Written by Ophir Gottlieb

PREFACE

There is an option strategy that has worked very well for QUALCOMM Inc.(NASDAQ:QCOM) over the last two years, but it's not about guessing stock direction.

QUALCOMM Inc.(NASDAQ:QCOM) is the large cap marvel that has found its way into almost every smartphone in the world. But, the stock has stagnated over the last two-years as has revenue and earnings. But, one bullish options trading strategy has a fascinating result. Here's a look at how an option trading strategy that would normally be quite risky can be applied with less risk but still strong results.

STORY

Selling puts is one of many option trading strategies that can be employed to take advantage of a bull market. For QUALCOMM Inc (NASDAQ:QCOM), it has been a risky and treacherous trade if employed during earnings releases. Staggering losses would have accumulated. Here's how we can see it explicitly with the CMLviz.com option back-tester Trade Machine.

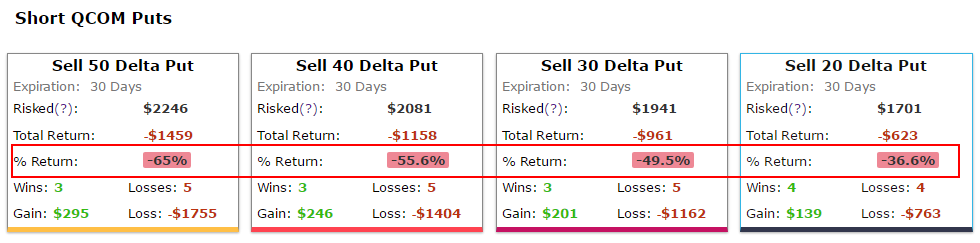

After the set up, we get these results. Again, we're just looking at trading the dates surrounding earnings releases.

The image above summarizes a back-test:

* Sell Puts

* Only during earnings

* Trade every 30-days

* Test the strategy for two-years

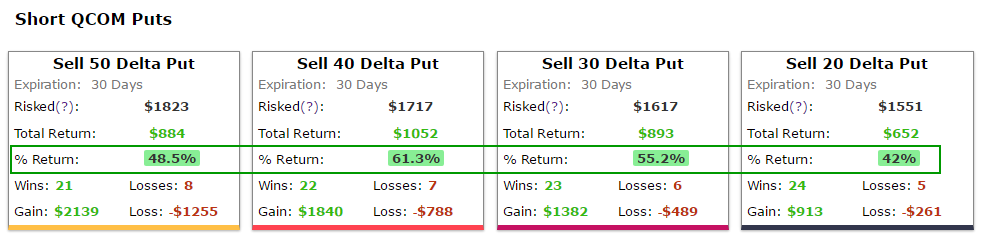

Selling puts has been a big loser when used on QUALCOMM Inc (NASDAQ:QCOM), especially when held during earnings. But the real analysis we want to examine is how well this strategy would have done if we eliminated that rather large risk of earnings. That is to say, if we sold puts every 30-days in QUALCOMM, but every time earnings approached, we closed the strategy (held no position), then started the strategy again after the volatility of earnings had ended. Here are the results:

Source: CMLviz Option Back-tester

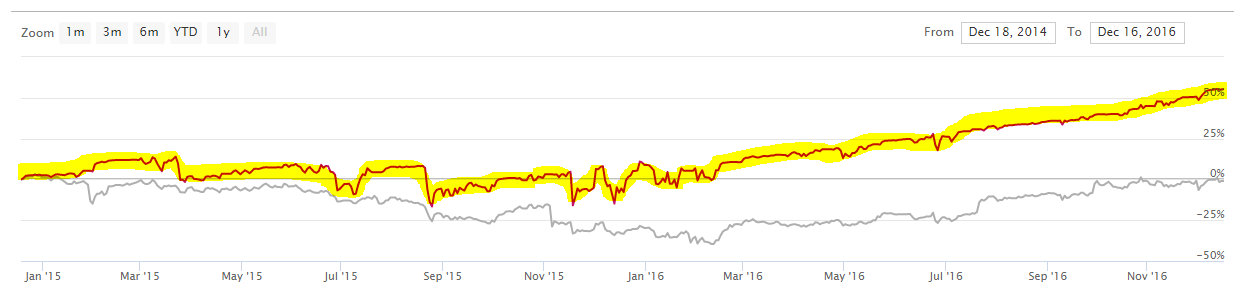

All of a sudden, the short put strategy turned out very well and far outperformed the stock too. Here is the option strategy in pink and the stock price in gray.

In this case we find a nice result -- a profitable option strategy that removes the risk of earnings and delivers strong results. Now, option back-testing is not about trying to guess which stocks will go up or down. It's not about guessing if Nvidia or Amazon are going to rise 100% again. It's actually the opposite.

It's about finding calm, low stress stocks like QUALCOMM Inc (NASDAQ:QCOM), and finding the strategies that created a high percentage of winning trades, gaining profitability slowly, while avoiding unnecessary risks.

For a full review of this process in just two minutes for QUALCOMM Inc (NASDAQ:QCOM), we can check out this quick video:

WHY THIS MATTERS

There's a lot less 'luck' and a lot more planning in successful option trading than many people know. You see, the top 0.1% are keenly aware of the how their option strategies performed in the market before placing a single trade. But it's not about trying to guess which stocks will go up or down. It's not about guessing if Nvidia or Amazon are going to rise 100% again. It's the opposite.

It's about finding calm, low stress stocks, and finding the strategies that created a high percentage of winning trades, gaining profitability slowly, while avoiding unnecessary risks.

If you place trades without knowing how they've performed in the past, then the hedge funds, Wall Street banks, and high frequency trade firms are taking advantage of your gap in knowledge. Their very existence depends solely on having information that others do not have.

But that information asymmetry ends, right now. In five minutes, your entire view of the options world, successful trading, and 'experts' will be turned upside down -- to your advantage. Tap here to see the CML Pro option back-tester.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. You must review customer account agreement prior to establishing an account. Investors could lose more than their initial investment. You must review customer account agreement prior to establishing an account.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please read the legal disclaimers below.

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.