Written by Ophir Gottlieb

PREFACE

While Apple Inc. (NASDAQ:AAPL) and Facebook Inc. (NASDAQ:FB) may seem to be headed in opposite directions with respect to growth, it turns out that both companies have arrived to similar crossroads, with similar risk and similar opportunity.

STORY: FACEBOOK

Facebook Inc. (NASDAQ:FB) crushed earnings this week, showing 91% year-over-year EPS growth and 56% revenue growth. Both are astonishing for a company of its size, but the stock tanked after the report.

Facebook 5-Day Stock Chart

That stock drop was predicated on comments from Facebook's CFO Dave Wehner when he said that ad revenue growth would be materially lower after mid-2017. Specifically, Wehner said the company expects that "ad load will play a less significant factor driving revenue growth after mid-2017" and that, going forward, Facebook expects to "see ad revenue growth rates come down materially" (Investopedia).

WHAT'S GOING ON

Facebook Inc. (NASDAQ:FB) generates more than 90% of its revenue from advertising and the company noted, again, that ad load, which is the number of ads each user is shown, will be decreasing in the future.

Further, the company noted rising expenses as it invests in research and development. Slowing revenue growth and increased costs pushed the stock down.

Facebook's "problem" is that it relies ever so much on one product, advertising, and it needs to innovate around that one product to create new business lines. The recipe of slowing growth, heavy reliance on a single product and high expenditures to innovate is exactly the one to cook up another tech giant, Apple Inc. (NASDAQ:AAPL).

STORY: APPLE

When Apple released its quarterly earnings earlier in October, the company reported its first full year over year revenue drop in over a decade. The focus, like Facebook, was on slowing growth for its single product champion, the iPhone, which accounts for more than 60% of revenue.

While Apple's CEO, Tim Cook, confidently noted that Apple would return to growth as of this quarter, the reliance on the iPhone is a strong headwind.

HUGE OPPORTUNITY

While Facebook and Apple face a slowdown in their overly concentrated revenues, the two have something else in common: over one billion users.

The social media site and the phone maker have amassed gigantic user bases, and while the core products may be slowing, there is a huge opportunity to introduce that billion person user base to the "next thing." The good news is, both companies seem to know exactly what that "thing" is.

While Facebook has focused on its virtual reality hardware and ecosystem with Oculus Rift, that niche is yet to hit the mainstream. But Facebook's real power is the 1.8 billion monthly active users on its platform, and it has turned its attention to that moat with its newly launched Facebook Marketplace.

Facebook's Next Product

Following the successful business model of Internet auction wunderkind eBay, Facebook has created its own commerce ecosystem. Here's a snippet from the USA Today, published on October 3rd.

On Monday Facebook is launching Marketplace, its version of the local rummage sale, and it's trying to coax its 1.71 billion users to hunt for new treasures or declutter their closets, moving more forcefully than ever onto the turf of Craigslist, eBay and other online services that help people peddle that designer coat, vintage car or gently used couch.

This business line has a simple goal: generate revenue from an existing massive user base from something other than advertisements. If Facebook can re-leverage its user base, it could have another winning monetization strategy as well as its first real diversification. Apple sees the same potential, in its own right.

Apple's Next Product

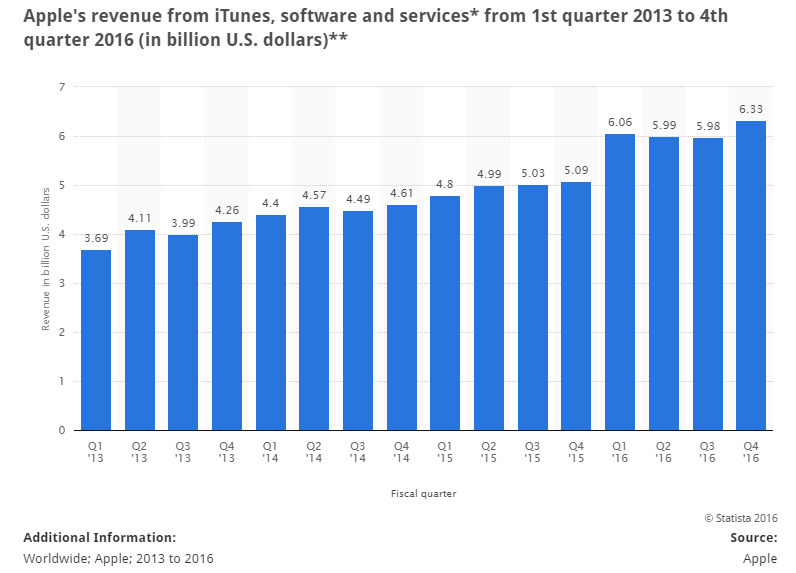

Apple is actually further down the line in its revenue diversification through its "Apple Services" segment. That segment is already 90% as large as Facebook in terms of revenue and is realizing accelerating growth.

Apple Services

Apple Services comprises of iTunes, iCloud, the app store, Apple Music, Apple Pay and other Apple software and services. The revenue base, like Facebook, is built on the back of an install base of over one billion people. While Apple Services accounts for approximately 14% of Apple's revenue, it makes up nearly a quarter of its operating income.

Tim Cook noted on the last earnings call that Apple Services would be showing growth even if iPhone sales stagnate, implying that the current install base of users is spending more and more money with their iPhone on services, so it is a legitimate diversification play for Apple.

Further, While Apple Pay has yet to make a material impact on revenue, the growth is astounding, standing at 500% year-over-year per the last earnings call, with more transaction volume in September alone than all of last year.

WHAT NOW

Facebook is finally showing slowing growth as its primary product, advertising, has reached near capacity. Apple showed, for the first time in over a decade, a full year of lower sales due to saturation of its kingpin product the iPhone.

But, both firms have accomplished the hardest part, which is to say they have both accumulated an user base that tops one billion people. The next step for each is to sell something else to the base. Apple has shown it is capable and it is succeeding. Facebook is on deck.

The author is long shares of Apple Inc. (NASDAQ:AAPL) and has no position in Facebook Inc. (NASDAQ:FB).

WHY THIS MATTERS

Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals. Of our Top Picks, Nvidia is up 110% since we added it. Ambarella is up 90% since we added it. Relypsa was taken over for a 60% gain and we are already up on Twitter when we added it to Top Picks for $15.60.

To become a CML Pro member it's just $25 a month with no contract. It's that easy -- you cancel at any time, instantly.

Each company in our 'Top Picks' portfolio is the single winner in an exploding thematic shift like self-driving cars, health care tech, artificial intelligence, Internet of Things, drones, biotech and more. For a limited time we are offering CML Pro at a 75% discount for $25/mo. with a lifetime guaranteed rate. Get the most advanced premium research along with access to visual tools and data that until now has only been made available to the top 1%.