PREFACE

According to newly released data from IDC, the Apple Inc. (NASDAQ:AAPL) iPhone SE is not selling well in the massive smartphone market that is India.

STORY

Chris Neiger's story for the Motley Fool tipped us off to this new data. Here's what's happening.

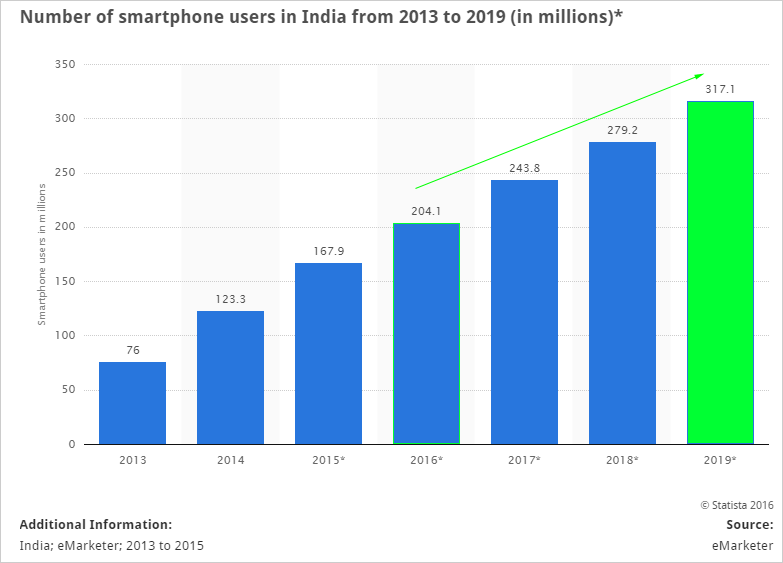

First, while smartphone sales growth is slowing in many of the mature markets like the United States and China, it is booming gin India. Here is a chart of the forecasts for Indian smartphone growth:

That's 204 million smartphone users in India in 2016. By 2017, India will be larger than the United States.

Apple Inc., however, has a tiny footprint in the market due to a bevy of reasons from high prices to very low local brand awareness. All of that seemed to change for the better after a deal was struck between the iPhone maker and India's government which allowed Apple to side-step the 30% local sourcing rules by way of a new rule for "cutting-edge technology."

It was all very neatly orchestrated, how Apple Inc. and India danced together to get the iPhone maker into the country and it has worked out well for India. Apple will be building a R&D center there and opening Apple stores. This was all great news for both parties. But, IDC has released data that is not really what Apple Inc. had in mind.

"Apple's iPhone SE failed to make any significant impact in the premium segment while its previous generation iPhone 5S continued to contribute majority volume."

Source: Jaipal Singh , Market Analyst, Client Devices, IDC India

The iPhone SE is Apple's newest iPhone that went back to the smaller screen but with vastly upgraded technology inside the phone. The iPhone SE sold very well last quarter and was in fact the primary driver for Apple's numbers coming in above consensus estimates. But the aspirations for the iPhone SE go much further.

The average middle class shopper in India doesn't have the same level of wealth as a consumer from the United States or China. Apple's phones are extremely expensive in India, where the average phone sells for about $150 per IDC.

While the iPhone 6 and iPhone 6S are far more expensive, the iPhone SE cuts the price by about $150. Still, even at the lower price point for Apple Inc. (NASDAQ:AAPL), it comes in at about $580 for the Indian consumer. Still very, very expensive.

Without strong brand recognition in India, consumers simply are unwilling to pay up for the iPhone SE, but rather have chosen to go with the iPhone 5Sm which is the same size but less expensive and with less powerful hardware.

IS APPLE FAILING IN INDIA?

A gut reaction to this data could be the disastrous kind -- that Apple is failing in India. Apple is not failing in India. Apple's market share in tier-I Indian cities jumped to 5.8% in calendar Q4 of 2015, up from 1%. but, the iPhone SE is a serious concern and Apple Inc. (NASDAQ:AAPL) has to do something.

Apple Inc. will be opening up its first Apple stores in India soon, and those stores have a gem for Apple everywhere else in the world. That's a start. The elephant in the room, of course, is Apple's average selling price. The company has held tight to its margins on the iPhone, almost like a battle cry. But, as Chris Neiger shrewdly points out, perhaps it's time for Apple to change its mode of operation -- at least for India.

We believe the Apple brand will see an upswing in recognition when the Apple inc. stores open and do believe the iPhone SE will be a success at some level in India. The phrase "failed to make any significant impact" will not be the end game -- it's the starting point and it was expected.

We also add that the $25 million technology center Apple Inc. (NASDAQ:AAPL) opened in May of this year, which will create 4,000 jobs, will have a direct impact on the company's brand recognition and that means, the iPhone's recognition.

The author is long shares of Apple Inc. (NASDAQ:AAPL).

WHY THIS MATTERS

There's so much going on with Apple, that it's nearly impossible to keep up with. But the real gems are the smaller companies that will power the technological revolutions that the giants will get behind. It's identifying trends and companies like this this that allows us to find the 'next Apple' or the 'next Google.' This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

That chart plots the growth in 4G usages worldwide and how it will grow from 330 million people today to nearly 2 billion in five years. This is the lifeblood fueling every IoT and mobile device on the planet and CML Pro has named the single winner that will power this transformation. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.