Written by Ophir Gottlieb

PREFACE

There is an option strategy that has worked very well for Ambarella Inc (NASDAQ:AMBA) over the last two years, but it's not about guessing stock direction. In fact, there's actually a lot less 'luck' and a lot more planning in successful option trading than many people know.

Ambarella Inc is a small cap technology company making waves with its video chipsets which act as "the eyes" to several breaking technology trends like drones, video surveillance, self-driving car systems and action cameras. The stock has been quite volatile.

But, here's a look at how an option trading strategy that would normally be quite risky, but when controlling for the risk of earnings, has done well over the last two-years while reducing risk exposure at the same time.

STORY

Selling puts is one of many option trading strategies that can be employed to take advantage of a bull market. But, for Ambarella Inc, it has been a risky endeavor if employed during earnings releases. Here's how we can see it explicitly with the CMLviz.com option back-tester Trade Machine.

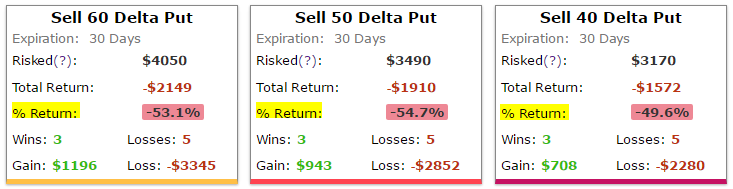

After the set up, we get these results. Again, we're just looking at trading the dates surrounding earnings releases.

Source: CMLviz Option Back-tester

The image above summarizes a back-test:

* Sell Puts

* Only during earnings

* Trade every 30-days

* Test the strategy for two-years

Selling puts has generally been a loser when used on Ambarella Inc (NASDAQ:AMBA) when held during earnings while also putting on a lot of risk. But the real analysis we want to examine is how well this strategy would have done if we eliminated that risk of earnings. That is to say, if we sold puts every 30-days in Ambarella, but every time earnings approached, we closed the strategy (held no position), then started the strategy again after the volatility of earnings had ended. Here are the results:

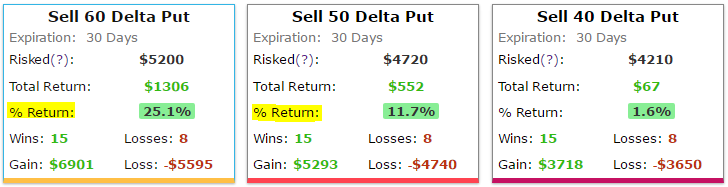

Source: CMLviz Option Back-tester

All of a sudden, the short put strategy turned out quite well and far outperformed the stock too. In this case we find a nice result -- a profitable option strategy that removes the risk of earnings and delivers strong results even in a stock that has under-performed and faced a volatile past.

Here's the best part, we can identify this approach in less than two-minutes for Ambarella Inc (NASDAQ:AMBA), we can check out this quick video:

WHY THIS MATTERS

Returning to the idea of back-testing again, there's actually a lot less 'luck' and a lot more planning in successful option trading than many people know.

But it's not about trying to guess which stocks will go up or down.

What the back-tester allows us to do is find calm, low stress stocks or ETFs (like SPY, QQQ, etc), and find the option strategies that have created a high percentage of winning trades, gaining profitability slowly, while avoiding unnecessary risks - specifically, avoiding earnings.

In a six minute video, your entire view of the options world and what "successful trading", or "experts" mean will be turned upside down - to your advantage.

Tap here to see the CML Pro option back-tester.

Thanks for reading, friends.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.