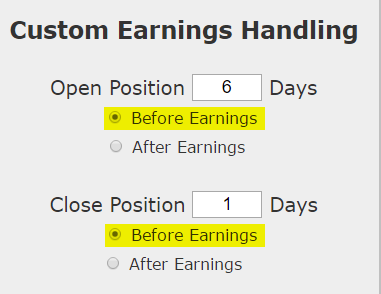

We want to look at a very short window, specifically opening a trade six-days before an earnings announcement and closing it the day before. Here it is plainly:

So, to be clear -- this trade does not take on the risk of earnings, it closes before earnings.

TRADE SET-UP

With the timing set, we now construct the trade in with these rules:

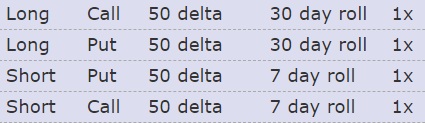

* Buy the at-the-money straddle with a 30-day expiration (or closest to it)

* Sell an at-the-money straddle with a 7-day expiration (or closest to it)

* Both of these straddles have expirations after earnings.

Here's how this looks, plainly:

And here is the reasoning behind the trade, before we get to the results:

TRADE REASONING AND RESULTS

The idea is to own the straddle with a longer expiration and sell the straddle with the closer expiration to benefit from the time decay in the shorter-term options. It's a fine cut to make this work, but this trade does not take earnings risk, does not take stock direction risk and takes very little volatility risk.

While the set-up took a while to describe, the results are easy. We see a 90.8% return over the last , which was 12 earnings cycles. This option trade won 9 times and lost 3 times.

Even further, each period of this trade is just six-days, so that 90.8% return is actually just 12 weeks of trading, and if we annualize that, it makes for a 460% return.

Checking More Time Periods in Amazon.com Inc

We're now looking at 28.3% returns, on 4 winning trades and 0 losing trades. It's worth noting again that we are only talking about six-days of trading for each earnings release, so this is 28.3% in just 4-weeks of total trading which annualizes to 430%.

WHAT HAPPENED

For the expert option trader, or the option trader that wants to take the next step in the evolution of trading, this is it. This is how people profit from the option market.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.