The earth’s oil sands deposits hold literally trillions of barrels of oil.

The problem has always been accessing this oil in a practical, clean and profitable way.

The traditional oil sands extraction methods are considered the dirtiest production method on the planet… and the most expensive, with breakeven pricing coming in as high as $75 a barrel.

Now, for the first time, a small company has taken the lead in this sector – with a proven, patented and potentially highly profitable oil sands processing technology.

Petroteq (TSX:PQE.V; OTC:PQEFF), a small Canadian company working in the oil sands of Utah, has developed a breakthrough, closed-loop system, that extracts clean oil from dry oil sands – for as low as $28 a barrel in high volume settings– considerably cheaper than traditional methods.

To understand the true importance of what this breakthrough processing means to the industry, it’s important to understand what makes the traditional oil sands methodology so costly.

The oil sands are a combination of clay, sand, water, and bitumen - a thick, heavy, black oil. This bitumen in the sands is too thick and too bound to the sand and clay surrounding it to be pumped out.

To extract the oil, the sand itself must be mined, usually with open-pit or strip mine techniques.

Once the oil “ore” is mined, it must be transported to an extraction plant for processing.

At the plant, a hot-water process is used to separate the valuable bitumen from all the sand, rocks, clay and other minerals.

Then, it moves on to separation cells, where hot water is pumped into the sand, forming a slurry that’s then piped into the extraction plant. At the extraction plant, the hot water/sand/bitumen mixture is agitated to release the bitumen from the sand.

The agitation causes tiny air bubbles to form, and attach to the newly released bitumen droplets, floating the bitumen to the surface. From there, it’s skimmed off for further processing.

Even after all that, the bitumen must be further diluted with lighter hydro-carbons before it can be transported through pipelines. Eventually, the bitumen will require additional upgrading before it’s ready to be refined.

It’s a time-consuming, inefficient, and capital-intensive process. Traditionally, it takes about 2 tons of oil-sands ore to generate one barrel of oil. And with all-in costs as much as $75.73 per barrel, and break even costs averaging about $37 per barrel in the US, only efficient oil sands projects are economically feasible in today’s market.

Well, that could be all about to change.

Because Petroteq (TSX:PQE.V; OTC:PQEFF) has brought online a simple, self-contained, and easily expandable processing plant for generating oil from tar-sands… aiming for production costs as low as $28 a barrel on volume.

After 5 years of research, 2 years of construction and testing, and over $15 million investment in assets, the breakthrough process is producing oil.

Here are the biggest reasons investors should consider looking more closely at this upstart company, and its breakthrough technology.

REASON: The first processing plant in Utah has just gone into production - and is expected to be producing 1000 bbl. of clean oil per day from the Uinta deposits

Petroteq’s breakthrough technology is already up and running, producing real, useable oil for what on volume is expected to be a fraction of the cost of traditional oil sands.

The company expects to scale up quickly, producing 1,000 barrels of clean oil a day by the end of the year.

And because the technology is easily scalable, production can ramp up quickly from there.

In fact, the company expects to more than double production every year for the next two years.

According to Dr. R. Gerald Bailey, President & Director of Petroteq, “As we expand the plant, it’s like a Lego kit. We add a few more similar units side by side and magnify the output.”

The innovative new “plug and play” system will allow the company to double production from 1,000 to 2,000 bbl per day in 2019… and then more than double again, scaling up to 5,000 bbl a day by the end of 2020.

With over 93 million barrels contingent resource of oil in its current leases, the company could potentially produce 10,000 barrels a day – for the next 25 years.

REASON: Petroteq’s technology is changing the oil sands economics

The company’s proprietary system is the game-changer the industry’s been needing for a long time. It’s clean, it’s completely self-contained, and it can extract 99% of all the hydrocarbons – at costs as low as $28/bbl on volume.

Unlike traditional processes, Petroteq’s (TSX:PQE.V; OTC:PQEFF) proprietary technology creates a continuous flow, closed loop system - where oil sands go in one end… and only oil and clean sands come out the other.

The real innovation of this system, and what makes it a true breakthrough, is the use of specially designed, non-toxic solvents to replace the thousands of gallons of water used in the traditional oilsands extraction processes.

Instead of being discharged, the solvents are simply recycled back through to be used again and again.

This allows the company to extract over 99% of all the hydrocarbons locked away in the sands – without using any water and generating zero greenhouse gas emissions.

Petroteq’s patented clean oil recovery technology may be the world’s most efficient system for extracting oil from the sands.

Designed and Patented by Petroteq's chief technology officer, noted Ukrainian chemist Vladimir Podlipskiy, the extraction technology took almost five years of research to develop.

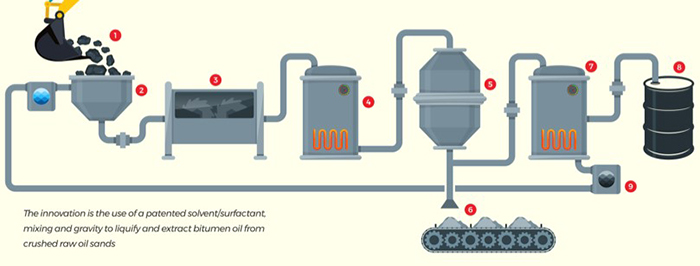

How the System works

Oil sands ore goes into the system, where it’s crushed into uniform chunks, 3/4 of an inch in size.

These small chunks are then moved to a vertical tank, where they’re mixed with the special solvents and spun furiously by three horizontal propellers. “It is like a cyclone,” says Podlipskiy.

The consistent size ensures that every piece of ore flows through the system more easily, from conveyor belts through to the pumps and the centrifuges.

Most importantly, the consistent size increases available surface area, allowing for a more complete extraction, and less time in the mixing tank, thus speeding up the entire process.

As the system moves on, remaining solids fall out of the mixture, and the remaining liquids are run through a heated separation column.

The heat causes the solvents to float off as vapor… where they’re condensed back into liquids and recycled back through the process with fresh ore.

Petroteq (TSX:PQE.V; OTC:PQEFF) expects to recycle over 99% of the solvents used in the process.

At the end, the black oil is piped out… and the sands emerge completely dry, scrubbed almost entirely of hydrocarbons and solvents.

The clean sand can immediately be returned to the mine pit, safely, and without the need for further remediation to prevent chemicals leaching into the ground.

Because there is no water used in the process, there’s no need for tailings ponds to hold the runoffs.

The self-contained, closed-loop nature of the system ensures that the only thing that comes out at the end is the extracted crude oil and the cleaned sands.

REASON: Petroteq’s Breakthrough Technology Eliminates the Negative Environmental Impact of Oil Sands Processing

Extracting oil from the oil sands is a time intensive, and dirty business. It requires thousands of gallons of water, and the use of chemicals and hydrocarbons to separate the oil from the sands.

Once processing is complete, all that now toxic water is run off and gathered in tailing ponds - open pools of sludge that will take decades to remediate.

The tailing ponds left over in Alberta, Canada from their massive oil sands projects have left pools of toxic waste holding over 1 trillion liters of sludge - covering 220 square kilometers. That’s roughly 73 of New York City’s Central Parks - covered in toxic slime.

Petroteq’s breakthrough technology uses no water… so it produces no run-off and creates no toxic sludge. Only two things come out at the end of this new process - oil, and clean sand.

Everything else is recycled. No waste water, no tailings ponds, no need for remediation.

REASON: Adaptable for virtually ALL oil sands

There are two distinct kinds of oil sands projects. One is called “water-wet” and the other, “oil-wet” (the terms refer to the characteristics of the rocks and soil the oil is contained in).

Water-wet oil sands are predominantly found in the fields of Alberta, Canada. Oil-wet ore is what’s typically found in the United States.

Utah’s deposits are the largest in the U.S., holding 14 to 15 billion barrels of oil in place, according to the Utah Geological Survey. While not all that oil is considered recoverable, the domestic market alone is still massive.

Petroteq’s (TSX:PQE.V; OTC:PQEFF) system works best on oil-wet sands, but because it is expected that Petroteq’s system will be adaptable to the unique demands of both kinds of deposits, the technology should in future be able to meet needs of oil sand markets all across the globe.

REASON: Immense Opportunities for International Expansion

Currently, Petroteq controls a contingent resource of 93 million barrels of oil on its properties in Utah - worth roughly $6 billion gross at $70 oil.

Yet that could prove small potatoes, very quickly.

Because Petroteq’s system can be licensed to other oil sands deposits, it opens up huge opportunities around the globe.

There are oil sands in many countries, but it is too expensive or dirty to extract.

And all that oil – much of it unprofitable at $70 crude – suddenly becomes hugely profitable with Petroteq’s $28 a barrel technology. All without the massive environmental impact that’s plagued the industry for years.

The U.S. Geological Survey estimated that Venezuela’s Oronoco oil sands could hold as much as 1 trillion barrels of oil in place…with 652 billion barrels considered accessible. And again, all the oil becomes immensely profitable when you can extract it for just $28 a barrel.

And these aren’t the only potential customers for Petroteq’s breakthrough technology.

Russia holds 34 billion barrels locked up in oil sands. Kazakhstan is sitting on 42 billion. China, 5.9 billion. Canada’s Athabaska field alone could possibly hold as much as 2 trillion barrels.

Petroteq’s (TSX:PQE.V; OTC:PQEFF) technology could become the most in-demand oil field technology in the world… and international licensing agreements could prove immensely profitable, especially if it is adapted for water-wet oil sands.

REASON: Intellectual Property Protection

Protecting innovative intellectual property rights is paramount in today’s tech-heavy world. Especially for a technology that could completely change the face of the oilsands industry, as Petroteq’s is doing.

The company has moved quickly to protect their proprietary process, fling provisional patents in many different countries around the world - including nations with significant oil sands deposits, such as the United States, Canada, China and Russia.

The patents should protect the entire extraction process, as well as the engineering and design features of the processing plants components and vessels, as well the makeup and specific combinations of the solvents used.

REASON: Expanding Market Impact with Another Potential Game-Changing Solution: BLOCKCHAIN

Blockchain technology - the digital open ledger systems pioneered by crypto-currencies like Bitcoin - is quickly becoming the next big thing in global technology.

And Petroteq is taking the lead by bringing another blockchain based technology to the oil and gas industry.

Called PetroBLOQ, it will be an innovative Blockchain-based platform designed exclusively for the oil and gas industry.

Fluctuating oil prices put market efficiency and cost-effectiveness in high relief for every facet of the industry – upstream, midstream, and downstream.

And blockchain offers what should prove to be the best solution for an industry exposed to the ups-and-downs of a volatile commodity.

PetroBLOQ’s Blockchain technology I designed to help deliver greater savings in costs and time - increasing transparency while increasing response times to global events and helping mitigate the effects of market fluctuations.

The Wall Street Journal has called Blockchain the “future in oil and gas”

“Oil and gas companies could derive many benefits from blockchain technology, from enhancing efficiency and transparency to more securely storing and managing data,” according to WSJ.

Transactions for trades, transfers, purchases and sales will be instantly verified across a network.

Because the Blockchain is decentralized, and open sourced, everything that takes place in the Blockchain will be immediately verified.

PetroBLOQ has the potential to reduce operating costs, while improving the speed at which transactions are processed. It will also make storing and managing the enormous amounts of data much more secure, strengthening the industry’s defense against cyber-attacks.

PetroBLOQ represents another industry innovation for Petroteq.

Blockchain will allow the creation of “smart contracts”. As the Wall Street Journal pointed out, “…knowing who gets paid what, why, and where; who is owed money; and who along the chain is performing as explicitly mandated by agreements is potentially game changing”.

Smart coding will create contracts that will essentially self-execute - minimizing backlogs, reducing overall costs and virtually eliminating the risk of fraud and corruption across all industry transactions.

Blockchain is also expected to improve the speed, efficiency, reliability and ultimately, the profitability, of commodities trading contracts.

IBM has stated that “Blockchain can help transform supply chain networks in the chemicals and petroleum industry. [It] enables immutable, transparent and auditable business transactions among participants and suppliers, distributors and partners.”

REASON: PetroBLOQ is building an international consortium of oil and gas producers

Since Blockchain has the capacity to create an unbroken chain of information across all oil and gas operations, regardless of geographic region - PetroBLOQ is building an international consortium of oil and gas companies, built on its own PetroBLOQ blockchain platform.

The company has already announced that Mexican oil giant Pemex will become the latest company to join the PetroBLOQ consortium. And the company intends to open up offices in key, strategic locations around the globe.

Petroteq’s (TSX:PQE.V; OTC:PQEFF) two biggest breakthroughs – clean oil sands processing, and the PetroBLOQ Blockchain technology – show the small Canadian company is stepping up and proving it has the solutions to the industry’s biggest and most costly problems. For any investor interested in smaller, innovative outfits, Petroteq deserves a spot on the “stocks to watch” list.

Other companies looking to take advantage of the next oil boom:

Encana Corporation (TSX:ECA): Calgary-based Encana saw October oil production recover to more than 325,000 oil-equivalent barrels per day after matching analyst expectations at just 284,000 boe/d in the third quarter.

The oil market looks to be recovering and now appears to be the perfect time to get in on the rebound with companies like Encana that are seeing a tangible improvement in performance. There is very much a future in oil stocks and plenty of value to be found amongst the survivors in Canada.

Husky Energy Inc (TSX:HSE): This integrated oil and gas company out of Western Canada also has stakes in the South China Sea and the Atlantic. While shares have dropped this year, they’ve started to rally since the second quarter.

The dip in stock price in the third quarter certainly looks to be bottoming out now, with the Royal Bank of Canada increasing its price target to $17 and energy markets looking to be at a turning point.

Canadian Natural Resources Limited (TSX:ENQ): This 53 billion market cap giant is one of the biggest names in Canadian crude oil and natural gas exploration, development and production. In the second half of the year this giant has turned around its stock and has now seen consecutive months of strong gains.

There is certainly exposure to oil sands here, and production and profits are both on the rise. It is all looking positive here as oil markets turn around and oil prices appear to have found a new price range that will only see production rise again in Canada.

Inter Pipeline Ltd (TSX:IPL): Another pipeline company that holds plenty of upside for the coming year, IPL is particularly interesting for its exposure to the oil sands sector which is sure to see a boost in production as more and more companies focus on increasing output in the new high oil price environment.

The crisis in Venezuela has already seen heavy oil imports to North America drop, and as demand for the product increases and prices for oil continue to rise, companies in the space are sure to see growth.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This news release contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include that PETROTEQ will be able to produce oil as currently scheduled, at the rates of production announced and at the targeted low prices from its Utah property; that PETROTEQ will successfully develop a blockchain supply chain solution for the oil industry; that it will have customers and contracts for its supply chain technology; that oil will be as much in demand in future as currently expected; that PETROTEQ’s technology is protected by patents and that it doesn’t infringe on intellectual property rights of others; that PETROTEQ will find licensees for its technology and that it can patent its technology in many countries; that PETROTEQ’s technology will work as well as expected and will become adaptable to water-wet oil sands; that blockchain technology will help PETROTEQ create a supply chain management system which can handle all transactions; and that PETROTEQ will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company’s patents and other technology protection are not valid, patents may not be granted in countries where PETROTEQ wants to license its technology; production of oil may not be cost effective as expected, technology development costs may be much higher than expected, the technology may not be adaptable to water-wet oil sands, there may be construction delays and cost overruns at the production plants, PETROTEQ may not raise sufficient funds to carry out its plans, changing and increased costs for extraction and processing; technological results based on current data that may change with more detailed information or testing; blockchain technology may not be developed to be as useful as expected and PETROTEQ may not achieve its business plans; competitors may offer better technology; and despite the current expected viability of its projects, that the oil cannot be economically produced with its technology. Currently, PETROTEQ has no revenues.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company to disseminate this communication. In this case the Company has been paid by PETROTEQ seventy thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. We have been compensated by PETROTEQ to conduct investor awareness advertising and marketing for TSXV:PQE and OTCQX:PQEFF. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits similar to those discussed.