Some of the biggest marijuana stocks in the U.S. have seen 1,000 percent gains over the past couple of years, and now it is Canada’s turn — where no one’s even looking.

Here, the minting of millionaires is going to be huge. Not only is medical marijuana already legalized across the country, but the Canadian government is preparing to introduce legislation in April 2017, fully legalizing the recreational use of cannabis by July 1st 2018.

Canadian small-cap Invictus MD (TSX:IMH.V; OTC:IVITF)—the FIRST licensed medical marijuana company to pay a dividend to shareholders—is set to make huge additional gains.

Here’s why:

- Legal cannabis is sweeping the nation

- The cannabis market is BIGGER than the combined sales of beer, wine and spirits.

- Canadian cannabis stocks won’t be cheap for long

- Canada’s first Marijuana ETF will soon launch... bringing even more attention to the sector

And there’s no province-by-province uncertainty in Canada—medical marijuana is federally legal, and in mid-April, the government is planning to put through its bill to legalize recreational use by next summer, so the urgency for investors is mounting.

You need to prepare now... before this happens.

It’s an industry Deloitte estimates could be worth $22.6 billion annually—again, this is far more than the combined sales of beer, wine and spirits.

Right out of the gate, Invictus MD, one of only 41 licensed producers, has demonstrated that it will lead the way. The company managed to raise CAD$12 million in only 6 hours in its latest offering, meaning it is cashed up and already generates dividends for shareholders.

Here are 5 Reasons to keep a close eye on Invictus MD (TSX:IMH.V; OTC:IVITF)—‘Canada’s Cannabis Company’:

#1 Nothing Beats Marijuana Stocks Right Now

Nothing moves a product out of the dustbin like legalization—and even better when it’s federal. Marijuana stocks have skyrocketed over the past year, with the seven largest ‘green giants’ soaring on the philosophy of a brand new world.

The shares of the medical marijuana producers more than tripled last year.

- AXIM Biotechnologies (NASDAQOTH:AXIM): exploded 1,720 percent

- Corbus Pharmaceuticals (NASDAQ:CRBP) was up 431 percent

- Aphria (NASDAQOTH:APHQF) grew 381 percent

- Aurora Cannabis (NASDAQOTH:ACBFF) was up 299 percent

- Canopy Growth Corp. (NASDAQOTH:TWMJF) up 259 percent

- Medical Marijuana (NASDAQOTH:MJNA) up 254 percent

- GW Pharmaceuticals (NASDAQ:GWPH) was up 64 percent

The smart money is investing too. Tribeca Investment Partners, a boutique fund manager, used bets on marijuana companies to help generate a 145 percent return over the year, according to Fortune magazine and Bloomberg. Nearly US$20 million of its investment gains in 2016 came from marijuana stocks, including Aurora Cannabis and Canopy Growth.

Things are about to explode even further with the launch of the first marijuana exchange-traded fund (ETF) in Canada, giving diverse exposure to this tantalizing sector. The Horizons Medical Marijuana Life Sciences ETF (TSX:HMMJ) will launch on the 4th of April on the Toronto Stock Exchange with 11 Canadian-listed stocks and four U.S.-listed stocks.

The frenzy surrounding Canada’s marijuana market is palpable, and will be even more frenzied with the looming recreational legalization bill.

This puts Invictus, which already has a license to produce, directly on the front line of a multi-billion-dollar market that promises massive new demand and very tight supply.

#2 The Right Acquisitions at the Right Time

Invictus MD (TSX:IMH.V; OTC:IVITF)—has an impressive head start on a market set to explode, with multiple projects in its Canadian investment pipeline. And it’s all about acquisitions.

The company’s dream team targets small- and mid-size companies with significant growth potential and directs their strategies towards profitability.

Recently, they’ve made some game-changing acquisitions at just the right time on the Canadian marijuana market: In total, these acquisitions were negotiated at a combined CAD$52 million, which is far less than the valuation of Invictus MD peers. In short; They are “cornering” the market at a low entry point.

The company owns over 33 percent in AB Laboratories Inc., which received its cultivation license last October. The catalysts here are mounting, with the sales license expected in Q2. This facility is already licensed for 100 kilograms and has a capacity for 1,000 kilograms, with active expansion plans underway.

Invictus MD is also in the process of closing its acquisition of 100 acres with AB Ventures Inc., and is targeting production here of 25,000 kilograms by 2020.

In Alberta, Acreage Pharms received its license to cultivate under ACMPR and has a purpose built 7,000 square foot facility and a 30,000 square foot expansion plan with an option to add a 20,000 square foot mezzanine. Invictus MD will own 100 percent of this project within 30 days of March 29, 2017.

It’s a brilliant set-up for a small-cap company with CAD$15.5 million in cash and 38 million basic outstanding shares.

#3 This is a Shareholder’s Dream

Invictus MD (TSX:IMH.V; OTC:IVITF)—made history right around Christmas by becoming, to our knowledge, the first marijuana producer in history to pay its shareholders a dividend. Why? Because “it made sense to give back to our shareholders who supported us”, according to Chairman and CEO Dan Kriznic.

It’s also why Kriznic himself has been rated one of Business in Vancouver’s ‘Top 40 under 40’.

The combination of smart and well-known management and the frenzy in Canada over marijuana has helped Invictus MD secure nearly CAD$30 million in the last four months. The first raise was CAD$12 million at $1.05, and the second was $16.2 million at $1.65.

Right now the company has a funded production capacity of about 10,000 kilograms which, compared to its peers, suggests Invictus MD is significantly undervalued.

Let’s put it another way: Invictus MD’s market cap to funded capacity is about 5 times the industry standard.

Prior to October, when it entered the license producer market, Invictus MD was busy acquiring all the ‘picks and shovels’ of the cannabis space. Invictus MD has made one smart move after another, and it’s always the ‘pick and shovel’ guys who have real longevity. First they acquired a fertilizer company that was cash-flow positive, and then they sold one of its lighting divisions for $5 million, having paid only $900,000 for it less than a year before. That’s how they managed their first shareholder dividend.

They’ve been nurturing their shareholders along with their crops. Invictus MD’s focus on two verticals—cannabis cultivation and cannabis fertilizer and nutrients—gives it a competitive, low-cost advantage on this playing field.

Now they’ve got prime real estate to add to their portfolio, and this is one cash crop that’s going to keep growing.

#4 Savvy Management on the Market Fast Track

Invictus MD is on the fast track to the market, with many strains already approved by the Canadian health authorities.

And these strains reach in to every market. Those include high THC strains used to help with pain management and cancer, and high-CBD strains used for epilepsy and anxiety disorders. And when it comes to recreational—the company is gearing up to work on all strains available.

This combined with its tight capitalization structure and access to capital make this a prime breakout target over the coming weeks and months.

They’re also not new to this game. Invictus MD isn’t just jumping on the green train at the 11th hour; it has been laying the ground work for a very smart expansion strategy.

Kriznic has turned $10-million companies into $150-million annual revenue generators. They’ve got a license to grow in more ways than one, and while they might not be a ‘green giant’ just yet, their undervaluation suggests they could be.

#5 Massive Demand, Unleashed

The fundamentals are clear—demand is set to further explode once recreational use of cannabis becomes legal.

Where does this leave us with supply? Playing some serious catch-up, which is a producer’s dream. In Canada, legalizing recreational marijuana could result in demand of about 400,000 kilograms of cannabis in its first full year, according to Canaccord Genuity analysts. And that’s just for recreational use. Demand for medical cannabis is also growing at a significant pace, and the total combined demand for the first year could be 575,000 kilograms.

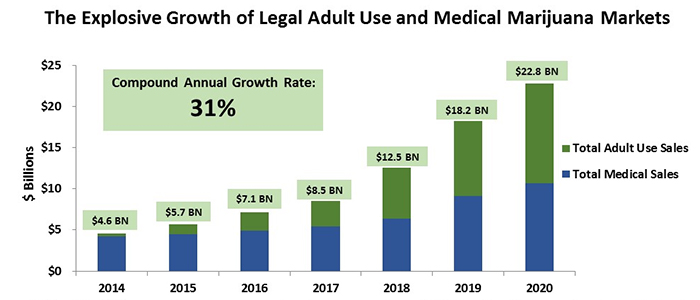

Source: New Frontier Data

Arcview Market Research of San-Francisco predicts that legal marijuana sales will reach close to $22 billion by 2021—up from nearly $7 billion last year. That’s an annual growth rate of 26 percent, and it’s in line with Deloitte’s own estimations. But while U.S. producers are facing a time of uncertainty thanks to Trump rumblings against legalization, in Canada, stocks are soaring and the future looks golden.

In Canada alone, Canaccord Genuity predicts that the recreational marijuana industry could reach $6 billion in sales by 2021.

Legalization is coming, and marijuana stocks are set to explode even further—and stay there. This market will reach its tipping point in the summer of 2018, but by then, Invictus MD (TSX:IMH.V; OTC:IVITF)—will already be solidly among the green giants.

Legal Disclaimer/Disclosure: This piece is an advertorial and has been paid for. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Baystreet.ca only and are subject to change without notice. Baystreet.ca assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.