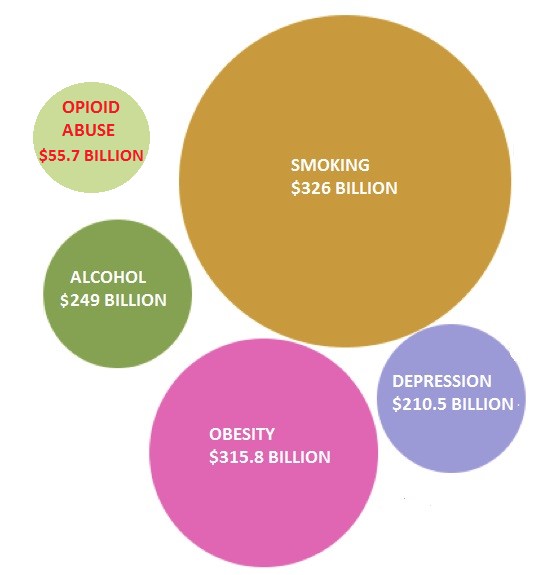

Obesity and smoking cost the U.S. economy $316B and $326B, respectively, in a combination of medical expenses and loss of [human] productivity. These multi-billion dollar unmet opportunities spurred potential solutions from Arena (ARNA) and 22nd Century Group (XXII), in turn rewarding the two companies with multi-hundred million dollar valuations [1].

Opioid abuse costs the U.S. economy $55.7 billion a year, according to the American Society of Addiction Medicine (ASAM) [2]. Obama has proposed to allocate $1.1 billion in spending on opioid abuse in his 2017 budget proposal. CVS and Walgreens are making naloxone available without prescription in 35 states in 2016 to counter the 260 Million prescriptions for opioid drugs like OxyContin and Percocet. Last week, the FDA approved Titan Pharmaceutical’s (TTNP) long lasting buprenorphine implant for opioid addiction, pushing Titan’s share price to 3 year highs.

As the medical world and regulatory bodies take action in the fight against opioids, we believe Opiant’s (OPNT) NARCAN nasal spray will be the biggest beneficiary and potentially reward investors with a 140% return. OPNT trades at $8.74 and has been flat since the start of the year. Peer valuations suggest that Opaint’s fair value is $21/share or roughly 2.4x higher than current market price.

America’s Obesity and Smoking Created Multi-Hundred Million Dollar Valuations for Emerging Solution Providers. Two Cases Explain The Opportunity for Opiant’s Nasal Naloxone

Figure 1: Billion Dollar Epidemics Have Prompted Innovative Solutions

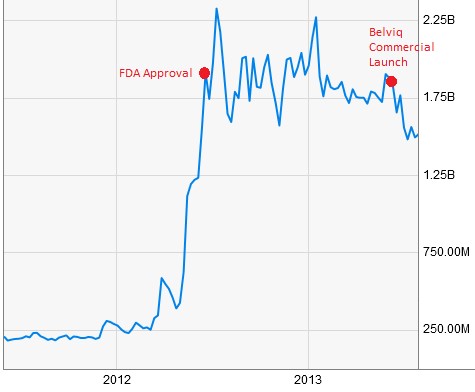

Case 1: Arena’s Solution to a $315.8B Problem

Widespread obesity has raised medical-care costs by $315.8 billion, amounting to $3,508 a year for each obese person [3].These growing concerns and a lack of viable solutions prompted the FDA to approve Arena’s Belviq weight loss pill in June 2012 and competitor Vivus (VVUS) the following month. Arena teamed up with commercial partner Eisai to launch Belviq a year later, by which time the company was sporting a market cap north of $1.75 billion.

Figure 2: ARNA Had A $1.75B Market Cap Upon FDA Approval & Commercial Launch

Case 2: XXII Low Nicotine Technology Attempts to Curb $300B Smoking-Related Drag on US Economy

Medical care costs, lost productivity and second hand exposure pushed smoking’s economic drag to an overwhelming $300 billion [4]. In 2009, The Tobacco Control Act granted FDA authority over the regulation of all tobacco products with aim of reducing nicotine in cigarettes. Accordingly, the established cigarette companies like Philip Morris (PM) and British American Tobacco (BTI) were required to moderate marketing efforts.

America’s smoking problem prompted regulatory change and presented an opportunity for 22nd Century’s (XXII) low nicotine cigarettes, which contain 95% less nicotine than conventional cigarettes according to the company. 22nd Century ran studies funded by the FDA’s Center for Tobacco Products to show that their low-nicotine cigarettes might reduce dependence on the addicting chemical and, consequently, the number of cigarettes smoked. This year, the company filed to receive the first FDA Modified Risk Tobacco Product (MRTP) designation, which would allow them to market their offering as the only ‘very low’ nicotine cigarette. Gaining this marketing edge could draw the attention of the big tobacco players and potentially encourage a licensing deal or acquisition worth hundreds of millions.

Opiant’s Approved Drug Addresses a $55 Billion Drag on America’s Economy

Opioid abuse is costing the U.S. economy $55.7 billion a year. Employers shoulder nearly a third of the costs due to medical expenses and absenteeism, which add up to $19,450/employee. Since 2001, overdose deaths from prescription opioids have risen 4-fold, reaching epidemic proportions.

NARCAN is the only non-injected naloxone approved by the FDA for opioid overdose. Historically, naloxone has been administered through a needle or syringe. Nasally-administered NARCAN, launched in the US on February 25th, is expected to broaden access to the life-saving drug and consequently expand naloxone sales due to its ease of use.

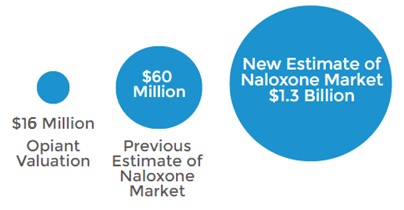

The market opportunity for a convenient and accessible form of naloxone (ie. nasal spray) is significantly larger than the $60 million reported for 2014 by IMS Health. This understated figure only considers data for injectible naloxone which has been approved since 1971 and is limited in real world use as only trained medical professionals are able to administer it. Additionally, the IMS estimate overlooks the notion of co-prescription, which is growing increasingly popular with overdose deaths mounting.

Doctors wrote 10,331 prescriptions for naloxone in 2014, compared to an estimated 259 million opioid prescriptions. A study published in the Journal of American Medical Association [5] estimates that roughly 7% of patients prescribed opioids are considered at high risk for abuse. If 7% of dispensed painkillers are co-prescribed with naloxone at NARCAN’s average price of $75/kit, then a more accurate market size for naloxone would be $1.3 billion (calculated in a prior note).

Figure 3: Nalxone Market Could be 21x Larger Than Previously Thought

However, the difficulty of predicting which patients will be high risk calls for a new health intervention. The American Medical Association encourages naloxone co-prescription to halt America’s epidemic. If naloxone is co-prescribed in a “Universal Precautions” manner- given with every opioid prescription- overdose deaths may be significantly reduced, as concluded by this University of New Mexico study [6]. Universal Precaution co-prescription would balloon naloxone’s addressable market to $19 billion.

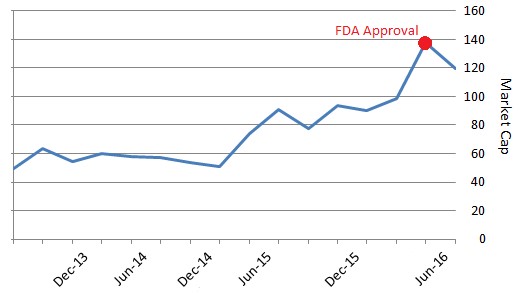

FDA Approval for Titan’s Opioid Drug Pushed Valuation to >$120 Million

Opioid addiction is treated with an FDA-approved drug called ‘buprenorphine’. Last week, the FDA approved Titan Pharmaceutical’s ‘Probuphine’, a reformulated buprenorphine implant that is effective for six months compared to other approved forms of the drug, which are administered daily. The buprenorphine treatment market is $1.75 billion.

The FDA approval triggered a $15 million milestone payment to Titan from commercial partner Braeburn Pharmaceutical. The company will also have the opportunity to earn sales milestones of up to $130 million and double digit tiered royalties from Probuphine sales. This regulatory event pushed Titan’s valuation to >$120 million at its peak.

Figure 4: Approval and Milestones Drive TTNP Market Cap

Opiant Valued <$9, While Peers Clearly Show Fair Value is $21 Per Share

In 2014, Opiant signed a licensing deal for NARCAN with Adapt Pharma, shifting commercialization responsibilities to Adapt in exchange for “more than $55 million” in regulatory and sales milestones and “up to double-digit royalties.”

Adapt’s founders have had prior success selling specialty pharma products. The three founders of Adapt Pharma - Seamus Mulligan, Eunan Maguire and David Brabazon - built specialty pharma company ‘Azur’ to $100 million in revenues in just 6 years. In 2011, Azur was acquired by Jazz Pharma in a $500 million deal, now worth roughly $1.8 billion. Adapt’s leaders’ prior successes are encouraging, particularly given that Adapt’s sole focus - after raising $95 Million to start the company - has been the licensing and commercialization of [Opiant’s] NARCAN for opioid overdose.

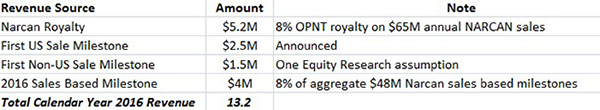

Given its first mover advantage as the only commercial nasal naloxone, we assume that NARCAN captures 5% of the estimated $1.3 billion opioid overdose market, which generates $65 million in 2016 sales. We also estimate OPNT’s royalty rate to be 8%. Our estimate for forward 2016 revenue includes sales milestones and NARCAN royalties for a total of $13.2 million (discussed in detail here) as shown in Figure 5, below.

Figure 5: Breakdown of OPNT’s Expected CY 2016 Revenues of $13.2M

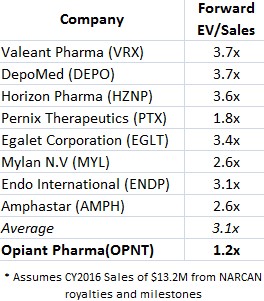

At a current $16 million enterprise value, OPNT trades at 1.2x EV/Sales (on a forward basis, assuming 2016 sales of $13.2 million).

We looked at a spectrum of specialty pharma peers that OPNT could be compared to, like Valeant (VRX) and Amphastar (AMPH). Each of these peer trades at a multiple far higher than OPNT, as shown in Figure 6, below.

Figure 6: Peers Suggests OPNT Shares Could Be Worth 2.4X Current Market Price

OPNT peer group clearly demonstrates that if OPNT were fairly valued at 3.1x forward EV/Sales, shares would trade for $21, compared to a recent market price below $9. Put another way, OPNT shares appear to trade at a 58% discount to fair value.

In the last three years, Opiant has raised nearly $10 million by selling future profit interests in their pipeline products at an average implied valuation of $40 million. This supports the thesis that OPNT is grossly undervalued at current market prices and that fair value is $21/share [7].

3 Catalysts That Could Correct OPNT’s Valuation in 2016

Additional Government Funding

This past month, the US Senate passed a series of bipartisan legislations that were aimed at curbing opioid addiction. Although no actual monetary figures were set, the bipartisan support is an encouraging sign that spending will back up the bills.

The budget allocates $400 million to battle opioid abuse this year [8], including tripling the number of naloxone distributions to 400,000. Congress has discussed outlaying an additional $570 million over the next five years while Obama has proposed to increase this funding to $1.1 billion over the next two years [9]. A potential increase in funding will leverage NARCAN’s position as the only available nasal naloxone and bring the solution one step closer to being a commercial hit.

Introducing NARCAN into Other Markets

Commercial partner Adapt filed to have NARCAN approved for use in Canada, moving Opiant one step closer to receiving milestone for first the commercial sale outside US. If NARCAN is sold in Canada by the end of the year, we estimate that this could trigger a milestone payment in the $1.5 million range.

Expanding Naloxone Distribution

Major pharmacy chains CVS and Walgreens agreed to make naloxone available over-the-counter (OTC) in 35 states this year. This also sets a precedent for other national pharmacies (Wal-Mart, Walgreens, Rite Aid et al.) to follow suit in offering naloxone OTC. Additionally, co-prescription is becoming a more widespread concept, as discussed above with AMA support and University of New Mexico study. Presumably, expanded distribution will create sales momentum and drive NARCAN sales.

What epidemic solution providers have taught us is that opportunity is often borne out of situations with a dire need. Investors who took advantage of these opportunities in the past were financially rewarded. We think these select issuers – Arena, 22nd Century and Titan- demonstrate this point and make a case for Opiant to also be valued like other companies that have provided an innovative solution in midst of epidemic situations. Regulatory tailwinds and increased distribution could make NARCAN a commercial hit and put the company on the radar of opioid makers such as Purdue, Endo and Teva. If revenues total $13.2 million, OPNT is worth $40+ million, or $21 a share, compared to a recent market price of $8.74.

Key Takeaways:

- Opiant Pharmaceuticals (OPNT) owns an FDA-approved solution to a crisis costing the U.S. $55 Billion per year

- 22nd Century for smoking, Arena in obesity, indirectly show how investors value companies with potential solution(s) to costly and/or pressing unmet health needs

- Titan Pharma's valuation (>$110 Million) on the back of FDA approval for their opioid addiction drug directly demonstrates disconnect in Opiant's valuation (<$17 Million)

- Opiant's solution should value the Company upwards of $21 per share compared to a recent market price of <$9

- Opiant's FDA-approved nasal naloxone, coupled with attractive valuation, could position the Company as a strategic antidote for Purdue, Endo, Teva or other major opioid drug maker

- $55 Billion in indirect costs from opioid abuse and direct cost in thousands of deaths put tailwinds behind co-prescription of naloxone (<11 thousand scripts written annually) and opioid painkillers (259 Million scripts written annually)

- Opiant is a direct bet on the uptake of the most-conveniently available drug for a growing opioid overdose market

- We see potential upside of 140% in owning OPNT

References & Endnotes

[1] While neither Arena Pharmaceuticals nor 22nd Century Group have the only potential solution to two respective multi-billion dollar problems, we used these companies as illustrative examples of valuation of companies with potential solutions to large unmet needs. Market valuation of both companies has varied over time.

[2] http://www.workforce.com/articles/21855-pain-points

[3] http://www.bloomberg.com/news/articles/2015-03-05/american-economy-has-a-weight-problem-as-costs-of-obesity-mount

[4] http://www.cdc.gov/tobacco/data_statistics/fact_sheets/economics/econ_facts/

[5] http://archinte.jamanetwork.com/article.aspx?articleid=1840033

[6] http://www.ncbi.nlm.nih.gov/pubmed/27093555

[7] Computation of shares outstanding does not include 2 million common shares underlying options and warrants because their dilutive effect and exercise is uncertain over time. If all options and warrants were exercised at their current strike price, Opiant would have a maximum of ~4 million shares outstanding.

[8] https://www.whitehouse.gov/blog/2015/12/30/more-funding-opioid-epidemic-bipartisan-budget-agreement

[9] https://www.whitehouse.gov/the-press-office/2016/02/02/president-obama-proposes-11-billion-new-funding-address-prescription

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC ("One Equity") on behalf of Opiant ("Opiant" or the "Company") as part of research coverage services. As of the date of this report we have received one hundred and eighty thousand dollars and twenty six thousand restricted shares of Opiant for our services beginning in February 2015. We expect to receive ten thousand dollars per month and up to an additional twenty four thousand restricted shares over the course of our coverage, however, our agreement is subject to termination at the discretion of the Company. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. While issuer-sponsored research is seen as biased, we strive to hold the highest ethical and fundamental standards when evaluating which companies we are willing to cover. We assess issuers prior to entering into a coverage agreement and attempt to cover only those we believe are truly undervalued and deserve greater visibility. Our research reflects our actual views. We do not publish investment advice and remind readers that investing involves considerable risk. One Equity urges all readers to carefully review the Company's SEC filings and consult with an investment professional before making any investment decisions. Please read our full disclaimer at http://www.oneequityresearch.com/terms/