Written by Ophir Gottlieb

PREFACE: Apple Inc (NASDAQ:AAPL) Earnings Vol

It's one of the great questions in option trading -- whether to buy or sell options during an earnings release. It appears there may be systematic mis-pricing in Apple Inc's volatility. Let's take a look.

We have been in a historically low volatility environment for several years and with that we have seen implied vols come down as well. Let's turn to Apple Inc, and see what owning options has meant during earnings releases.

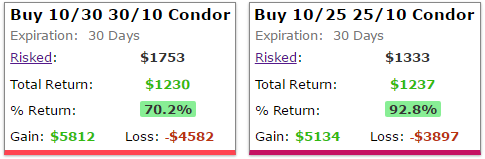

We test a three-year strategy of owning out of the money iron condors in Apple Inc but only held during earnings. Here are the results:

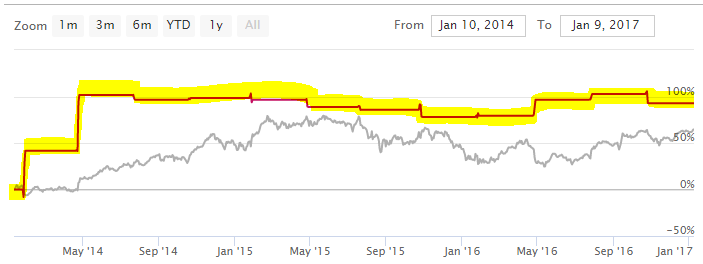

And for context, here is the return of that strategy versus the stock itself:

Those are staggeringly high results considering that option strategy had a total holding period of just a few weeks. The results are large enough that we need to dig deeper into what's going on.

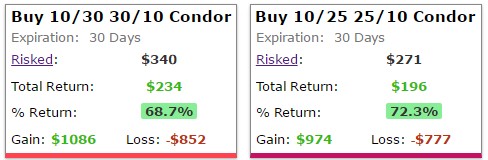

Let's look at this same strategy, but use no special trading rules. That is, we will look at 3-years of owning monthly out of the money condors for Apple, including earnings and all other times well:

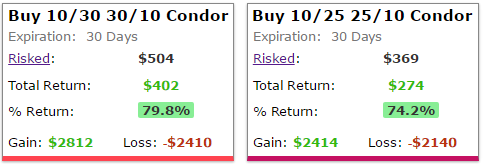

Now we can see that generally owning vol in Apple Inc (NASDAQ:AAPL) has been a loser. This is the phenomenon we discussed at the top -- historically low volatility for several years. Before we get too excited about owning earnings vol in Apple (which is very risky even though it is long options), let's look at the results of that strategy over just the last year:

So we can see some consistency here. Owning the earnings vol in Apple over three-years or just one-year has been a big winner, albeit very risky. And, just to add a little more fuel to this argument, we can also look at an one-year back-test of owning out of the money condors in Apple over the last-year during all periods -- i.e. not just earnings:

So, we have come to a thesis, or at least a standing hypothesis: The depressed implied volatility pricing in Apple options appears to be a slight mis-pricing. While the market has been in a malaise, Apple Inc (NASDAQ:AAPL) appears to be coming out of it and the option market may not have figured it out yet.

Owning the out of the money condors in Apple during earnings has been a winner for one-year and three-years, and even just owning those same condors at all times (rolling every 30-days) over the last year has been a winner.

This is what a vol discrepancy looks like and it takes a nice tool to identify it. So let's go even further, and talk more generally.

There's actually a lot less 'luck' and a lot more planning in successful option trading than many people know. But it's not about trying to guess which stocks will go up or down.

What the back-tester allows us to do is find calm, low-stress stocks and ETFs and then identify the option strategies that have created a high percentage of winning trades, gaining profitability slowly, while managing earnings.

Here is a quick 5-minute demonstration video of CMLviz Trade Machine Option Back-tester which includes some hidden winners. Tap Here for the Video

Thanks for reading, friends. The author is long shares of Apple Inc (NASDAQ:AAPL).

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.