Written by Ophir Gottlieb

PREFACE

We noted NVIDIA Corporation at $19 a year and a half ago and added it to Top Picks for $32. The company remains a Spotlight Top Pick, but the stock has hit a wall. Once hitting $120, the stock has dropped to $100, including a $10 drop yesterday on a number of analyst downgrades.

The question now becomes, "what do we do with Nvidia, now?"

STORY

Friends, let's take a step back here. NVIDIA Corporation (NASDAQ:NVDA) isn't going anywhere. In fact, as the CEO said in the latest earnings call, it is the fastest growing technology company in the world. But there's more to that statement -- a lot more.

First, when we talk about growth here, sometimes we reflect upon companies where growth is coming while earnings are forsaken. That is not the case at all with Nvidia. Check these numbers and charts out.

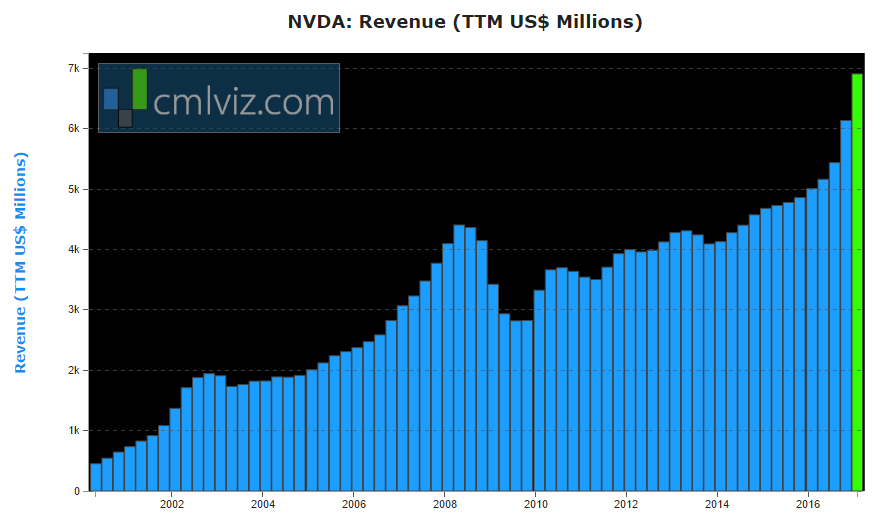

First we look at revenue (TTM):

NVIDIA Corporation has hit $6.9 billion in revenue, up 38% year-over-year. But, this gets much bigger. These are numbers for the last quarter, compared the same quarter one year ago:

* Gaming revenue was $1.35 billion up from $810 million for 66% growth.

* Data center revenue was $296 million up from $97 million for 205% growth.

* Automotive revenue was $128 million up from $93 million for 38% growth.

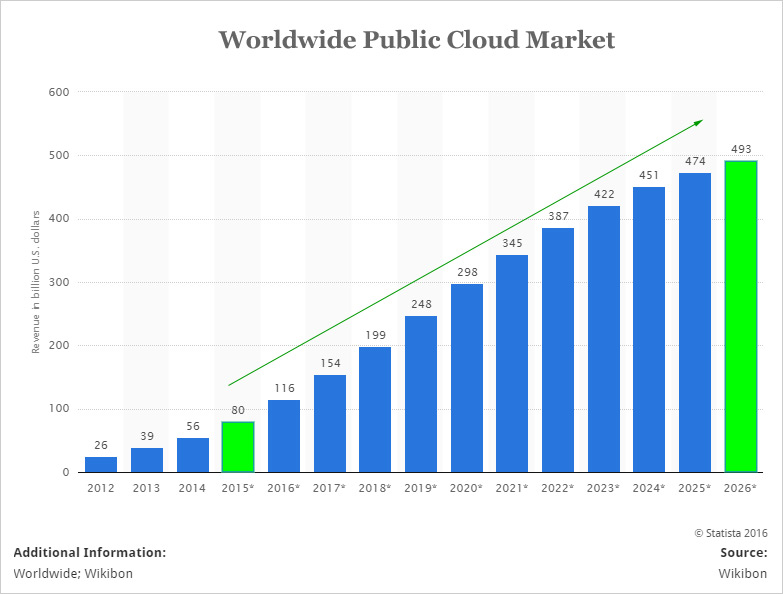

Friends, the data center revenue isn't even in the first inning, to use a baseball analogy, or, it's the preface to a book, not even in chapter one, yet. Here is how the public cloud computing platform world looks:

The worldwide cloud market is pegged to grow from $154 billion in 2017 to $493 billion by 2026. That's 220% on its own. But, for Nvidia, that's nowhere near the realm of reality. Right now, still, 99% of servers in the cloud are powered by the Intel Xenon processor.

But those chips are too slow to handle any kind of highly sophisticated multi-thread processes, which go well beyond just machine learning. Remember, the sheer size of the world of data is going to grow so much that charts don't actually help. We have to put it in words, so try this:

In 2012 the Library of Congress estimated that all printed, audio, and video material came in at 3 to 20 petabytes. That means that one exabyte could hold a hundred thousand times the printed, audio and video material, or 500 to 3000 times all content of the Library of Congress.

By 2021, global traffic alone will generate 49 exabytes... per month.

That means that data that is the size of 14,700,000% of all the printed, audio and video material of all-time will be generated in a month on just mobile devices.

That data is too large to move around on the current technology -- both chips and actual metal (see our Top Pick on optics). But, the Nvidia GPUs do have the speed to handle that data, and the world is starting to catch on.

Sure, we see 205% year-over-year growth in data center revenue, so that's one part of the circumstantial evidence. But now Amazon and Microsoft, the two largest cloud players, openly offer Nvidia GPU powered machines to their clients, and the conversion so barely (barely) at the beginning.

In just the last quarter, Nvidia announced:

* Collaborated with Microsoft to accelerate AI with a GPU-accelerated Microsoft Cognitive Toolkit available on the Microsoft Azure cloud and NVIDIA DGX-1™.

* Partnered with the National Cancer Institute and the U.S. Department of Energy to build CANDLE, an AI framework that will advance cancer research.

* Unveiled the NVIDIA DGX SATURNV AI supercomputer, powered by 124 Pascal-powered DGX-1 server nodes, which is the world's most efficient supercomputer.

This $830 million business for Nvidia in the last year has the potential to grow to a $3B opportunity should it grow to 30%-40% of the $10B server chip market and that is for machine learning, alone.

Even biotech is pushing forward for greater reliance on accelerated computing and deep learning. It's everywhere - in everything we see the future becoming. Here's what the CEO said in the last earnings call:

There's several elements of our Datacenter business. There's the high performance computing part. There's the AI part. There's GRID, which is graphics virtualization.

There's cloud computing, which is providing our GPU platform up in the cloud for startups and enterprises and all kinds of external customers to be able to access in the cloud, as well as a brand new AI supercomputing appliance that we created last year for anybody who would like to engage deep learning and AI, but don't have the skills or don't have the resources or don't have the desire to build their own high performance computing cluster.

And back to automotive, and that $128 million and 38% growth. That's actually small because the smart car revolution is just now beginning. If you want to know which chip is powering Tesla -- its Nvidia.

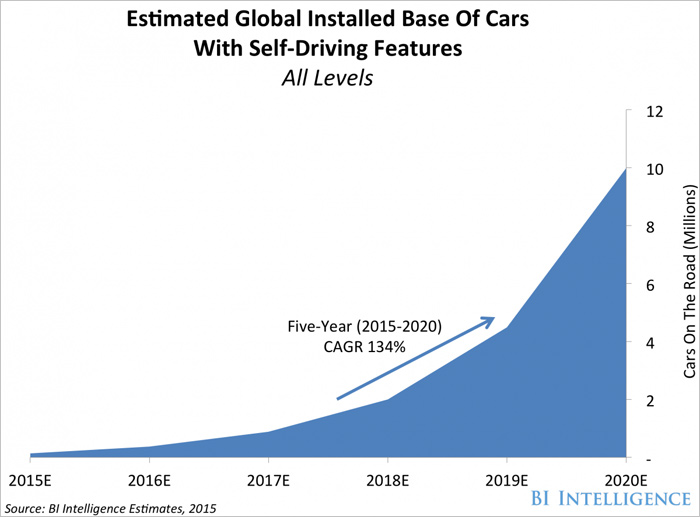

Here is the growth in the self-driving featured automobile that is forecast:

That's 134% compounded annual growth for the next five years and as you well know, we believe that number is too low. In fact, just in the last quarter Nvidia:

* Partnered with Audi, to put advanced AI cars on the road by 2020.

* Partnered with Mercedes-Benz, to bring a NVIDIA AI-powered car to the market.

* Partnered with Bosch, the world's largest automotive supplier, to bring self-driving systems to production vehicles

* Partnered with Germany's ZF, to create a self-driving system for cars, trucks and commercial vehicles based on the NVIDIA DRIVE™ PX 2 AI car computer.

* Partnered with Europe's HERE, to develop HERE HD Live Map into a real-time, high-definition mapping solution for autonomous vehicles.

* Partnered with Japan's ZENRIN, to develop a cloud-to-car HD map solution for self-driving cars.

Barron's notes that the firm provides processors to more than 50 automakers working toward driver-less cars.

This is my take on self-driving cars, when I was interviewed on CBC:

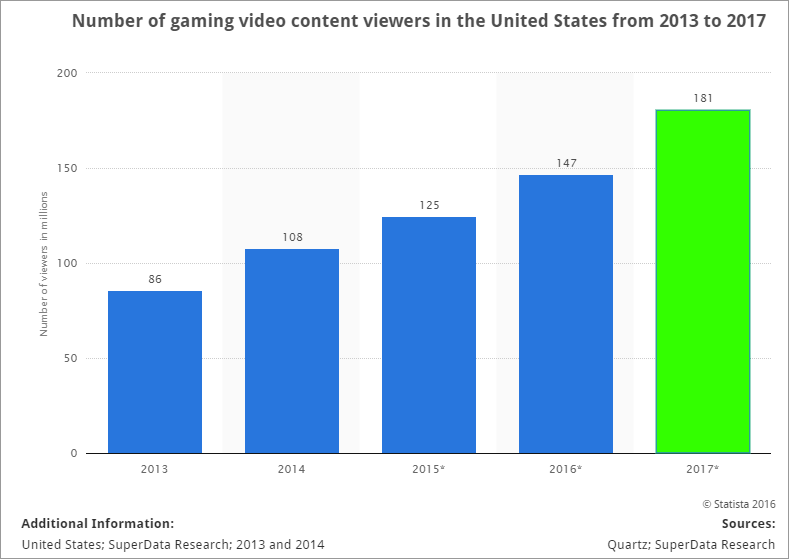

Then there's gaming, which is Nvidia's core business right now. Here is the growth, just in the United States, of video game viewers:

And Nvidia recently announced it's own cloud based service for gamers -- allowing players that can't afford a full Nvidia rig to "rent time" on the cloud to play games.

While there are claims of competition from AMD, of course there are. Nvidia is leading every single bit of every single revolutionary technology that is coming. Yes, competition is going to come in -- it has to. But AMD lost out to NVDA with Tesla, and, in all frankness, AMD has always been a loser.

It got crushed by Intel when it first came into existence and attempted to compete with its CPUs. Nvidia facing competition is hardly the story here -- everything else we just discussed is the story.

But there's actually more...

NVIDIA Corporation GPUs will power augmented and virtual reality. Remember, AR was just called out, yet again, by Apple CEO Tim Cook and how he believes that is Apple's "next big thing."

Virtual and augmented reality are just beginning. In fact, while VR often takes all the headlines, Digi-Capital released research that read (emphasis added):

The AR market could grow from nearly nothing today to $90 billion by 2020. Nearly half that revenue is expected to come from sales of AR hardware, while the remainder could come from retail, enterprise, and gaming uses.

And then there's artificial intelligence, also powered by Nvidia's GPUs:

[T]he rise of AI will lead to cost reduction and new forms of growth that could amount to $14-$33 trillion annually.

Friends, that's $14 – $33 trillion per year.

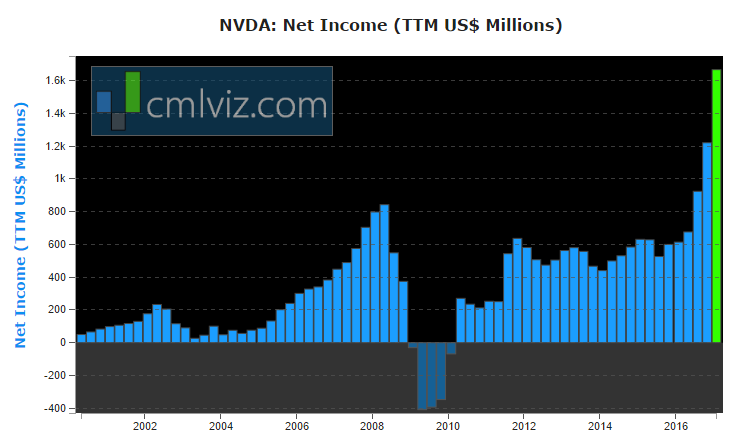

And now we can turn to actual earnings:

Nvidia's net income, also known as after tax profit, was $1.67 billion in the last year, up 171% year-over-year. For perspective, Amazon's net income over the last year was $2.4 billion.

MORE

Here are some more facts for you to consider, whichever direction you go with Nvidia. This is last quarter's earnings results highlights:

* Growth was driven primarily by Datacenter tripling with a rapid adoption of AI worldwide.

* AI is transforming industries worldwide. The first adopters were hyperscale companies like Microsoft, Facebook and Google, which use deep learning to provide billions to customers with AI services that utilizes image recognition and voice processing.

The next area of growth will occur as enterprise in such fields as health care, retail, transportation and finance embrace deep learning on GPUs.

* Microsoft announced that its GPU-accelerated Microsoft Cognitive Toolkit is available both in Azure cloud and on premises with our DGX-1 AI supercomputer

* Growth for the quarter and fiscal year was broad based with record revenue in each of our four platforms, Gaming, Professional Visualization, Datacenter and Automotive.

* Q4 Gaming revenue was a record $1.35 billion, rising 66% year-on-year and up 8% from Q3

* GRID, graphics, virtualization business doubled year-on-year, driven by strong growth in the education, automotive, and energy sectors.

* With NVIDIAs powering the market's only self-driving cars and partnerships with leading automakers, Tier 1 suppliers, and mapping companies, we feel very confident in our position as the transportation industry moves to autonomous vehicles.

* Gross margins were at record levels.

* GAAP operating income was $733 million, and non-GAAP operating income was $809 million, both more than doubled from a year earlier.

* We expect revenue to be $1.9 billion, plus or minus 2%. At the mid-point, this represents 46% growth over the prior year.

SIZE

We don't know what the future holds exactly for Nvidia. We do know the company has a current market cap of $53 billion. We believe if it executes properly on its potential, this will be a mega cap technology company. It will take years, not weeks, but Nvidia sitting with a $150 billion market cap does not seem out of the realm of possibility.

WHAT ABOUT THE STOCK PRICE?

So what about the stock price right now? We certainly don't know about the next week, or even year. The entire market could take a bath. But our perspective is 3-10 years, not 3-10 months. And in that vein, we remain bullish on Nvidia, and re-iterate our Spotlight Top Pick Status.

The author is long shares of NVIDIA Corporation (NASDAQ:NVDA).

WHY THIS MATTERS

If the kind of research we touched on with Nvidia interests you then what we offer may be up your alley: Our research sits side-by-side with Goldman Sachs, Morgan Stanley, Barclays, JP Morgan, and the rest on professional terminals as a part of the famed Thomson First Call group. We do this research several times a week and we also have a list of spotlight companies.

Each company in our 'Top Picks' portfolio is the winner in an exploding thematic shift like self-driving cars, mobile data and connectivity, health care tech, artificial intelligence, Internet of Things, drones, biotech and more. For a limited time we are offering CML Pro for $19/mo. with a lifetime guaranteed rate. Get the most advanced premium research along with access to visual tools and data that until now has only been made available to the top 1%.