If you thought you missed the boat on the wireless boom—think again. The seeds of telecommunications that have minted billionaires in the U.S. are now budding in the explosively fertile land of Latin America.

We’re still only at the start of this game, with wireless telecom spending expected to hit $917 billion by 2020. And every segment of this is set to take off in Latin America—from wireless communications service providers and cable TV companies, to the most lucrative niche of independent cell tower landlords.

Across segments, rapid wireless subscriber growth and heavy investments in LTE rollout make Latin America a phenomenal investment opportunity.

Just watch what the giant American telecoms are doing—and where they’re looking for their next big win. AT&T is hungrily pouncing on Latin America, particularly Mexico, because the U.S. market is already mature.

Wireless subscribers in Mexico have increased 37 percent year on year, and wireless revenues are up 9.5 percent over the same period.

We are right at the heart of a big data market evolution in the Latin American telecommunications industry, and this is the prime time to get a foothold. Led by Brazil and Mexico, Latin American telecoms are expected to invest nearly $1.79 billion by 2022 in big data services.

And if that wasn’t enough, the next telecom gold rush is right around the corner. Telecom providers are racing to secure the infrastructure and know-how to roll out 5G, the next generation of mobile technology.

The growth in the number of cellular phones has increased by more than 17 percent in the last year to 236 million, according to Teleco. Brazil has several telecom companies which are publicly traded, most of which trade on the New York Stock Exchange. According to the free list of Brazil stocks at WallStreetNewsNetwork.com, there are almost half a dozen Brazilian telecom companies that pay yields in excess of 1.5 percent.

Across Latin America, there is a fierce struggle for market share going on—and this is where the early-in opportunities come into play.

The next Mark Warner or Steve Case—he’ll come from this sector, and this playing field.

Here are our Top 5 Picks in the Latin American telecommunications explosion:

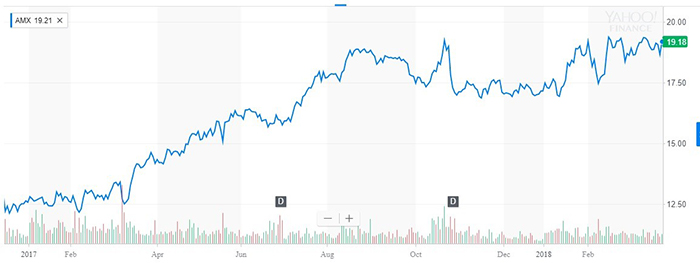

#1 América Móvil (NYSE:AMX)

This is the baby of Mexican billionaire Carlos Slim. America Movil’s wireless division, Telcel, dominates mobile number porting across Latin America. And in this game, it trounces even AT&T.

The catalysts for this company keep rolling in. By the end of this year, Slim has already rolled out 4.5G in parts of Mexico and expects a 5G network by 2020. This is where the real growth in this industry is, and America Movil’s got it in droves.

America Movil has so far invested over $52 billion in Mexico's telecom sector alone.

Mexican internet use increased 5 percent just between 2015 and 2016, and some 85 percent of users are getting internet access through mobile phone devices.

Slim isn’t worth over $70 billion for no reason. He’s the 7th richest person in the world, and we recommend following his lead on this one.

#2 Tower One Wireless (CNX:TO; OTC: TOWTF)

If you want to get in on what is possibly the purest profit in this industry, this company represents a niche segment that is off the radar even though it could be about to explode.

This is the independent cell tower niche. It’s the backbone of the wireless revolution, and there’s very little competition.

Tower One Wireless (CNX:TO; OTC: TOWTF) is one of only 4 publicly traded companies cashing in on the cell phone tower niche in the entire world.

The first three rose to a combined market cap of over $100 billion in the first phase of this evolution. Tower One could to be the next to cash in.

Its latest acquisition – a services company out of California – looks sure to give Tower One a boost against its competition. The deal will double the number of Tower One’s all-important Master Service Agreements (MSAs) to 20, while providing the company with 33 self-performed teams that will drive the growth of this disruptive small-cap even higher.

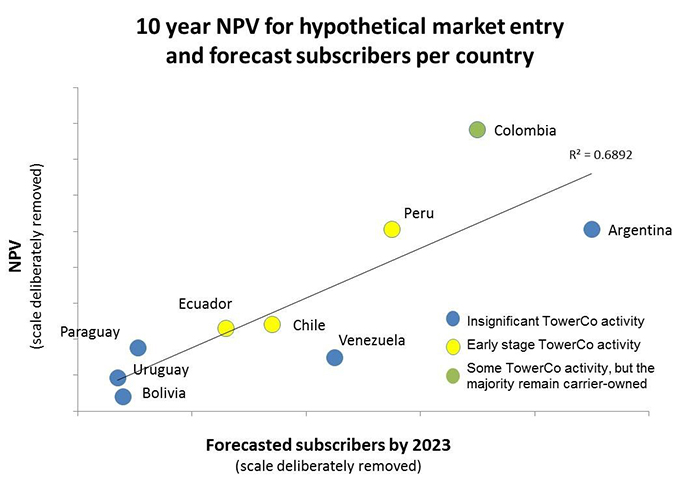

So far, South America has only 100,000 towers, and it needs 150,000 towers in the next three years to accommodate demand and growth by the telco giants.

And this veracious demand is only the beginning, with the 5G revolution poised to transform the sector in 2019, potentially pushing the value of companies like Tower One higher still.

This is a brilliant segment niche, because these cell tower owners simply build towers and then rent them out to wireless providers. A single tower can serve up to 4 telcos, and then the tower owners just sit back and enjoy large profit margins and continuous cash flow. This is a level playing field, unlike the wireless providers where competition is fierce.

Tower One is the only small-cap entry point into this industry. It was established in 2015 and has a market cap of only $20 million.

#3 Regal Beloit Corp (NYSE:RBC)

The exploding demand for mobile and fixed broadband networks solutions continues in 2018.

As the industry prepares itself for 5G networks, direct current (DC) power systems are what make the wireless revolution possible.

Regal Beloit sees huge opportunities in developing markets as all these networks need to be powered using direct power systems to prevent grid outages.

This market generated $3.92 billion in 2016, according to Frost & Sullivan, and is projected to reach $4.41 billion by 2021. That’s a compound annual growth rate of 2.4 percent.

The company recently said that it is looking to expand its ‘core activities’ through acquisition, and while its share price fell due to a somewhat disappointing earnings report, we think this company remains one of the most attractive ones in the space.

#4 Telefonica Brasil SA (NYSE:VIV)

One of the best value plays in the space right now could be Telefonica Brasil, share prices fell back after rallying to a 52-week high in January. This giant subsidiary of Spanish telecom major Telefonica SA (TEF) is a key ruler of the wireless market in Brazil, and one of the biggest catalysts is its Vivo commercial brand.

Telecom markets remain a highly competitive playing field, but as an established brand, Telefonica knows that continuous investments in its network are the most important factor.

If you’ve got it already, it’s probably a good idea to hold onto it. This company has demonstrated a great ability to sustain its competitive edge and both move and move WITH the market.

This month, Telefonica outlined a new ‘aggressive’ expansion strategy. The company planned 24 billion reais ($7.26 billion) in capital expenditures over the next three years, dwarfing its direct competitors.

The company’s CEO Navarro also said that the company will focus on the country’s fast growing broadband segment.

The company managed to expand its market share in mobile markets and also saw the amount of broadband customers grow. The company’s EBITDA and net earnings also significantly improved in 2017, posting a 12.8 percent year on year growth in net profits.

#5 TIM Participacoes S.A. (NYSE:TSU)

This stock has seen very steady growth in the last year, and as the 5G revolution comes into play, it is likely to see still more gains going forward. TSU (or TIM Brasil) is the Brazil subsidiary of Telecom Italia and covers Brazil with cellular service, with help from two subsidiaries. It’s the biggest system operating in the country and has over 63 million subscribers – accounting for 66 percent of the Brazilian population.

In the last year this stock has climbed from $13.75 to $21.60 as it continues to expand its network. It also gets to boast being the first mobile operator deployed in every single state in Brazil, giving it a clear growth advantage. It’s now The Number 1 provider of 4G coverage in the country and it’s 4G and fiber optic networks cover nearly 71,000 square kilometers. When the 5G revolution gets underway, you can be sure that this Brazilian giant will be right at the forefront of the industry.

This is the fastest mover in Brazil and the upside potential should be very tempting for investors. The company expects earnings growth of 22.5 percent for the current year and as the 5G revolution is rolled out it is likely that the gains will be bigger still.

TIM Participacoes S.A. is certainly one to watch.

Honorable Mentions in the Wireless Space

BCE Inc. (TSX: BCE) is a Canadian giant. Founded in 1980, the company, formally The Bell Telephone Company of Canada is composed of three primary subsidiaries. Bell Wireless, Bell Wireline and Bell Media, however throughout its push into the position of one of Canada’s top telco groups, it has bought and sold a number of different firms.

BCE is also at the forefront of the Internet of Things movement in Canada. Its Machine to Machine solutions are being used by numerous businesses throughout North America and its new LTE-M network is sure to rapidly increase the adoption of these solutions.

It’s paying a quarterly dividend of $0.72 per share right now. It’s had some great results, even if net income has declined a bit in the most recent quarter. It’s still blowing other telcos out of the water.

Cogeco Communications Inc. (TSX:CCA): Cogeco Communications Inc., formerly Cogeco Cable Inc., is a Canada communications company with a $2.62-billion market cap. Right now, it’s got negative earnings, but over the longer term, this company is looking good.

The company has rallied significantly since the beginning of the year and trades for C$92 now as a result of stronger earnings. Canada’s 4th largest cable company could rally even higher as the company could prove to be a prime takeover target for its larger peers Rogers or Bell.

Redline Communications Group Inc. (TSX:RDL ): Redline is not a giant, but it does operate in more of a niche environment—in hard-to-access places, providing wireless for critical industries, including oil and gas, and anywhere from the rainforests of South America to the slopes of Alaska and the deserts of the Middle East.

While the company didn’t manage to squeeze a profit in Q2 2017, we expect the company to improve its operations results as it did in the previous quarter. The company’s main challenge remains to expand and attract new customers for its new LTE product.

Avigilon (TSX:AVO): Avigilon develops, manufactures, markets and sells HD and megapixel network-based video surveillance systems, video analytics and access to control equipment. This technology goes hand-in hand with the telecom sector, as new developments in security rely increasingly on wireless connections. We expect strong continuous growth in the analytics business and a company such as Avigilon is well positioned to capture market share in the Canadian markets.

As a key player in the digital security marketplace, it is clear to see why Avigilon made the list. With telecom technology continuing to move forward, investors can count in Avigilon to provide lasting value.

Forward-Looking Information

This news release contains "forward-looking information" identified by the use of forward-looking terminology such as "plans", "expects" "intends" or variations of such words or indicates that certain actions, events or results "may", "could", "would", "might" or "will be" taken, "occur" or "be achieved". Forward-looking information includes, but is not limited to the POWTF’s intention to have 100 towers by Q2 2018, 200 towers by Q4 2018 and 300 towers within 2 years; that the margins on cell tower operations are huge, generally around 80%; that a cell tower can be built in just one month, and a cell operator can be brought online two weeks later; that cell operators sign deals for 10 or 20 years; that shortly after construction on a tower starts, it can generate cash; that the tower value can be substantially higher than building costs based on demand and rental rates; that demand for the towers will continue to be strong; that 10,000 towers are needed in South America; . These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Tower One to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks related to not being able to agree with telecom companies on important aspects of tower rental; the estimation of personnel and operating costs; that the cell market in South America will not grow as expected; that Tower One may not receive required regulatory approvals; construction of cell tower risks, including cost overruns, labor issues, technology that doesn’t work as well as expected; delays or problems in construction; the availability of necessary financing; cell operators may not come to quick or long term agreements as expected; competitors may offer cheaper, faster or better services, reducing expected revenues; general global markets and economic conditions; risks associated with currency fluctuations; competition faced in securing experienced personnel with appropriate industry experience and expertise; the reliance on key personnel; financing, capitalization and liquidity risks including the risk that the financing necessary to fund continued development of Tower One's business plan may not be available on satisfactory terms, or at all; the risk of potential dilution through the issuance of additional common shares of Tower One; the risk of litigation; and the risk that cybercrime, climate change including unusual weather, or changing technology may severely damage Tower One’s business. There may be many other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. We undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by law. Investors are cautioned against attributing undue certainty to forward-looking statements.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by TOWTF eighty thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. We have been compensated by TOWTF to conduct investor awareness advertising and marketing for CNX: TO; OTC:TOWTF. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.