One massive investment opportunity is going largely unnoticed, perhaps by design. A multi-billion-dollar sector, whose main assets are often quite literally hidden in plain sight.

Once you find out what it is... and how much money it makes every month... you’ll start hunting for it in your neighborhood. In fact, it might be the most profitable business there.

Once You See It, You Can’t Ignore It

Unlike most infrastructure projects, this industry does its best to make their assets less visible to the public, while their services reach out to a rapidly growing portion of the population. They like it that way.

With profit margins that are over 80 percent in some markets, and a bevy of investment grade tenants at the ready to guarantee early and ongoing cash flow, it’s a wonder how this industry still remains under the radar of most investors.

But, for those investors who are already aware of this sector, they’ve been keenly rewarded.

Already, the public market has witnessed three companies in this field soar to dizzying heights. Every one of them has a multi-billion-dollar market cap.

Since recently going public, Tower One (CNX: TO; OTC: TOWTF ) is now the fourth publicly-traded company in North America in this industry, and it is the only small-cap entry point into an industry with up to 80 percent EBIDTA margins, and near-instant cash flow.

But that doesn’t mean competition isn’t fierce.

Demand for these high-yielding assets in question has skyrocketed over the past 10 years, causing the combined market cap of the 3 main companies trading in North America to rise to more than $120 billion.

This was all with those main companies producing less than half a million units.

And somehow, this instant cash flow business model is still under the radar, as investors are literally passing by these assets every day without thinking about them.

Look Up, Way Up

What are they? Look up...

Cell phone towers are everywhere, increasing their coverage every year, all while designers do everything in their power for the public not to notice them.

Towers are often designed to blend into their surroundings, sometimes even disguised as palm trees, crosses, and public art installations.

Aesthetics aside, these towers are being rapidly dispersed across the world, expanding high speed internet coverage to more and more remote regions. All the while, telecom providers are snapping up leases on the towers to increase their presence, and reliability for customers.

Cell phone towers are an industry that is very straight-forward to leverage, where the owners of the towers can jump into breakeven cash flow on a semester basis, if not less.

And demand for wireless cell phone towers has skyrocketed over the past 10 years in North America and many developed nations.

Now the entire planet is shifting to wireless communication.

There’s a reason that the three companies that focused on this infrastructure niche could start from zero, collectively build almost half a million towers, and rise to a combined market cap of more than $120 billion.

Now the wave of high speed mobile data, and telecom coverage is spreading at a rapid rate in the developing world.

And there’s only one small-cap entry point available to the average investor looking to get in at the beginning of a major growth arc story.

Tower One Wireless Corp. (CNX: TO; OTC: TOWTF) is entering this market with a niche advantage. It’s tackling the surging demand for new towers in South America—particularly in Argentina and Colombia.

Already with a foot in the door, and management’s established relationships with the major wireless providers and local governments in the region, Tower One has planned a very clear path to success.

Liquid Real Estate

An advantage that cell phone tower owners have over other real estate conglomerates is that all of their tenants have an investment grade credit rating.

So, to any investor looking at the credit risk side of the industry, it’s quite simple.

You build a tower, costing between $50k to $100k (depending on the size), which takes 30 days to build. By day 45, you’re probably already collecting cash flow from tenants with big pockets—namely multi-billion-dollar telecoms.

The return on investment per-tower is the most eye-opening aspect of the sector.

The typical client is a multi-billion-dollar telecom, and the typical lease is a monthly payment over 10-20 years.

With just one client in place, the towers can be paid off within a few short years, leaving a majority of the tower’s lease to build and compound profit.

An average client’s lease on a tower comes to around $12,000-$15,000 per year. If even just one client is signed, then the tower is often paid off before the halfway mark of a ten-year term.

Those profit margins are increased in multiples every time that the tower is assigned to more than one carrier, with many towers capable of handling up to four tenants without diluting service.

Adding additional clients does not increase the cost of service delivery for the tower owner, but it does increase the profit margin significantly.

Two clients on one tower nearly pays off the construction of the tower in just over two years. Four clients, brings the payback amount down to just over one year, with an income potential of $48,000 per year.

But even with just one client, a single $50,000 tower, can return back $120,000 over the course of a ten-year term. And a 3-client tower is close to $360,000, for a 7x return on initial investment.

Argentina

Tower One (CNX: TO; OTC: TOWTF) has targeted South America as its field for expansion, as the growth in demand is rising in the region more rapidly than in North America.

In particular, the company sees a major opportunity in Argentina, which is making gains after a shift in political policy more towards growth and stability.

Aggressive demand in Argentina has been projected to require an additional 10,000 towers in just three years.

There are four major carriers in Argentina, including moguls Claro (owned by America Movil) [NYSE: AMOV], Tigo (owned by Millicom International) [OTC: MICCF], Telefonica [NYSE: VIV] and Telecom Argentina [NYSE: TEO] - all are multi-billion-dollar giants.

Already with a foothold in Colombia, Tower One’s Argentinian expansion plans are blue sky, and give management confidence that they can begin a similar growth arc to their competitors in the region.

With an already known potential client base, Tower One (much like other tower companies) doesn’t have to spend on marketing. Contracts in South America are a result of relationships, a commodity that the Tower One team, which includes the former President and CEO of Deutsche Telekom USA, now T-Mobile, and the former COO of Continental Towers, which built over 200 towers in Colombia under his watch, is already entering the game with.

Tower One (CNX: TO; OTC: TOWTF) has the vision to bring South America into the wireless revolution, and to become a major provider of wireless communication towers to the South American market. In doing so, their mission is to create significant cash-flow, and shareholder value in the process.

Competitors

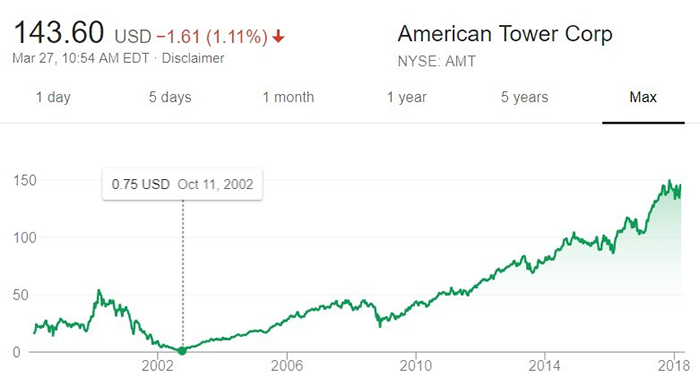

American Tower Corporation (NYSE: AMT) has a mkt cap of more than $60 billion, having risen from a share price of $0.75 in 2002, to its current share price of $143. American Tower has accrued a portfolio of approximately 147,000 towers, for an average value of over $377,000 per tower.

SBA Communications (NASDAQ: SBAC) has a mkt cap of over $20 billion, having risen from $0.22 per share in 2002, to over $170 per share today. SBA has a portfolio of over 26,000 towers for an average value of over $615,000 per tower.

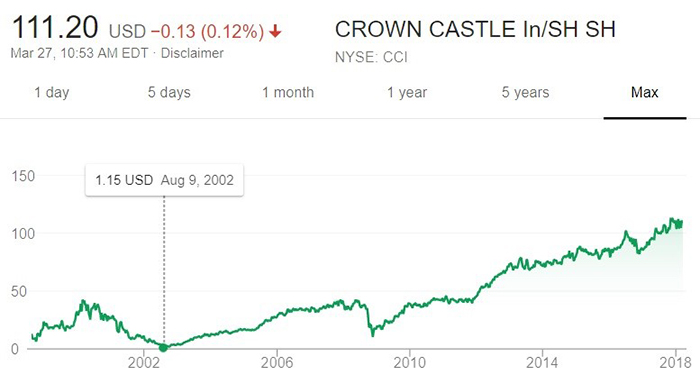

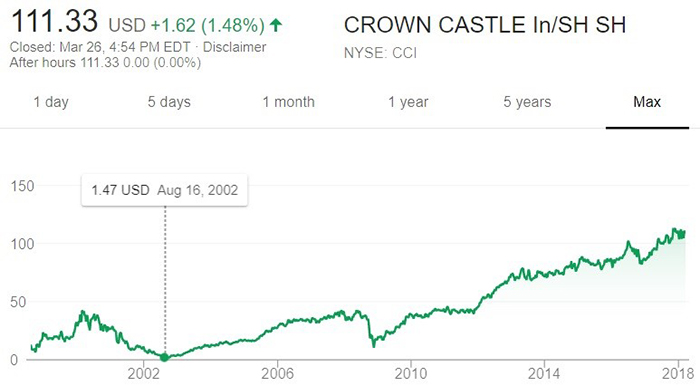

Crown Castle (NYSE: CCI) has a mkt cap of over $45 billion, having risen from $1.47 per share in 2002, to nearly $111 per share today. Crown Castle has a portfolio of approximately 40,000 towers for an average value of over $931,000 per tower.

All three comparables are far along in their story and see value in the South American wireless boom as well. But Tower One has an advantage over its competitors, in that it’s at an earlier stage in the story, a much smaller company that can move quickly but with the same strategy for growth.

Tower One Projections

Currently, Tower One (CNX: TO; OTC: TOWTF) has a portfolio of 42 towers, with another 10 towers under development/construction and 80 sites ready to build.

With an initial investment of only $10 million, and a growth path set through an aggressive South American expansion plan, Tower One is seeking to capitalize on a massive demand in a growing industry.

According to America Towers, there are 10,000 new towers required in Argentina alone.

Tower One has projected itself to be at 100 towers by Q2 of 2018, with a fair value projection of $60.4 million (based on an average per-tower value calculated from the comparables), or a 2.5x increase from today’s market cap.

By Q4 2018, Tower One expects to have amassed 200 towers, with a projected $101 million market cap, based on a $504,000 value per tower.

Long story short, Tower One projects a future where its $10 million initial investment can be grown into a value of over $200 million in assets in just two years.

By averaging the per-tower value of the three majors, we get approximately $660,000 per tower, with an average revenue of $51,000 per tower. Tower One believes this target is achievable.

As Argentina seeks to build 10,000 new towers in the coming years, that leaves a value of $6.6 billion in towers, with potential revenue of $510 million up for grabs.

Management

And it’s likely they’ll get their fair share of the market because...

Tower One (CNX: TO; OTC: TOWTF) is led by Alex Ochoa. The returns Ochoa was witnessing on each tower is what drew Alex Ochoa to the market. In fact, he left being a Director at Mackie Research Capital, one of the top retail and institutional brokerage firms in Canada, to build Tower One Wireless, and capitalize on his relationships formed in South America.

In Latin America, many major projects are largely driven by having a friendly relationship with those in charge of handing out the permits.

The Tower One team are well versed on the business climate in the region, and targeted Argentina specifically as a space that is set to explode in a flurry of new towers.

Ochoa’s desire to capitalize on this surprisingly overlooked market led him to assemble a dream team of expertise to see Tower One’s vision to fruition.

Among the who’s-who on the board and management team, is former President and CEO of Deutsche Telekom USA, now known as T-Mobile, Roland Bopp - who has been brought on as an advisor. His contacts in the very tight-knit world of telecommunications could be Tower One’s ace in the hole, as he will have worked on the other side of the table in client negotiations for towers, and was a major player as the wireless boom took off.

Taking on the role of COO will be former COO of Continental Towers, Luis Para. While CEO at QMC Towers, Luis helped expand the company’s portfolio to over 2,500 towers.

The Inside Track

Soon this story will get out. This is more than a passion project for Alex Ochoa and his team. The opportunity was so good that Ochoa left a prestigious position at Mackie Research to pursue this tower boom.

Management has locked up 40 percent of the shares in the company.

With just a $10 million initial investment, the company will now begin its path towards major growth targets.

At a starting point of $0.25 per share, and a current market cap of $11.8 million, Tower One gives investors a chance to enter into a market that has already seen companies such as American Tower, SBA Communications, and Crown Castle have meteoric rises, through steady organic growth. Tower One hopes to emulate that success.

The company’s vision is to finance and build at least 300 towers in the next 24 months, while creating a profitable income stream.

At competitors’ tower valuation today, the company should be worth over $200 million once they’ve reached that marker.

Tower One’s strategy is to acquire growth to become one of the largest tower companies in South America, with a long-term goal to build a profitable company that pays out dividends and continues to grow each year.

The company is entering into a market where multi-billion-companies are the norm. The top 3 of Tower One’s competitors are multi-billion-dollar market caps.

If Tower One (CNX: TO; OTC: TOWTF) can hit its two-year goal of 300 towers, which should value the company’s assets at over $200 million, that would be 20x the current market cap, subject to share dilution and debt financing.

Honorable mentions in the telco space:

Shaw Communications Inc (TSX:SJR.B): Shaw Communications, a giant in the Canadian telecoms sector, saw a drop in its share price following its disappointing forecasted earnings growth in 2017. In a sector that is set to see growth, undervalued and experienced companies such as this can make for a great hold play.

Shaw owns a ton of infrastructure throughout Canada and its cloud services and open-source projects look to address some of the biggest issues that its customers might face before the customers even face them.

With a market cap of $13.73 billion, Shaw Communications is going to be a big player in the sector for quite some time to come, and as it nears its 52-week low this could be a great time to pick up a telecoms giant.

EXFO Inc (TSX:EXF): EXFO isn’t new to the Canadian tech sector. The company was founded in 1985 in Quebec City, and its original products were portable testing products for optical networks. Since then, the company has acquired and build 3G, LTE, protocol, copper/xDSL, IMS, and VoIP test and service assurance products.

Recent developments from EXFO are promising for long term growth potential. The new baseband unit emulation technology which is sure to be adopted on a large scale, as the tech offers operators a reduction of costs and a faster revenue stream.

EXFO Inc is a model in the telecommunications industry. With a market cap of $273-million, EXFO is strong, but still growing.

Blackberry Ltd (TSX:BB) This well-known cell-phone pioneer is engaged in the sale of smartphones and enterprise software and services. The Company's products and services include Enterprise Solutions and Services, Devices, BlackBerry Technology Solutions and Messaging.

Blackberry used to be a worldwide leader in phones, but Apple, Google and other Android manufacturers have rapidly acquired market share. Blackberry has since focused on software and is now developing systems for autonomous vehicles. Tech giants such as Apple and Google won’t be able to repeat Blackbery’s success in this sector that easily.

Sandvine Corporation: Ontario is seeing some vibrant cybersecurity growth, as well. Sandvine corp. is engaged in the development and marketing of network policy control situations for high-speed fixed and mobile Internet service providers. Products include Business Intelligence, Revenue Generation, Traffic Optimization and Network Security.

As the wireless revolution takes off, the need for security becomes even greater, and Sandvine has positioned itself ahead of the pack.

Celestica Inc. (TSX:CLS) is a manufacturer of electrical devices used in IT, telecommunications, healthcare, defense and aerospace industries. The company has seen strong growth YoY which we expect to continue as the sales expectations are almost 3% better than last year’s.

While many investors thought the stock was overvalued after a stellar run in 2016, the recent correction and volatility in the stock has attracted new buyers and the stock has recovered since.

Forward-Looking Information

This news release contains "forward-looking information" identified by the use of forward-looking terminology such as "plans", "expects" "intends" or variations of such words or indicates that certain actions, events or results "may", "could", "would", "might" or "will be" taken, "occur" or "be achieved". Forward-looking information includes, but is not limited to the POWTF’s intention to have 100 towers by Q2 2018, 200 towers by Q4 2018 and 300 towers within 2 years; that the margins on cell tower operations are huge, generally around 80%; that a cell tower can be built in just one month, and a cell operator can be brought online two weeks later; that cell operators sign deals for 10 or 20 years; that shortly after construction on a tower starts, it can generate cash; that the tower value can be substantially higher than building costs based on demand and rental rates; that demand for the towers will continue to be strong; that 10,000 towers are needed in South America; . These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Tower One to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks related to not being able to agree with telecom companies on important aspects of tower rental; the estimation of personnel and operating costs; that the cell market in South America will not grow as expected; that Tower One may not receive required regulatory approvals; construction of cell tower risks, including cost overruns, labor issues, technology that doesn’t work as well as expected; delays or problems in construction; the availability of necessary financing; cell operators may not come to quick or long term agreements as expected; competitors may offer cheaper, faster or better services, reducing expected revenues; general global markets and economic conditions; risks associated with currency fluctuations; competition faced in securing experienced personnel with appropriate industry experience and expertise; the reliance on key personnel; financing, capitalization and liquidity risks including the risk that the financing necessary to fund continued development of Tower One's business plan may not be available on satisfactory terms, or at all; the risk of potential dilution through the issuance of additional common shares of Tower One; the risk of litigation; and the risk that cybercrime, climate change including unusual weather, or changing technology may severely damage Tower One’s business. There may be many other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. We undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by law. Investors are cautioned against attributing undue certainty to forward-looking statements.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by TOWTF eighty thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. We have been compensated by TOWTF to conduct investor awareness advertising and marketing for CNX: TO; OTC:TOWTF. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.