Written by Ophir Gottlieb

PREFACE: Finding Edge In Bank of America Corp (NYSE:BAC)

This is Edge. This is Winning. This is what has happened in Bank of America Corp (NYSE:BAC).

There is a way to measure edge in an options strategy. That's one of the great beauties of option trading in general, the market prices the 'greeks,' which serve as a measure of probability. If a trade wins more often than the probability that is priced in, it has edge.

Here is that same thought process, but in English: A 20 delta (out of the money) put should end up in-the-money about 20% of the time (delta is roughly a measure of probability). In other words, if we sold a 20 delta put, we would expect that we could have a winner 80% of the time, or 4 out of every 5 trades.

As an aside, that's why when you see those clickbait advertisements for option services that read "90% winning trades," they likely just mean they are selling 10 delta options. There is no edge to that trade -- it is priced so that while it wins nine out of ten times, the one loss would lose the entire again from those nine winning trades.

EDGE

Now, back to our idea of edge. If we can find an option strategy that has a 20 delta, but if selling it wins more than 80% of the time, then we have edge. Even further, even if it wins 'just' 80% of the time, if the net profit is positive, then that's another measure of edge. When we have both, we have a great trading result, and that is exactly what we find with Bank of America Corp (NYSE:BAC).

Bank of America Corp (NYSE:BAC)

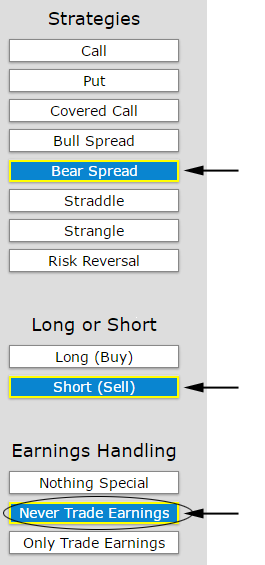

If we test selling a 20 delta put, every 30-days in Bank of America Corp over the last 3-years, but always avoiding earnings, this is the set-up:

And this is what we find:

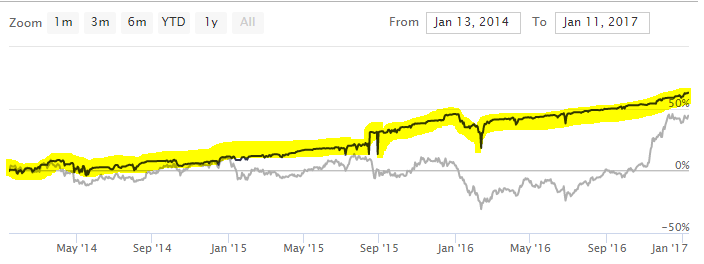

We see 35 wins and 6 losses for a 85% win rate. That's above 80%, and the return, which is what really matters, is very high at 63% after accounting for Reg T margin requirements. Here's how that short put looked (highlighted in yellow) relative to the stock price (in gray):

But, of course, we have to go further than one test. If we do this same strategy but over 2-years, and again, always avoid earnings, we get these results:

That's 24 wins and 3 losses for a 89% win rate (greater than 80%) and a total return of 52.3%, again, that's after margin requirements. We can do this same thing looking at the last one-year:

We see 12 wins and 1 loss, for a 92% win rate (greater than 80%) and a positive return of 21.6% (after margin requirements).

SO WHAT JUST HAPPENED?

We can't predict the future -- or at least we can't look at the past and guarantee the future. But, we can absolutely look at the history of option trading in a stock, measure the expected probability of success and then see the actual success rate. In BAC we see a higher win rate than the option market is pricing in for short puts, and the result is superior returns.

This isn't a guarantee of future success -- but this is exactly how to calculate edge for a back-test. Now this process goes yet further -- beyond Bank of America Corp (NYSE:BAC) and beyond just short out of the money puts.

It turns out there is actually a lot less 'luck' and a lot more planning in successful option trading than many people know. But it's not about trying to guess which stocks will go up or down.

What the back-tester allows us to do is find calm, low-stress stocks and ETFs and then identify the option strategies that have created a high percentage of winning trades, gaining profitability slowly, while managing earnings.

Here is a quick 5-minute demonstration video of CMLviz Trade Machine Option Back-tester which includes some more winners.

Video Demonstration

Thanks for reading, friends. The author has no position in Bank of America Corp (NYSE:BAC).

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.