If you took NIH funding and got a drug approved by the FDA in the last 3 years, you are part of an elite group of 4 small-cap publicly-traded biotech names ranging in size from $13 Million to $6.8 Billion[1].

Why does this matter? Because 3 out of these 4 companies have seen their shares soar 330%[2]. We think the fourth biotech company - Opiant Pharmaceuticals (OPNT) - could see its share price triple in 2016.

Opiant developed NARCAN in partnership with the National Institute of Health’s NIDA division, inked a $55 Million + royalties licensing deal with Adapt Pharma, won FDA approval for NARCAN, and are now helping solve an estimated $1 Billion opioid overdose epidemic. So how is it that Opiant’s shares, which trade under the ticker OPNT, are valued at just $13 Million?

We think OPNT trades crazy cheap and has strong reason to rise 160%+ this year. Performance among peers like Titan Pharma (+135%), Alkermes (+178%), and BioCryst (+680%) only further bolster our bull case for owning OPNT.

Why Did Titan, Alkermes and BioCryst Rise 135%, 178% and 680%, Respectively?

Roughly 10% of FDA-approved drugs are discovered with the help of a public sector institution - eg. National Institute of Health (NIH) or Health and Human Services (HHS) - according to a study published in the New England Journal of Medicine[3].

The select few companies that effectively used non-dilutive public sector funding to gain FDA approval, whether in the form of grants or public-private collaborations, created millions in value for their shareholders.

CASE 1: TITAN PHARMA (TTNP) +135%

Titan Pharma was awarded with a $7.6 million grant, which covered approximately half of the expenses of Probuphine’s Phase III study. Probuphine, Titan’s long acting implant for opioid addiction, was granted FDA approval in May 2016, by which time the company’s enterprise value nearly tripled.

Figure 1: Titan’s Enterprise Value Tripled To $140 Million on Probuphine’s Approval

CASE 2: BIOCRYST (BCRX) +680%

BioCryst developed their influenza vaccine Rapivab with a combined $179.9 Million from Department of Health and Human Services. With Rapivab’s approval, BioCryst’s enterprise value rose 7 fold.

Figure 2: HHS Funding Helped Ignite BioCryst’s Ascent

CASE 3: ALKERMES (ALKS) +178%

Alkermes has risen 178% since using NIDA funding for Aristada, but their case is slightly more complicated as advancement of their other late-stage drug candidates have lifted their valuation and share price performance, relative to the importance of the aforementioned drug products for both Titan Pharma and BioCryst, respectively.

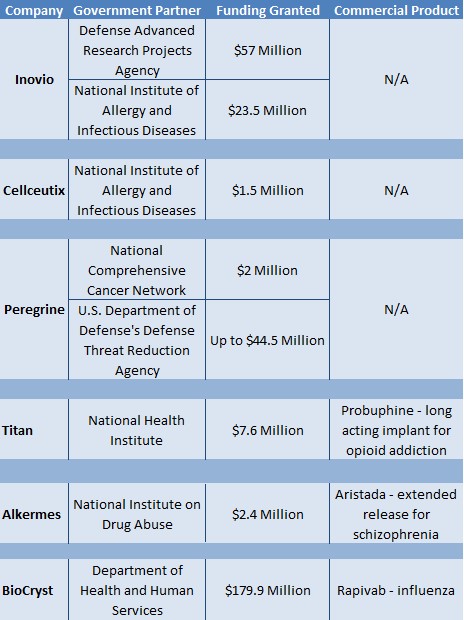

The NIH has doled out hundreds of millions in grants and/or research partnerships with dozens of other small but arguably promising companies like Peregrine (PPHM), Inovio (INO) or Cellceutix (CTIX), but this has not had any lasting impact on shareholder value without a FDA approval, as shown in Figure 3 (below).

Figure 3: Government Sponsorships That Lead to Commercialized Products Reward Shareholders

For instance, the Department of Defense’s Defense Threat Reduction Agency granted Peregrine (PPHM) up to $44.5 Million[4] to support its cancer and viral infections programs. Peregrine was unable to get a drug past the FDA and has accumulated a deficit of more than $500 million while share count has been diluted by 59% since 2014. Peregrine’s value has consequently fallen 87% in the last two years.

In another instance, Cellceutix (CTIX) was granted $1.5 Million from the National Institute of Allergy and Infectious Disease (NIAID), but has not yet been able to commercialize any of its drug candidates[5]. Cellceutix’s enterprise value has fallen 71.5% since January 2015 peaks.

Opiant Leveraged Government Funding To Win FDA Approval For Disruptive Drug, Secure a $55 Million Licensing Deal And Perpetual Royalty Stream For Shareholders

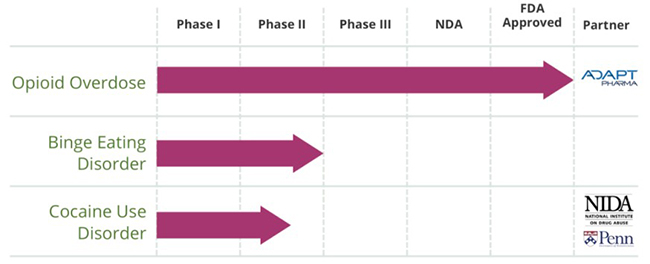

Opiant Pharmaceuticals (OPNT) has used National Institute on Drug Abuse (“NIDA”, a division of the NIH) funding to develop and commercialize their overdose drug, NARCAN. NARCAN, a nasally-administered version of naloxone, was approved by the FDA on November 18, 2015 and launched on February 25, 2016 by Opiant’s commercialization partner Adapt Pharma. Opiant now receives a royalty from every sale of NARCAN and is once again turning to non-dilutive government grants to advance their other pipeline candidates.

Opiant collaborated with NIDA to establish a regulatory pathway that would bring nasal naloxone to an estimated $1.3 Billion opioid overdose market[6]. NIDA sponsored two clinical studies that showed NARCAN’s efficacy in treating opioid overdoses. Opiant then struck a licensing deal with Adapt Pharma to get nasal naloxone through the final FDA hurdle and commercialization in exchange for $55 Million in milestone payments and tiered royalties on global sales.

Now, Opiant has shifted NARCAN commercialization to Adapt. Adapt Pharma is operated by some of the most successful specialty pharma executives who built and sold their last company, Azur Pharma, for $500 Million (read more: After $500 Million Exit, Pharma Experts Shift Focus To This Disruptive Company’s Product).

Opiant Leveraging Success of NARCAN to Find Funding For Other Disruptive Drug Candidates

On December 23, 2015, Opiant announced that it partnered with NIDA to test an opioid antagonist drug in patients with Cocaine Use Disorder at the University of Pennsylvania. The Phase II study will be funded by a NIDA program and top-line results are expected in the first half of 2017.

Figure 4: Opiant Teaming Up With NIDA Once Again For Cocaine Use Disorder

There are about 900,000 current cocaine abusers in the U.S., as reported by The Substance Abuse and Mental Health Services Administration (SAMHSA)[7]. Presently, there are no medications approved by the FDA to treat cocaine addiction and treatment is limited to behavioral interventions.

Opiant’s opioid nasal spray could be used as a symptom-driven therapy to help patients reduce or avoid cocaine use. This could present OPNT with a ~$810 Million market opportunity. We assume that cocaine abusers use Opiant’s nasal spray once/month and it costs the same as NARCAN – roughly $75 per dose.

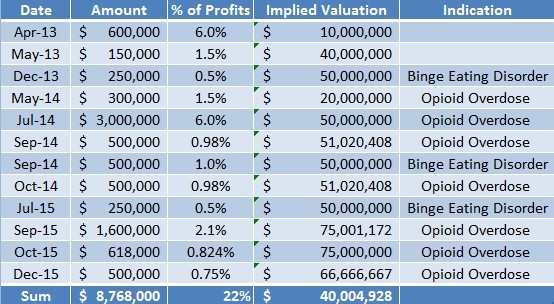

Opiant Has Raised Capital At An Implied $20 Per Share, But Now Trades At Less Than $8?

In the last three years, Opiant has raised nearly $9 Million by selling future profit interests in their pipeline products at an average implied valuation of $40 Million (or $20 per share).

Figure 5: Last ~$9 Million in Capital Invested At Implied Valuation More Than 2x Current Market Price

At current market prices, Opiant trades for just $13 Million, supporting the thesis that OPNT shares are grossly undervalued. The company has convinced investors to dish out ~$9 Million at an average implied $40 Million valuation.

Opiant’s management has done a superb job creating shareholder value. The company has largely funded R&D of its pipeline through government grants and by selling non-dilutive profit interests at implied valuations of more than twice its current share price. Importantly, the most recent rounds were at an implied valuation of more than 5x their current valuation, which further bolsters our bull case for OPNT.

These non-dilutive measures are currently being overlooked by the market, as OPNT trades near 52-week lows and a 60%+ discount to our computed fair value of $20.

Titan Pharma on the one hand, and Cellceutix and Peregrine on the other hand, are excellent examples of how companies can effectively and ineffectively utilize government funding to create shareholder value. Opiant is developing a reputation of advancing drug candidates through the FDA’s regulatory pathway through non-dilutive methods, but its shares have not reflected this.

As Opiant continues to receive royalties from NARCAN and advances the other drug candidates the only way they know how, the disconnect between OPNT’s market price of sub-$8 and fair value of $20 could quickly narrow, suggesting potential upside of at least 160%.

References & Footnotes

[1] We defined companies as “small-cap biotechs” due to their respective enterprise values on August 12, 2016 and being the only such companies to receive FDA approval between January of 2014 and August 2016

[2] On average, the three companies that effectively used government funding rose 330% two years leading up to their respective FDA approvals

[3] http://www.nejm.org/doi/full/10.1056/NEJMsa1008268#t=articleTop

[4] http://www.biospace.com/News/peregrine-pharmaceuticals-inc-provides-update-on/185584

[5] http://cellceutix.com/cellceutix-anti-fungal-compounds-awarded-1-5-million-sbir-grant/#sthash.0pwKntc7.J9KITyvy.dpbs

[6] 7% of ~260 million opioid prescriptions are considered high risk for abuse. A price of $75/NARCAN kit would mean the market size for naloxone is $1.3 Billion. Read more at: http://ir.baystreet.ca/article.aspx?id=208

[7] http://www.samhsa.gov/disorders/substance-use

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC ("One Equity") on behalf of Opiant ("Opiant" or the "Company") as part of research coverage services. As of the date of this report we have received two hundred thousand dollars and thirty seven thousand restricted shares of Opiant for our services beginning in February 2015. We expect to receive ten thousand dollars per month and up to an additional thirteen thousand restricted shares over the course of our coverage, however, our agreement is subject to termination at the discretion of the Company. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. While issuer-sponsored research is seen as biased, we strive to hold the highest ethical and fundamental standards when evaluating which companies we are willing to cover. We assess issuers prior to entering into a coverage agreement and attempt to cover only those we believe are truly undervalued and deserve greater visibility. Our research reflects our actual views. We do not publish investment advice and remind readers that investing involves considerable risk. One Equity urges all readers to carefully review the Company's SEC filings and consult with an investment professional before making any investment decisions. Please read our full disclaimer at http://www.oneequityresearch.com/terms/