It’s no secret that skin and hair care are booming industries. Combine these high-growth products with a proven direct-response marketing approach, and you’ve got a recipe for success.

Take the Proactiv skin care line of acne products. Proactiv is reported to have done almost $900 million in sales in 2014 and over $1 billion in 2015. Privately held Guthy-Renker reportedly mulled a sale of the product line for over $2 billion earlier in 2016, before instead partnering with mega-nutrient company Nestle this past March.

Guthy-Renker has turned this dermatologist-created brand into a household name in the last decade. But remarkably, Proactiv comes from humble beginnings. Created quite literally in the kitchen of Katie Rodan and Kathy Fields, two dermatologists with an entrepreneurial streak, the two formulated the product in their spare time in the ‘90s. In the 20 years since, the product has garnered multi-million dollar success. Rodan and Fields launched a separate skin care business in 2000 under the same name (Rodan + Fields), which is reported to have grown from $24 million in sales in 2010 to $627 million in 2015 — 2400% growth in 5 years.

Most impressive, Proactiv has been so successful by relying on — and almost solely because of — a focus on direct-response marketing: infomercials and internet advertising. It goes far beyond the traditional brand awareness marketing harnessed by giants like Coca-Cola (NYSE:KO) or Apple (NASDAQ:AAPL).

Needless to say, skin care is a tremendous consumer segment, especially with the right marketing mix. Two small-cap hair and skin care companies that are making waves in recent years are PhotoMedex (NASDAQ:PHMD) and ImmuDyne (OTCQB:IMMD).

Direct marketing is exactly how Photomedex (PHMD) grew its consumer products business, led by the No!no! Hair Removal System, into a $200 million-per-year business at its peak. The company sold more than 5 million of the devices during its hay day. PHMD’s performance — quadrupling in the three years after it started marketing No!no! — is evidence that skin care is the place to be — and that sales ramp fast.

But the company made some critical mistakes by over-leveraging, and it has been forced to parlay off products just to meet its debt obligations. What went wrong? Reliance on a single consumer product line, an overly-aggressive approach to acquiring new assets, and an inability to pivot from television infomercials to the expanding world of online advertising.

ImmuDyne is clearly learning from the failures of its peers.

At the end of 2015, ImmuDyne co-developed the Inate MD line of skin care products, which are based primarily on yeast beta-glucan ingredients manufactured and provided by ImmuDyne. ImmuDyne’s business has, for years, been built on selling beta-glucan commercially, and the pivot to a consumer product has big implications for investors.

Investors who understand what a consumer line can do to ImmuDyne’s sales (much like the wildly successful ProActive) are starting to perk up as the launch trajectory rolls in.

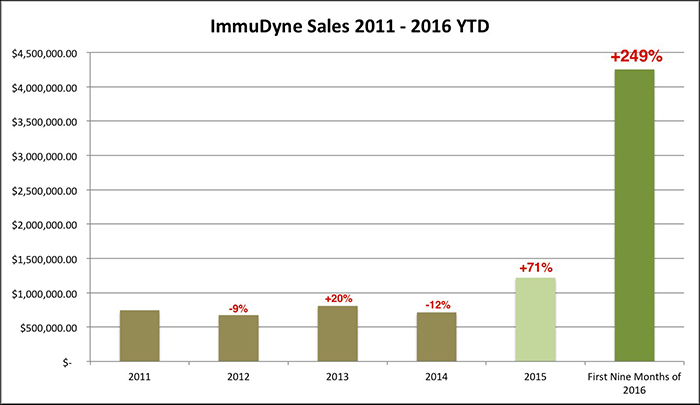

In the first three quarters of 2016, ImmuDyne’s sales are up a massive 240% over the entirety of 2015, on track for growth of 300% year-over-year. And that’s missing an entire quarter!

With a history of lean operations under the leadership of Mark McLaughlin (just $330K in G&A last year) and an already churning marketing machine, ImmuDyne’s Inate MD skincare line is growing enviously. But the company is quickly taking steps to diversify its consumer business.

ImmuDyne isn’t relying on a single product line to continue this growth. In September, the company picked up exclusive, worldwide rights to the patented PilarisMax line of hair loss products, which they began marketing in November. Just like the Inate skincare line, that means Q1 of 2017 will be the first three full months of sales for this revolutionary hair product.

In the first quarter of 2016, Inate’s first three full months at ImmuDyne, revenue grew 400% compared to the prior year period. It only took one quarter for the Inate line to begin ballooning the company’s revenue. If that’s any sign, IMMD is absolutely a stock to watch into 2017 as the PilarisMax line starts to sell.

PHMD saw a 240% surge in its stock price after breaking out from a one-year period of consolidation. IMMD has likewise been range-bound for 12 months. With sales moving in the right direction, and the bottom line following along, investors won’t want to be left behind when the breakout occurs.

About One Equity Stocks

One Equity Stocks is a leading provider of research on publicly traded emerging growth companies. Our team is comprised of sophisticated financial professionals that strive to find the companies and management teams that will outperform the market and deliver investment returns to our subscribers. We are not a licensed broker dealer and do not publish investment advice and remind readers that investing involves considerable risk. One Equity Stocks encourages all readers to carefully review the SEC filings of any issuers we cover and consult with an investment professional before making any investment decisions. One Equity Stocks is a for profit business and is usually compensated for coverage of issuers. In the case of Immudyne, we have not been compensated but anticipates being compensated 250,000 shares of common stock in the near future in return for advisory, marketing and business development services. Several of our partners and affiliates are long IMMD and to the best of our knowledge none of them have any intention of selling stock in the next 6 months. The owner of One Equity stocks is long IMMD.