PREFACE

Two seemingly contradictory phenomena are equally true for International Business Machines Corp (NYSE:IBM) stock, and together they have created a wonderful option trading result for years.

STORY

Selling out of the money puts is an option investment that has a very clear belief system: The underlying stock simply will not go down a large amount. If that reality exists, the returns can be substantially larger than simply owning the stock. In this case, a low volatility stock, like IBM, can represent opportunity -- that's one phenomenon -- but the other appears contradictory.

This is a two-year stock chart for IBM, with the blue "E" icons denoting an earnings event.

We have highlighted several occasions where IBM stock has not done well off of earnings releases -- often times showing abrupt moves down from the reports. This is the second phenomenon. If we take all of this together, here is how selling out of the money spreads in IBM every month has done over the last 2-years.

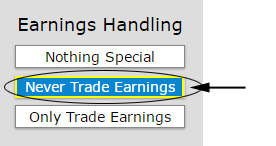

While the stock itself has been up 15%, selling the put spreads has actually been a loser. But, remember those two phenomena we discovered -- IBM could be a wonderful trading vehicle for options, if we could eliminate the risk of earnings. Here's how test that idea with the tap of the mouse:

And here are the staggering results:

Yep, we have seen a 8% loser turn into a 145% winner by simply avoiding earnings. That 145% return compares to 15% for the stock, or nearly a 10x return. We have accepted the two phenomena surrounding IBM, (i) it has been a relatively low volatility stock and (ii) the first phenomenon is true only when we remove the risk of earnings.

IT WORKS CONSISTENTLY

What we need to do now is look at this short put over various time periods. We see that it has worked over the last two-years, now let's look at the last year:

A 45% return has been increased to 109%, and the second approach takes less risk by avoiding earnings.

The results aren't a magic bullet -- it's just access to objective data.

For completeness, here is the side-by-side comparison over six-months:

What Just Happened

This is how people profit from the option market - it's preparation, not luck. To see how to do this for any stock or ETF and for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.